With Hurricane Harvey’s devastation still fresh in our minds, another catastrophic tropical storm — Hurricane Irma — hit the shores of Southern U.S., this time affecting the city of Florida in its wake. Although Irma hit the coast of Florida as a Category 4 Hurricane on Sep 10, it has now been downgraded to a tropical storm. However, the damages inflicted by the storm are colossal.

As far as the Utilities are concerned, more than 6.2 million Floridians were affected by blackouts, as the companies cut power on grounds of safety. Works pertaining to power restoration have already been initiated by the utility providers but the pace of the same remains a laggard owing to torrential rainfall and subsequent flooding. This in turn is likely to impact few utilities, particularly those supplying power in areas of heavy rainfall like Jacksonville.

Economic Impact of Harvey & Irma

According to BBC News, analysts initially estimated that the United States will bear an economic cost of $300 billion from Irma alone. However, post hitting Florida, the storm lost intensity driving down loss estimates.

Currently, credit rating firm Moody's analysts estimate that Harvey and Irma will lead to around $150-$200 billion loss in the United States and an additional $20-$30 billion economic expenses owing to disruption services. This in turn, forced the firm to downgrade the nation’s Q3 forecast for gross domestic product by half a point to 2.5%.

Nevertheless, the fourth quarter is likely to witness improved growth, provided rebuilding efforts are successful.

How Have Utilities Been Impacted?

There is no denial of the fact that if Irma impacts the whole economy, the Utility sector will be unable to escape its wrath, at least in the near term. Notably, none of the major utilities in Texas, following Harvey, suffered any significant damage in their generation fleet or power generating system, thanks to advanced infrastructural development.

This time, we notice that utilities that have started vigorous restoration in the Irma affected areas have witnessed a positive movement in their share price. However, some utilities suffered mildly due to damaged grid systems as customers continue to face power outages. Nevertheless, the overall sector is expected to not to suffer much following such hurricanes, in the long term. This is due to the sector’s significant investments toward improving the grid system and transmission and distribution lines, in recent years. In particular, many overhead transmission lines have been changed to undergrounds so they don’t come in the path of such storms.

Here we have discussed a handful of primary utility providers in Florida and have tried to ascertain whether they have successfully managed following Irma’s rampage in the state.

Gainer

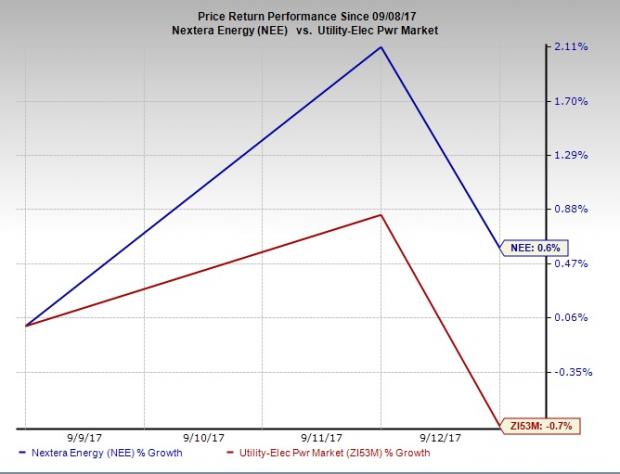

NextEra Energy, Inc. (NYSE:NEE) : NextEra Energy is engaged in the generation, transmission, distribution, and sale of electric energy. It currently carries a Zacks Rank #3 (Hold).

Notably, by Sep 12, Florida Power & Light Co. (FPL), a subsidiary of NextEra Energy had restored power to 2.3 million customers, which was 40% of those affected across Florida. The company announced that customers on the state's east coast can expect power to be restored by about Sept 17. Moreover, its system upgrades have allowed FPL to automatically reroute power and address about 1.5 million outages.

Shares of this company inched up 0.6% following Irma’s havoc.

Losers

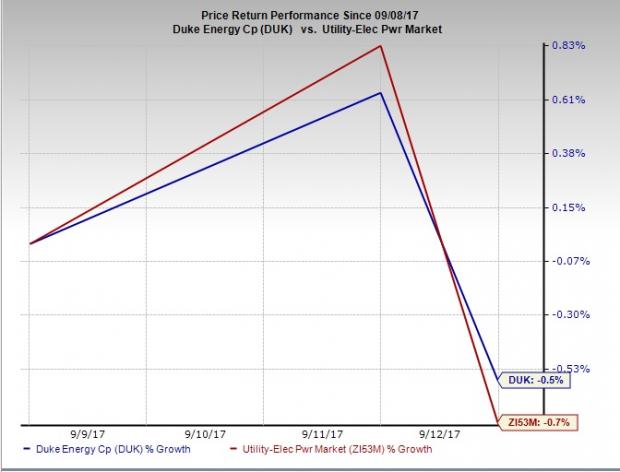

Duke Energy Corporation (NYSE:DUK) : Duke Energy is a diversified energy company with a wide portfolio of domestic and international, natural gas and electric and regulated and unregulated businesses which supply, deliver and process energy. It currently carries a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Notably, by Sep 12, the company restored power to only 0.4 million consumers, out of the approximately 1 million customers. It also reported that its electrical system has suffered significant damage in Hardee and Highlands County, as a result of which power restoration will take time.

Shares of this company dipped 0.5% following Irma.

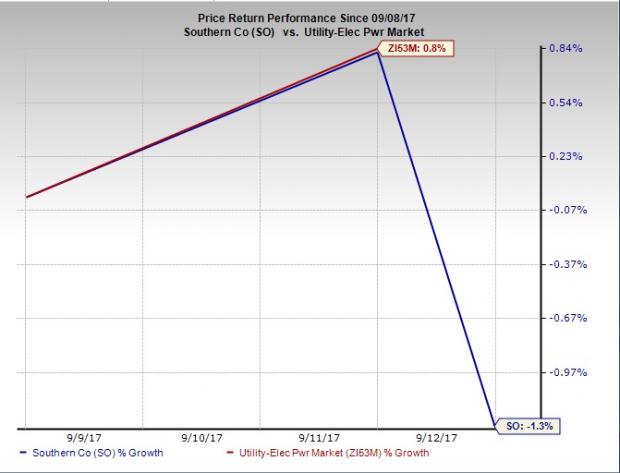

Southern Company (NYSE:SO) : Southern Company’s operations include wholesale electricity generation and natural gas services, retail energy services and natural gas storage operations. It currently carries a Zacks Rank #3.

The company’s CEO and chairman Thomas Fanning has expressed concerns regarding power restoration in Florida as heavy wind and rainfall have destroyed the state's infrastructure. He revealed that it will take weeks for restoration. In Georgia, almost 1 million of the company’s customers faced power outage.

Shares of this company dropped 1.3% post Irma.

Valuation Signals More Upside in Utilities

A valuation analysis of the Utility sector reveals that the stocks are not that expensive at this point, thereby giving room for further upside, in future. The sector currently has a trailing 12-month EV/EBITDA ratio of 10.8, which is much lower than the high end of 11.6 during the period. Additionally, the reading compares favorably with the market at large, as the current EV/EBITDA for the S&P 500 is at 10.9. The sector’s favorable positioning compared to the overall market certainly signals more upside as well.

Irma is expected to hamper the third quarter earnings of the sector as the storm has severely affected the infrastructure of the state. Nevertheless, positive valuation metrics hint at strong growth prospects for the utilities in the future, once the effect of Irma wears out.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

NextEra Energy, Inc. (NEE): Free Stock Analysis Report

Southern Company (The) (SO): Free Stock Analysis Report

Duke Energy Corporation (DUK): Free Stock Analysis Report

Original post