It seems that the spin-off from Hewlett Packard Enterprise Company (NYSE:HPE) , along with restructuring initiatives, is apparently paying off at last for HP Inc. (NYSE:HPQ) , as evident from its last few quarterly results. The company not only reported better-than-expected results for third-quarter fiscal 2017, but also continued the revenue growth momentum for the fourth consecutive quarter after several quarters of decline. The quarter also marked back-to-back second time in a row where both Personal Systems and Print segments have grown in the same quarter since 2010.

HP’s total revenues increased 9.8% year over year to $13.060 billion and outpaced the Zacks Consensus Estimate of $12.077 billion. The better-than-expected top-line performance was driven mainly by strength in the Personal System and Printing segments, along with the successful launch of products.

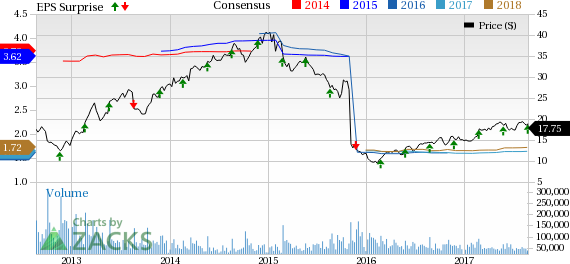

The company’s bottom-line results were also impressive, wherein its non-GAAP earnings from continuing operations of 43 cents per share came a penny ahead of the Zacks Consensus Estimate, as well as matched the upper-end of management’s earlier guidance range of 40-43 cents.

Despite reporting better-than-expected results and strong top-line growth, shares of HP fell nearly 1.4% during yesterday’s after-hour trade. This may be due to the fact that the company’s GAAP and non-GAAP earnings failed to mark year-over-year improvement. Apart from this, a lower-than-expected earnings guidance range for the fiscal fourth quarter might also have turned investors cautious.

Notably, HP’s non-GAAP earnings came in lower than the year-ago quarter’s earnings of 48 cents. On a GAAP basis, the company posted earnings from continuing operation of 41 cents, down from 49 cents reported in third-quarter fiscal 2016. The year-over-year decline in bottom-line results was stemmed by elevated costs and expenses, which were partially offset by higher revenues and reduced share counts.

HP’s shares have underperformed the industry to which it belongs to in the year-to-date period. While the stock has returned 27% in the said period, the industry gained 37%.

Quarter in Detail

The Personal Systems segment generated revenues of $8.404 billion, up 12% year over year. Commercial revenues increased 11%, while Consumer revenues were up 14%. The company witnessed a 7% rise in total shipments, driven by a 12% increase in Notebook unit shipment. Desktops unit shipments were down 3% on a year-over-year basis.

Printing revenues were up 6% year over year to $4.698 billion, primarily due to a 10% increase in supplies revenues. HP’s total hardware unit sales inched up 1% owing to an increase of 1% in Consumer hardware units. Commercial hardware units, however, remained flat on a year-over-year basis.

Region wise, revenues from Americas were up 8% year over year. EMEA revenues grew 14%, while the Asia Pacific and Japan region increased 15% year over year, all in constant currency.

Gross margin expanded 30 basis points (bps) on a year-over-year basis to 18.6%, primarily driven by better margin in the printing segment backed by improved productivity and higher supplies mix. However, elevated commodity costs of Personal Systems partially offset the aforementioned benefit.

Non-GAAP operating expenses flared up 35% year over year to $1.4 billion.

Non-GAAP operating margin from continuing operations contracted 170 basis points to 7.7%. The contraction can be attributed to escalating costs and expenses. HP’s non-GAAP net income from continuing operations came in at $735 million compared with $826 million reported a year ago.

Balance Sheet and Cash Flow

HP ended the fiscal third quarter with cash and cash equivalents of $6.967 billion compared with $6.223 billion in the previous quarter. The company had long-term debt of $6.744 billion compared with $6.710 billion last quarter.

The company generated cash flow of $1.775 billion from operational activities during the quarter. HP repurchased shares worth $302 million and paid dividends worth $222 million, in the same time frame.

During the first three quarters of fiscal 2017, operating cash flow came in at $2.997 billion, while the company paid $673 million as cash dividend and bought back shares worth $911 million.

Guidance

HP raised its lower-end earnings guidance range for fiscal 2017. The company now anticipates non-GAAP earnings per share from continuing operations in the band of $1.63-$1.66 (previously $1.59-$1.66). The Zacks Consensus Estimate is currently pegged at $1.64 per share.

For the fiscal fourth quarter, HP projects non-GAAP earnings from continuing operations in the range of 42-45 cents per share (mid-point: 43.5 cents). The Zacks Consensus Estimate is pegged at 44 cents.

Our Take

We are impressed by the performance of HP’s PC segment, wherein the year-over-year increase can be attributed to growth in Commercial and Consumer revenues.

HP’s efforts to turn around its business have been commendable. The company is working on product innovation, differentiation and enhancing the capabilities of its printing business to stabilize the top line.

The recently released PC shipment data by IDC depicts that HP’s restructuring initiatives, such as focus on product innovations, pricing, marketing and sales activities, divestment of non-core assets and cutting jobs to lower costs, are paying off. HP, as per the data compiled by IDC, witnessed year-over-year shipment growth for the fifth quarter in a row, after registering decline for five consecutive quarters.

With the start of shipping A3 multifunction printers to more than 80 countries, which covers all its key markets, HP can revive its printing business and grab a bigger share in the inkjet printer market. Also, the acquisition of Samsung’s printing business is anticipated to support the development and manufacturing of printers.

However, macroeconomic challenges and tepid IT spending remain near-term concerns. Competition from the likes of International Business Machines (NYSE:IBM) and Apple (NASDAQ:AAPL) adds to its woes.

HP currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

One Simple Trading Idea

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing, and exclusive of fees, it can turn thousands into millions of dollars.

This proven stock-picking system is grounded on a single big idea that can be fortune shaping and life changing. You can apply it to your portfolio starting today.

HP Inc. (HPQ): Free Stock Analysis Report

International Business Machines Corporation (IBM): Free Stock Analysis Report

Hewlett Packard Enterprise Company (HPE): Free Stock Analysis Report

Apple Inc. (AAPL): Free Stock Analysis Report

Original post

Zacks Investment Research