With the jaw-dropping stock-market dives we’ve seen in the last 3 months, you can be forgiven if your stomach tightens just a bit when you go to check your retirement account.

So today I’m going to give you my 3 best tips for securing your hard-earned cash—and even better, locking in a dividend stream you can easily live off of in retirement.

And no, you won’t need a seven-figure nest egg to pull off what I’m going to show you now.

Step #1: Diversify the Right Way

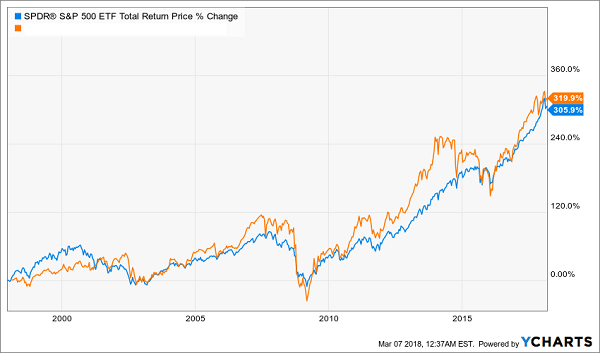

You no doubt know that diversification is key to protecting your wealth, but if you only go halfway, it will end in disaster. By that I mean doing what many folks do: throw their money in a low-cost index fund, like the Vanguard S&P 500 (NYSE:VOO), and leave it at that.

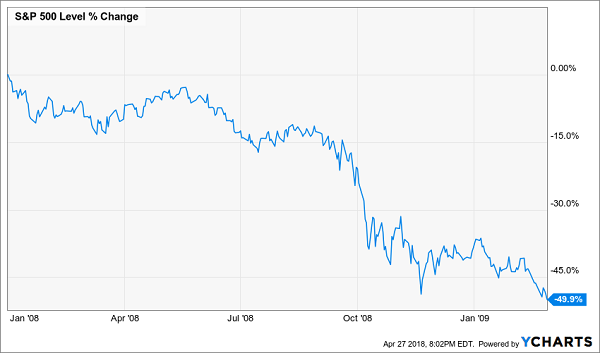

But these people have forgotten their history. Like the last time the S&P 500 did this—just 10 short years ago:

50% of Your Nest Egg—Gone in a Year!

So how do we save our hard-earned cash from the next swoon?

One easy way is to buy US Treasuries to offset any hits you might take in the stock market, since Treasuries tend to go up when stocks go down (and vice versa):

The Treasury Cushion

But since Treasuries don’t go up as much as stocks go down in bear markets, this isn’t going to cut it. We need to dig deeper.

There are many other investments that go their own way—which isn’t necessarily in the same direction as stocks.

For example, municipal bonds tend to rise when people are more risk-averse, while tech stocks fall. So you want to make sure you have a bit of both so you can profit from one when the other goes down and avoid suffering losses that will take years, or decades, to recover from.

This is the most important tool the ultra-rich use to protect their nest eggs. The stories you hear of multimillionaires losing everything? It’s almost always a result of failing to diversify. Take Masayoshi Son, a billionaire who lost around $70 billion (yes, with a “b”) during the dot-com crash of 2000. Why? Because all of his money was in stocks.

Step #2: Add Some Funds to Your Stocks

You want to diversify beyond just asset classes, though. To get broad exposure within each asset class, add some funds to your stock holdings.

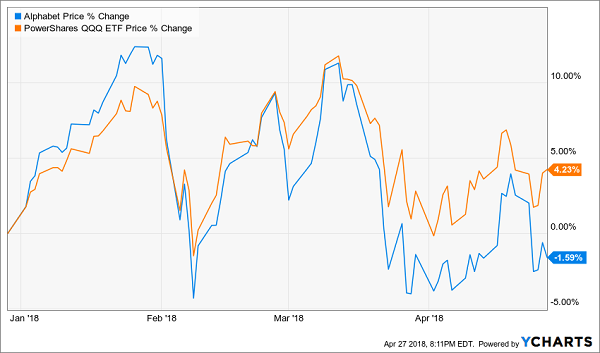

To explain why this is important, let’s take a look at Alphabet (NASDAQ:GOOGL) (GOOG) and the PowerShares QQQ Trust Series 1 (NASDAQ:QQQ), which tracks the tech-focused Nasdaq 100 index. If you bet only on GOOG in 2018, you’d be down a bit on your investment. But the index? It’s up 4.2%:

The Consequences of Going All in on One Stock

Of course, you could point to Amazon (NASDAQ:AMZN) as the better pick—it’s up 34.2% in 2018. But if you’d chosen AMZN over QQQ or GOOG in early 2016, you would’ve made the worst choice of all:

Now Who’s the Biggest Loser?

The takeaway? Buying a fund lowers your risk of buying a good stock at a bad time.

Because even if you’re right to bet on either of these companies—which have both soared over the long term—buying at the wrong time, when their rises have been overextended, would have crimped your returns.

With a fund, you get access to a lot of high-quality companies in one buy. And while you may get some at a bit of a high price, you’ll also get some cheap. So buying a fund that’s diversified across stocks lowers your risk of overpaying for just one stock, limiting your downside in the short term—a crucial move if you’re a retiree who needs to tap your portfolio for cash.

Step #3: Lock in Big Cash Dividends

The final key to protecting your nest egg is also the most often overlooked: securing an income stream.

Because if you can invest your nest egg in assets that produce income higher than your annual costs, provided that income stream never declines below your expenses, you can largely ignore market swings.

Most people ignore this because yields are lousy right now. Even with the 10-year Treasury reaching 3%, you’re still getting a measly $2,500 per month on a million bucks. That’s less than $15 per hour, less than minimum wage in a growing number of US cities.

With the S&P 500, you’re getting less—$1,525 per month in income on a million bucks. Madness!

People try to subsidize these paltry income streams by harvesting capital gains from their stock holdings—but that’s much easier said than done. Structuring payouts in a way that won’t destroy your portfolio is almost impossible—especially if you end up retiring a year or two before a recession.

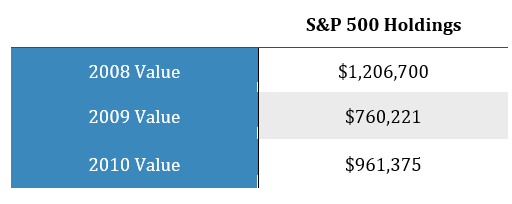

To demonstrate this, look at what happens to a $1.2-million nest egg put in the S&P 500 just before the 2008–09 meltdown; while it grows a bit before the end of 2008, things go downhill fast:

Index Fund Clobbered by a Bear

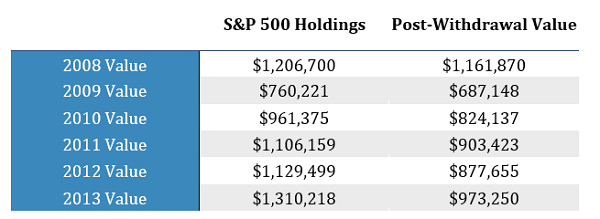

As if that weren’t bad enough, it’s doubly devastating for retirees who need income from their investments. Look at what happens to a retiree during the same period who tries to live off of $45,000 in passive income on that $1.2-million nest egg:

Even with a conservative 3.8% withdrawal rate, the retiree’s nest egg takes several years to recover from the 2009 loss—and although the S&P 500 recovers by 2013, the retiree’s portfolio is still down 18.9% from where it was 5 years earlier.

Why? Because of a lack of a solid income stream.

To protect from this, you need to not only on diversify away from just stocks but also toward funds that get you a variety of holdings and safe dividend income.

Revealed: This “Indestructible” 10.0% Dividend Is a Must-Buy

My favorite funds for all investors—retirees and twentysomethings alike—are a special kind of investment called a closed-end fund (CEF).

If you’re not familiar with CEFs, here’s the upshot: they can (and regularly do) deliver fast 20%+ gains and massive 8%+ dividends in one single buy! They are, hands down, the closest thing to the perfect investment I’ve ever seen.

I recently released my 5 very best CEFs to buy for 2018, and I’ll reveal the complete list when you click here.

When you do, I want you to pay particular attention to fund No. 3 on my list.

It’s a totally ignored CEF paying a rock-solid 10.0% CASH dividend now. It’s run by a Warren Buffett disciple who uses the master’s battle-tested strategies to deliver outsized gains when the market is soaring—and slash your volatility when stocks fall out of bed.

And it works like a charm!

That’s why I’ve made this fund—which has been around since 1986—a core recommendation of my “safety first” CEF Insider service. Check out how it’s outperformed the market since then, with a LOT less volatility:

A Smooth Ride Higher

Imagine holding a fund like that, which rides higher like it’s on rails! Also remember that almost all of this return was in CASH, thanks to pick No. 3’s monstrous 10.0% dividend, offering even more protection from the market’s ups and downs.

I’m ready to reveal all the details on pick No. 3 and my other 4 top CEF recommendations for 2018 (average dividend: 8.2%). All you have to do is click here and I’ll give you the names, symbols, buy-under prices and my complete research on all 5 of these incredible wealth builders now.

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, "7 Great Dividend Growth Stocks for a Secure Retirement."