In my most recent post, I indicated that I expected US stock prices to move up further, but in a choppy fashion (see Correction, what correction?). For more risk averse investors and traders who are afraid of the volatility, I can suggest another way to approach this market.

Under these circumstances, directional market volatility could be mitigated with a pairs trade. Buy the outperforming sectors and groups and short the underperforming sectors and groups. There are a few that could be looked at.

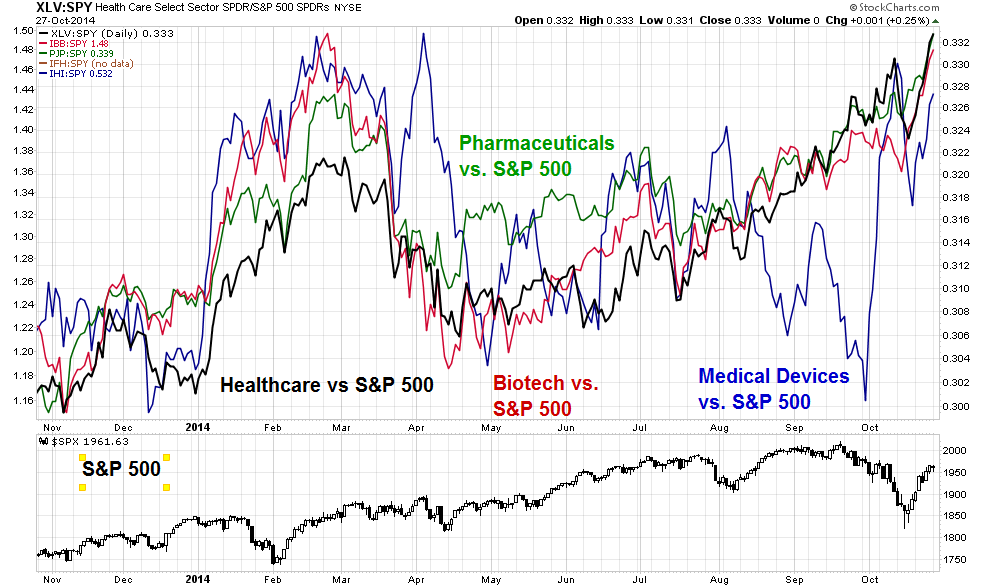

One possible long position is Healthcare. The Healthcare sector and its industries have been fairly consistent outperformers in the last year, even in the recent correction. The chart below shows the relative performance of this sector and its industries compared to the SPX in the past year, as well as the SPX in the bottom panel.

I do have one caveat. The relative performance of the Medical Devices group, as represented by the iShares DJSU Medical Devices Index (NYSE:IHI), seems overly volatile and should probably be avoided as a long candidate.

Another long candidate might be the NASDAQ. The NASDAQ 100 has been on a tear since May. By contrast, smaller stocks, as represented by the Russell 2000 small caps (iShares Russell 2000 Index (ARCA:IWM)) or mid-caps (SPDR MidCap Trust Series I (NYSE:MDY)) have continued to underperform during the same period.

These charts suggest the follow long and short positions as pairs trades:

- Long: Healthcare or any healthcare industry except Medical Devices

- Long: NASDAQ 100

- Short: Small or mid caps (IWM or MDY)

Disclaimer: Pairs trading represents a relatively exotic position and requires a higher level of sophistication that is not appropriate for everyone. Do your own due diligence and know your own risk tolerances before entering the trade.

Disclosure: I have no pairs positions on at this time, but I could enter in any of the aforementioned positions at any time in the near future. Long TQQQ

Cam Hui is a portfolio manager at Qwest Investment Fund Management Ltd. ("Qwest"). This article is prepared by Mr. Hui as an outside business activity. As such, Qwest does not review or approve materials presented herein. The opinions and any recommendations expressed in this blog are those of the author and do not reflect the opinions or recommendations of Qwest.

None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this article constitutes investment advice and any recommendations that may be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions. Past performance is not indicative of future results. Either Qwest or Mr. Hui may hold or control long or short positions in the securities or instruments mentioned.