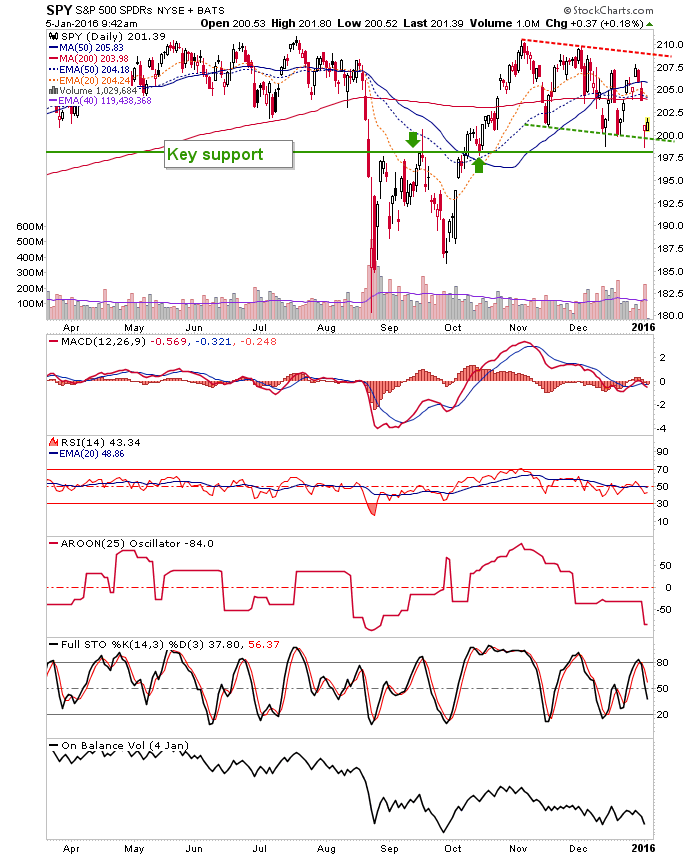

We have been following gentle downtrend channels like this one in the SPDR S&P 500 (N:SPY) on the SPX and Dow for weeks now, along with a sideways channel on NDX. Subscribers were well prepared for Monday’s drop to the channel bottoms and what I think could be a bounce attempt per support noted on this chart, below.

MACD and RSI are weak, the trend is down, STO has probably not bottomed after crossing below 80 and OBV is very weak. I think we bounce, but those with bearish conviction will be looking at the moving average cluster (which would fill the gap) or as an extreme, the channel top as limiters.

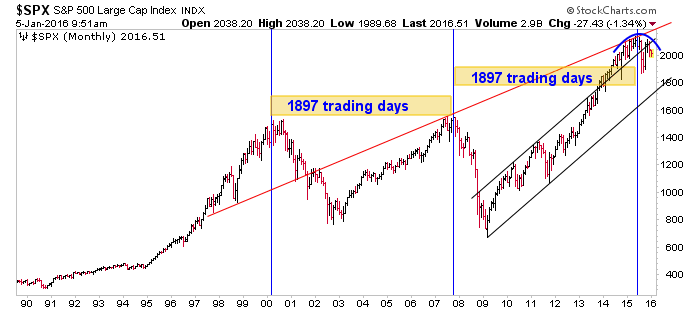

We have been noting the “dunce” cap on SPX head (blue) for months now. Also, this chart is my representation of cycle analysis that I bought from Peter Eliades that seems to have nailed a top of some kind. We reviewed this months ago as well.

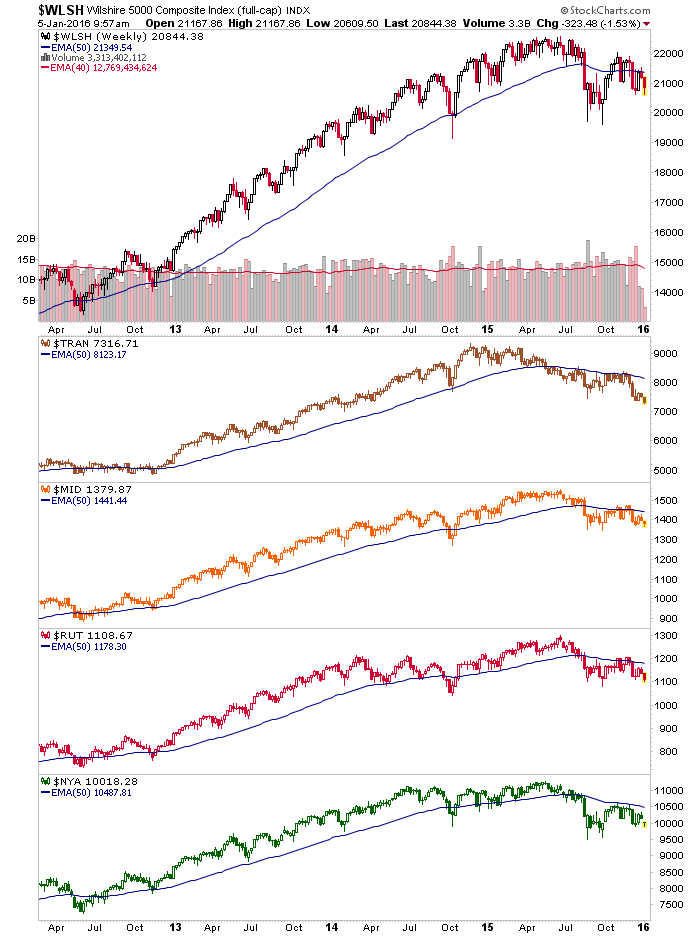

Finally, here is a broader view of the US market using the Wilshire 5000 weekly chart. We have kept this front and center as well. Does this look healthy to you?

I expect a bounce, but the intermediate trend is heading to bearish now. A loss of support per the SPY at top would pretty much seal that deal.