The dollar surged to one-week highs against the other major currencies on Friday, supported by the release of better-than-expected employment data in the U.S. The U.S. Labor Department announced that the economy added 209,000 jobs last month, surpassing past expectations for an increase of 183,000. The U.S. economy added 231,000 jobs in June, whose figure was revised from a previously estimated 222,000 rise.

Also the U.S. Commerce Department released a report on Friday showing that the trade deficit decreased by more than expected in June. The report said the trade deficit narrowed to $43.6 billion in June from $46.4 billion in May. Analysts had expected the deficit to narrow to only $45.0 billion. The narrower trade deficit was primarily due to a continued increase in the value of exports, which grew by 1.2 percent to $194.4 billion in June after rising by 0.4 percent to $192.0 billion in May.

For today, the UK is to produce an industry report on house price inflation while financial markets in Canada are to remain closed for a holiday. Minneapolis Fed President Neel Kashkari and New York Fed President William Dudley are both due to speak.

This week will show key data on consumer prices in France, Germany, Italy, Switzerland, China, US and the UK complemented by US jobless claims and price inflation data to be released on Thursday and Friday.

The dollar gained against most other currencies on Friday, boosted by NFP data showing the U.S. economy created more jobs than expected while news from the Trump administration on tax reforms raised sentiment.

The dollar was on track to record its biggest one-day gain of the year, after a strong U.S nonfarm payrolls report and U.S. trade balance data eased concerns about a possible slowdown in the economy.

This week economic data from Germany and France on trade and production figures could give further impulses to the Euro currency, while later on Thursday US jobless claims and Friday’s inflation figures could be key drivers.

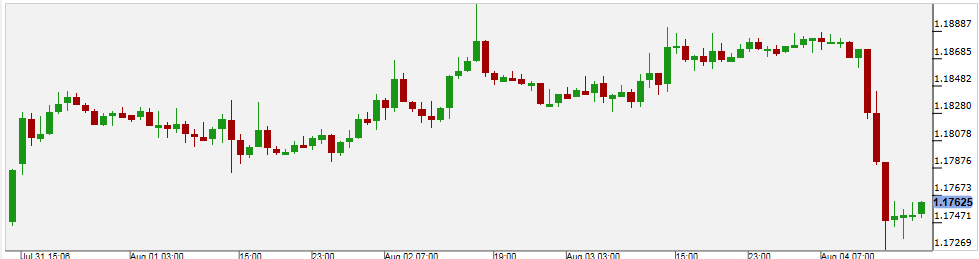

Pivot: 1.1795

Support: 1.172 1.165 1.161

Resistance: 1.1795 1.1845 1.191

Scenario 1: short positions below 1.1795 with targets at 1.1720 & 1.1650 in extension.

Scenario 2: above 1.1795 look for further upside with 1.1845 & 1.1910 as targets.

Comment: the RSI shows downside momentum.

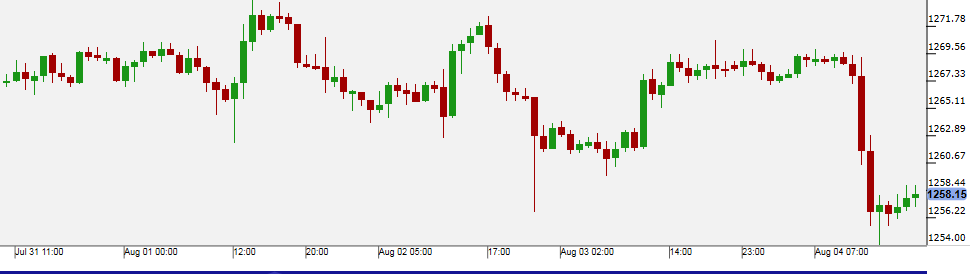

Gold

Gold prices fell in the wake of a surge in the dollar, after a stronger-than-expected U.S. economic data eased concerns over a possible slowdown in the U.S. economy.

Gold remained on track for a three-week winning streak on expectations the U.S. Fed might not stick to its plan on raising rates at least once more this year. Gold prices had traded within a tight range for most of the week, struggling to make use of the weakness in the dollar, as market participants awaited further insight into the strength of the labor market.

Inflation data due on Thursday and Friday will probably be the main focus for gold traders this week.

Pivot: 1261

Support: 1252.25 1248.75 1245

Resistance: 1261 1264 1267

Scenario 1: short positions below 1261.00 with targets at 1252.25 & 1248.75 in extension.

Scenario 2: above 1261.00 look for further upside with 1264.00 & 1267.00 as targets.

Comment: the RSI broke below a rising trend line.

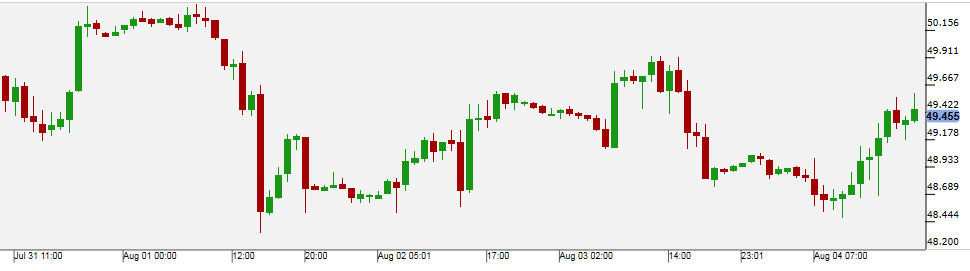

WTI Oil

The U.S. active rig count fell by four this week to 954, according to a Friday report from Baker Hughes. On the other side there was pressure on the prices due to an increase in OPEC exports and strong domestic production.

Due to this mixed data oil traded slightly lower than at the beginning of last week, while volatility allowed traders some opportunities in short term trades last week.

In the week ahead, market participants will focus on monthly reports from the Organization of Petroleum Exporting Counties and the International Energy Agency to assess global oil supply and demand levels.

Pivot: 48.7

Support: 48.7 48.33 48.02

Resistance: 49.55 50 50.4

Scenario 1: long positions above 48.70 with targets at 49.55 & 50.00 in extension.

Scenario 2: below 48.70 look for further downside with 48.33 & 48.02 as targets.

Comment: the RSI is bullish and calls for further upside.

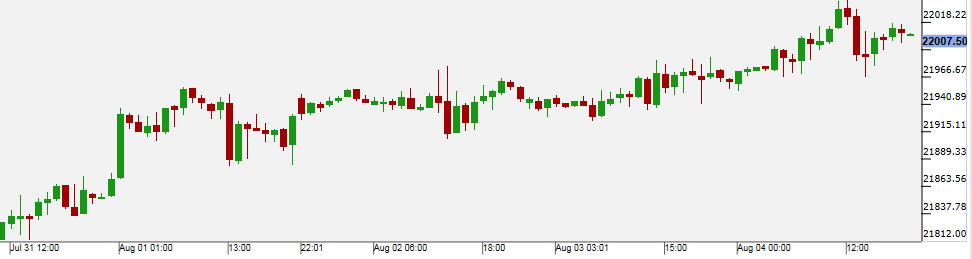

US 30

The Dow Jones Industrial Average kept on pace to close at another record on Friday, after data on the U.S. labor market showed higher job additions in July. The leading equity index is on track to close with its eighth record and ninth day in the plus. Gains were also seen in the S&P 500 and the Nasdaq.

Bank shares among them Bank of America (NYSE:BAC), JP Morgan and Citigroup (NYSE:C) were the biggest winners of the positive economic data. This was also evident in solid gains of the US Banks EFT which registered the biggest gains of all equity ETFs currently offered by iFOREX.

In the week ahead, inflation data due on Thursday and Friday will be in the spotlight for this week, as investors try to assess whether the Fed will go ahead with another rate hike as planned.

Pivot: 21935

Support: 21935 21885 21835

Resistance: 22050 22110 22165

Scenario 1: long positions above 21935.00 with targets at 22050.00 & 22110.00 in extension.

Scenario 2: below 21935.00 look for further downside with 21885.00 & 21835.00 as targets.

Comment: the RSI is supported by a bullish trend line.