The dollar rose against the euro and the pound, but declined against the yen on Wednesday, as forex traders reacted to the Fed's interest rate hike of 0.25% and plans for additional rate increases next year.

The Fed's 25 basis-point interest rate increase on Wednesday was widely anticipated by financial markets though they appeared to have been caught out by the central bank signal of three hikes in 2017, up from around two flagged at its September policy meeting.

The Fed's unexpectedly hawkish tone, it announced three likely rate increases next year, in addition to today's boost, sent the dollar toward its highest level since 2002 against a basket of 16 currencies.

While the Dow Jones Industrial Average late yesterday afternoon backed away from the 20,000 level, falling below 19,750, and the S&P 500 was down even more acutely, dropping 0.6% to 2258, on intraday trading. All sectors of the index were in the red, led by the real-estate and energy sectors, two-dividend paying groups that have been favored trades in the now bygone era of historically low interest rates.

Today the euro zone is to publish preliminary estimates on private sector business activity; the Swiss National Bank is to announce its latest monetary policy decision and hold a press conference to discuss the economic outlook; the U.K. is to release data on retail sales and the Bank of England is to announce its latest monetary policy decision; Canada is to release data on manufacturing sales ; while the U.S. is to release a raft of data, including reports on consumer prices, jobless claims and manufacturing activity in both the Philadelphia and New York regions.

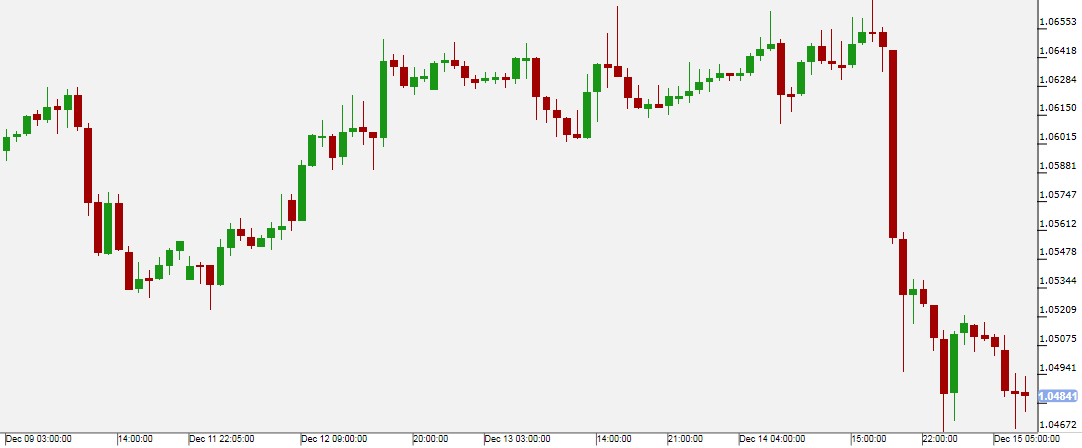

On Wednesday, ahead of Fed policy decision, the euro rose 0.28% to 1.0653, as investors grew more and more cautious.

Earlier Wednesday, the U.S. Commerce Department said retail sales ticked up 0.1% in November, disappointing expectations for a 0.3% gain.

Core retail sales, which exclude automobiles, gained 0.2% last month, compared to expectations for an increase of 0.4%.

Data also showed that U.S. industrial production fell 0.4% in November, compared to expectations for a 0.2% slip.

On a more positive note, the U.S. producer price index rose by 0.4% in November, beating expectations for a 0.1% uptick.

But after Fed interest rate hike the dollar increased to a 14-year peak against a basket of major currencies and EUR/USD settled lower at 1.0521 for the day.

Pivot:1.0558

Support:1.04951.04661.044

Resistance:1.05581.05881.0615

Scenario 1:short positions below 1.0558 with targets at 1.0495 & 1.0466 in extension.

Scenario 2:above 1.0558 look for further upside with 1.0588 & 1.0615 as targets.

Comment:a break below 1.0495 would trigger a drop towards 1.0466.

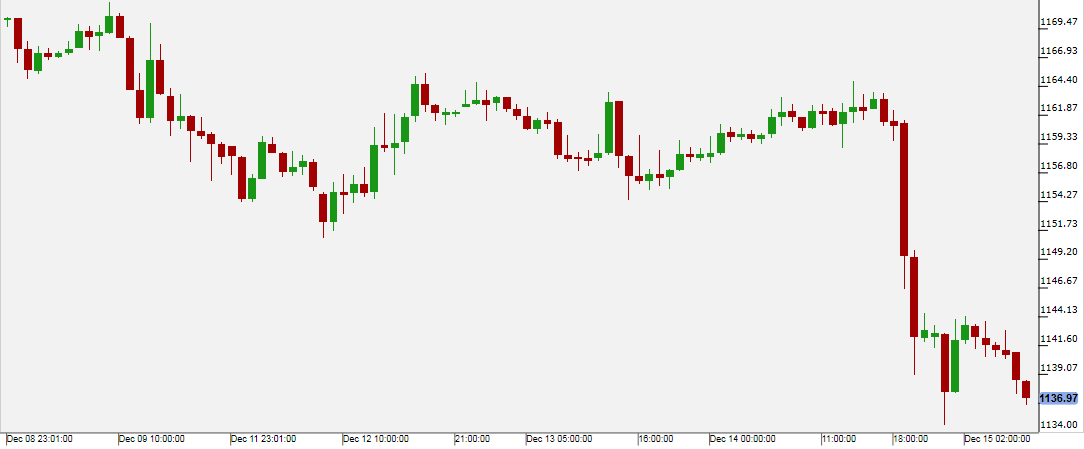

Gold

Gold prices fell smartly in Asia as the Federal Reserve said it may need to hike rates three times in 2017 as it made a widely expected nudge up in its policy rate on Wednesday.

Overnight, the precious metal prices fell on the Federal Reserve interest rate hike and provided guidance of as many as three increases next year, with investors focused on plans by President-elect Donald Trump to cut taxes and spend heavily on infrastructure.

Like other federal agencies, Fed Chair Janet Yellen confirmed the Federal Reserve has been in touch with President-elect Trump's transition team, but would not be drawn into direct comment on the monetary policy impact, or on the status of regulations aimed at avoiding a repeat of the Global Financial Crisis.

Pivot:1151

Support:113911351130

Resistance:115111551160

Scenario 1:short positions below 1151.00 with targets at 1139.00 & 1135.00 in extension.

Scenario 2:above 1151.00 look for further upside with 1155.00 & 1160.00 as targets.

Comment:the RSI is mixed and calls for caution.

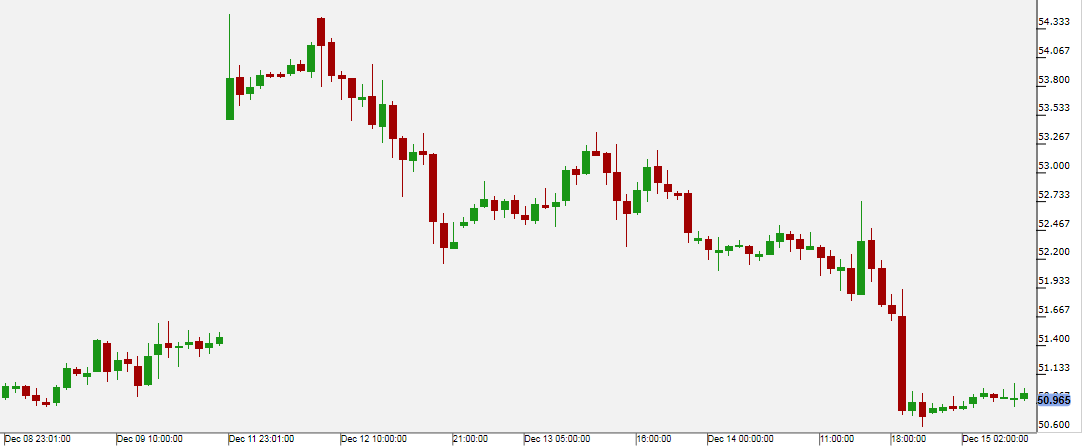

WTI Oil

On Wednesday the U.S. Department of Energy reported a 2.563 million barrel drop in U.S. crude inventories, more than the 1.584 million barrel decline seen, while distillate stockpiles, which include diesel and heating oil, fell by 762,000 barrels, and gasoline supplies gained 497,000 barrels.

Oil prices stabilized on Thursday, as a tighter market looms in 2017 due to planned output cuts led by OPEC and Russia, after sharp declines earlier following Wednesday's U.S. interest rate increase that drove investors out of commodities.

ANZ bank said on Thursday that oil markets would move into a substantial deficit in the first quarter of 2017 if the Organization of the Petroleum Exporting Countries (OPEC) and other producers led by Russia go through with their announced cuts of almost 1.8 million barrels per day (bpd) in output.

Pivot:52.7

Support:51.851.551.05

Resistance:52.753.1553.75

Scenario 1:long positions above 52.70 with targets at 51.80 & 51.50 in extension.

Scenario 2:above 52.70 look for further upside with 53.15 & 53.65 as targets.

Comment:the RSI is bearish and calls for further downside.

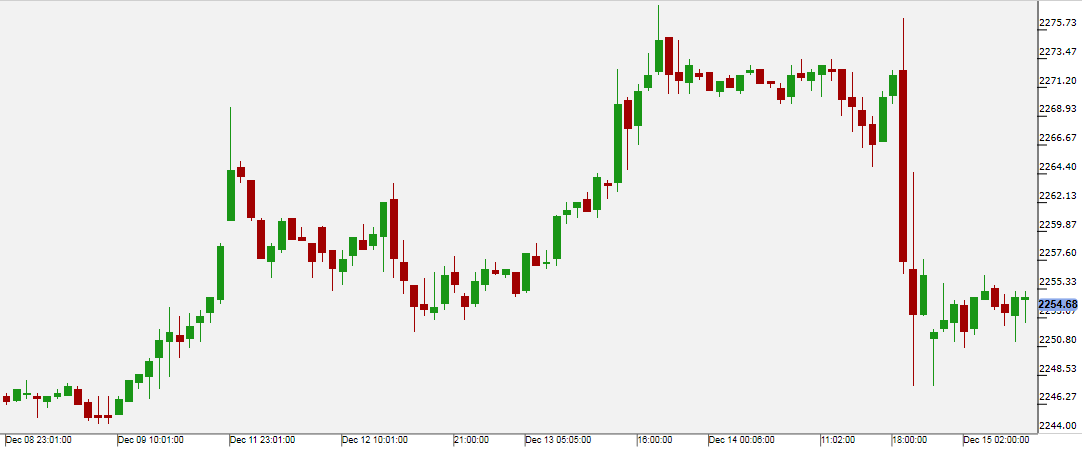

US 500

U.S. stocks fell the most in two months on Wednesday, after the Federal Reserve raised interest rates by a quarter point and signaled hikes could come next year at a faster pace than some expected.

Energy stocks weighed the most on the S&P 500 after a sharp drop in U.S. crude oil prices.

The Fed's decision to raise rates comes as President-elect Donald Trump, who will be sworn in next month, is seen cutting taxes and increasing spending on infrastructure.

Fed Chair Janet Yellen indicated the central bank was, at the margins, adapting to Trump, as some committee members began shifting fiscal policy assumptions to slightly faster growth and lower unemployment.

Stocks sold off during Yellen's press conference after the Fed statement.

Pivot: 2269

Support: 2253 2247 2240

Resistance: 2269 2273 2283

Scenario 1: short positions below 2269.00 with targets @ 2253.00 & 2247.00 in extension.

Scenario 2: above 2269.00 look for further upside with 2273.00 & 2283.00 as targets.

Comment: the RSI is mixed with a bullish bias. The 50-period simple moving average is in support.