On Monday, the Economic Modern Family, which consists of 1 index and 5 key sectors, showed mixed signals as half of the Family closed down for the day.

The Russell 2000 iShares Russell 2000 ETF (NYSE:IWM), iShares NASDAQ Biotechnology ETF (NASDAQ:IBB) and VanEck Vectors Semiconductor ETF (NYSE:SMH) were down with iShares Transportation Average ETF (NYSE:IYT), SPDR® S&P Retail ETF (NYSE:XRT), and SPDR® S&P Regional Banking ETF (NYSE:KRE) up on the day, Monday.

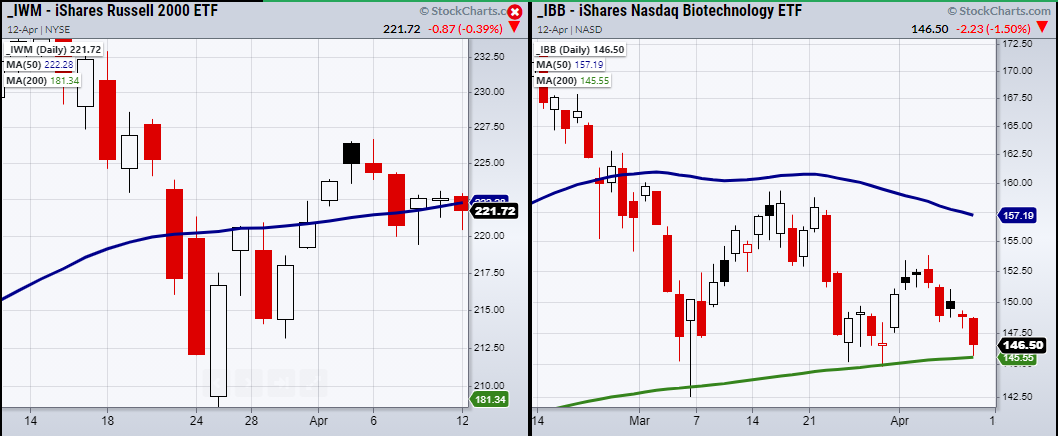

With SMH lingering in all-time high territory, IWM and IBB were the most worrisome of the bunch, as both sit near pivotal price levels made by their major moving averages.

For IWM, the 50-Day moving average at $222.28 (Blue Line) and IBB, way weaker, sit above the 200-DMA at $145.55 (Green Line). The key difference is their behavior around their moving averages.

For example, if you look at IWM, you can see that it has broken through its 50-DMA 4 consecutive times in the last 4 trading days. IBB already broke its 50-DMA, but now has respected its moving average. Out of the 4 recent days it came close to breaking; it only broke once on Mar. 5.

This shows that if IBB breaks its 200-DMA and closes under, it will have much more meaning. It could impact the IWM to finally break its 50-DMA.

Because IWM cannot be trusted to hold its moving average, we can look at the bigger picture as the 50-DMA represents more of a price range to hold near, than a specific price level to put technical weight on.

This means that for today's trading session, if IWM decides to head lower, it will need to hold recent support of $219.39 from the Apr. 8, while IBB needs to hold over its 200-DMA at 144.55.

If IBB does break under its moving average and into a distribution phase, always watch for a second close under the moving average to confirm the phase change.

ETF Summary

- S&P 500 SPY) Made New highs.

- Russell 2000 (IWM) 219.39 support. Resistance 226.69.

- Dow (DIA) 333.43 support.

- NASDAQ (QQQ) 338.19 high to clear. Support 321.40.

- KRE (Regional Banks) Needs to hold over 68.15.

- SMH (Semiconductors) Bounced off the 10-DMA 250.07.

- IYT (Transportation) New highs.

- IBB (Biotechnology) 145.55 support.

- XRT (Retail) Needs to clear 93 then 96.27.

- Volatility Index (VXX) Needs to find support.

- Junk Bonds (JNK) Support 108.58 the 50-DMA.

- LQD (iShares iBoxx $ Investment Grade Corp Bond ETF) 131.61 next resistance area the 50-DMA.

- IYR (Real Estate) Held over the 10-DMA at 93.50.

- IYR (Utilities) Doji day. 64.19 support.

- GLD (Gold Trust) Held the 10-DMA at 161.78.

- SLV (Silver) Watching for second close under the 200-DMA at 23.13.

- VBK (Small Cap Growth ETF) 282.30 resistance area from the 50-DMA.

- UGA (US Gas Fund) 31 support area. 32.66 resistance.

- TLT (iShares 20+ Year Treasuries) 134.97 support. 138.66 resistance.

- USD (Dollar) Needs to hold over 92.00.

- MJ (Alternative Harvest ETF) Broke support at 21.55.

- WEAT (Teucrium Wheat Fund) Failed second close over the 50-DMA at 6.17.