President Trump hasn’t wasted any time implementing his agenda since taking office. In the days since his inauguration, he’s signed a blitz of executive actions. These include expediting pipeline projects, freezing federal hiring and building the much-discussed “Trump Wall.”

The president built his 2016 campaign around his pledge to “build a wall and make Mexico pay for it.” While there has been some uncertainty about the feasibility of the plan (especially the second part), it seems to be moving forward now that Trump is in office.

And by authorizing the project, he’s creating a number of lucrative opportunities for investors. Let’s look at why and how you can profit from the construction of the Trump Wall.

How the Trump Wall Is Being Built

Last Wednesday, the president signed his first executive order. That order enabled construction of the border wall and outlined the federal government’s strategy for targeting sanctuary cities.

The wall would run along the nearly 2,000-mile border with Mexico. Other than that, there aren’t many specifics available yet about what the project would entail.

For one thing, we’re still not sure whether the Wall will be a full-fledged rampart or a system of fences. According to government estimates, it would cost about $6.5 million per mile for a single fence, or about $11 million per mile to build a more robust wall. That puts the final price tag on the project somewhere between $10 billion and $20 billion.

Both are big numbers. And whether we’re building a wall or a fence, it’ll still be a huge undertaking for America’s construction industry. Therein lies the perfect investment play on the Trump Wall.

How To Invest

To put it in perspective, the U.S.-Mexico border is longer than the distance between Moscow and Paris. Building $6.5 million worth of wall on every mile of that stretch will be one of the largest construction projects in history. And it will require a lot of construction equipment.

That’s why Caterpillar (NYSE:CAT) and Fluor (NYSE:FLR) are likely cheering this turn of events. They’re two of the largest construction and engineering firms in the world. Fluor is the largest in the S&P 500 and Caterpillar is a Dow Jones Industrial Average component.

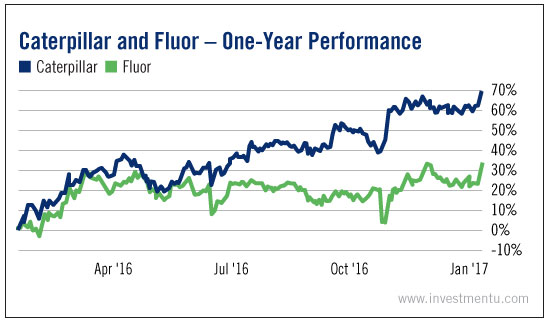

As a result of their size and prominence, these two companies had well-performing stocks before Trump was elected. But you can see how much both shot up after November 8.

While Trump’s forceful leadership style has worried some government contractors, it has been a boon to construction stocks. Companies like Fluor and Caterpillar could get some invaluable contracts from the Trump Wall.

For better or for worse, it seems like our 45th president is following through on his campaign promise. Whether or not you agree with Trump’s stance on the Mexican border, there’s no denying that the wall is a project of macroeconomic proportions. That means now is the time to trade on the beginning of its construction.

Thoughts on this article?