Scars are moments branded into your skin for all eternity.

We learn from them.

And maybe that’s what we’re seeing with the American consumer at the moment.

The question is: Has the American consumer learned to be more careful after the last crash? Or is something broken that needs to be attended to?

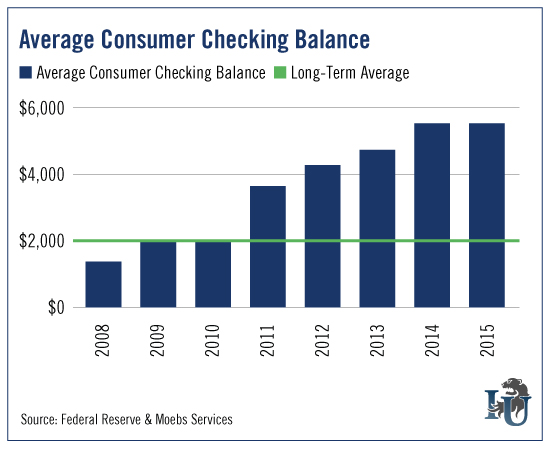

A report from Moebs Services recently pointed out that the average American has $5,459 in their checking account.

First, it’s the highest reading in a quarter-century. Second, this sum has been on a steady march higher.

Now, that might appear to be bullish... and it potentially could be. You might say to yourself, “Well, Americans have more money. That’s a good thing right?”

Well, the reality is, the average American’s checking account balance, according to Moebs’ data, was roughly $2,000 from 1994 to 2008.

Historically, when times are good the amount held in checking accounts falls.

We all understand that money has a tendency to burn a hole in our pockets. And Americans burn through that cash when optimism is high. For example, in 2007 - when everything seemed wonderful right before the collapse - the average American held $788 in their checking.

When unemployment is high or economic conditions are rife with uncertainty, the average checking account balance balloons. Americans start squirreling money away, unsure when that rainy day will arrive.

And that brings us to today...

The average account balance is more than 250% above the long-term average. And it’s nearly seven times higher than the pre-recession level in 2007.

American consumers typically have a combined $280 billion in their checking accounts. This year, it’s $657 billion.

Another study from BlackRock showed a similar undercurrent. Americans are holding twice as much cash as they know they should because their perceptions have soured on the stock market.

In recent weeks, this has been a good move as the markets have buckled.

In the BlackRock study, 72% of participants felt that investing wasn’t a way for them to reach their retirement goals. And for the younger generations - 25- to 34-year-olds - half felt the potential gains of investing in stocks weren’t worth the risk.

This was the largest percentage of any generation. And millennials are the largest generation in this country.

Two out of three stated investing was like gambling. These same folks reported 70% of their portfolios were cash.

So, money is just sitting in checking accounts - earning roughly 0.05% interest - while the stock market has more than doubled over the last several years.

It doesn’t make much sense.

Clearly, there are big scars left from the financial crisis that haunt Americans.

Yet unemployment has ticked lower, nearing full-employment levels. The price of gasoline has declined, easing the burden of a constant expense. Energy prices have declined. And consumer spending has remained largely resilient - particularly with big-ticket items like automobiles.

We’re getting conflicting information. Americans are tucking more cash away, but are overcorrecting because of the scars left from the Great Recession.

They feel comfortable in their financial positions. Sure, they know they have too much cash... but they don’t want to ramp up spending or invest it.

And this might be the new normal we have to face and address. But it doesn’t mean you should do the same.

The average investor - and American - has been notoriously bad with money. Over the last two decades, the typical investor returns are a mere 3.5% annually. That’s half the return of the S&P 500.

Cash is comfortable.

A security blanket in case times get tough.

But a return of 0.05% is not going to be enough in the long run. It’s not even close to keeping up with inflation, which is low at this point. Even then, the longer cash sits around, the more value it loses as inflation erodes it away.

Personally, I’m not the biggest fan of cash. But everyone should at least have six months of reserves. I keep some extra cash in my brokerage accounts, but that’s purely for emergencies - for when the market pulls back, sells off or corrects.

That way I always have plenty of capital to plow into stocks at lows.

I hate seeing that cash sit... it’s doing nothing but being lazy. But I know it’ll earn its keep with bursts of gains as the markets bounce higher. Since the start of the fourth quarter, the Dow Jones Industrial Average is up nearly 6%. And it’s up 12.25% from its low in August.

That’s how extra cash should be earning its keep. Put it to work to help elevate your portfolio returns.