Stocks around the globe were pummeled last week.

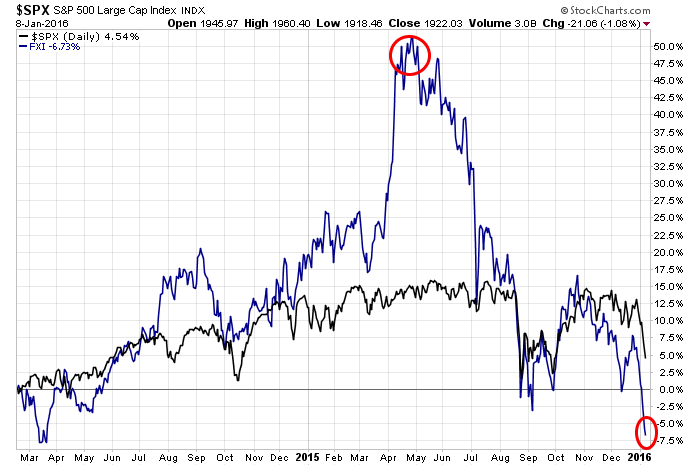

This is of no surprise to my followers as my trend analytics model gave us clear technical evidence (combined with Elliott Wave price labeling) that the important multi-year highs had completed back in the middle of 2015.

We have, and continue to remain bearish in my outlook for stocks.

Last week was a rough beginning to the New Year of 2016. Three of the first four trading days witnessed the Dow Jones Industrial Average down over 200 points. Friday, January 8 2016, the DJIA had fallen to 16,314, its lowest level since October 2,2015 and down another 167 points. For the week, it was off 1078 points, the greatest decline in the first week of the year in the history of the DJIA. Since a cycle high of 17,977 on Nov 3,2015 the DJIA is now down 9.2%. To put this in perspective, the decline into the low of August 24 was down 16.4% from the high in May 2015.

In China, the government appears to be totally lost on what to do next.

| China opens in the red, Shanghai down 2.51%, Shenzhen sheds 3.28% |

The efforts to control matters tightly did not work, the result is PANIC. The Chinese government suspended the newly created circuit breaker system for their stock market which cut short two trading sessions last week after the index fell 7%. It did not work. The Chinese Shanghai Composite Index started the year off at 3536 last Monday January 4, 2016. Friday, January 10, 2016, it had fallen to 3056, a loss of 13.5%. weekly loss was 6.2%, less than in comparison to the DJIA’s. The same sense of PANIC here is probably just as real as in China.

Stocks are bearish. The low could end up experiencing a loss of 28-50% from last year’s all-time high.

Last year, a surprisingly strong dollar weigh heavily on the prices of oil, precious metals and other commodities. Silver and palladium look to many like downright bargains right now. Average Americans wish their dollars were that strong when they needed gas, electricity and to pay the rent.

This year will prove to be quite interesting. Oil prices are so cheap, there may cause negative industry-wide repercussions. Also, the strong dollar could damage U.S. exports to the point of being an issue in the 2016 election campaign. Certainly, the outlook for 2016 is a monumental socioeconomic dilemma.

But it’s NOT a problem for me, we will capitalize profits fromhere for huge capital returns in this “Slow Roasting Bear Market”

I point to the weakness in the energy sector and the panic in China’s stock market as the primary cause of this current plunge.