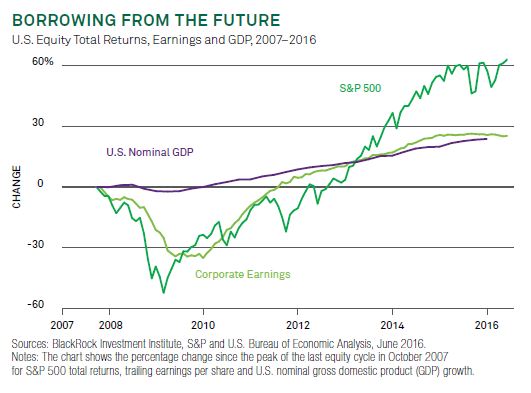

According to Blackrock (NYSE:BLK), since the S&P 500 hit its October 2007 peak of 1565, it has produced a total return of approximately 60%. The market gains are three times the increase in the growth of the U.S. economy itself (GDP); they are also three times the increase in the growth of corporate earnings.

What does it mean to experience market gains that are roughly three times the increases in US nominal GDP and corporate earnings? It implies that we are borrowing stock gains that we would have had in the future and, instead, experiencing tomorrow’s gains today. Stated differently, investors will be paying back present returns with sub-par future results. This is what happens when significant detachment from underlying economic fundamentals and corporate profits occur.

Could this time be different? It could be. The creation of electronic currency credits (e.g., dollars, yen, pounds, euros, etc.) by central banks around the globe has certainly pushed financial matters into uncharted waters.

On the flip side, there is a tendency for stock benchmarks to revert back to a corporate profits trend as well as a price trend. They did so in the 2000-2002 tech wreck; they did so in the 2007-2009 financial collapse.

Consider the regression chart below. On the last two occasions where the S&P 500 reached the two standard deviation level – 142% above the trend (circa 3/2000) and 82% above the trend (near 10/2007) – the index reverted back (i.e., black line.) If the heralded benchmark were to revert back to its trend today, The S&P 500 would trade near 1150. That represents a 46.8% bearish price descent from 2160.

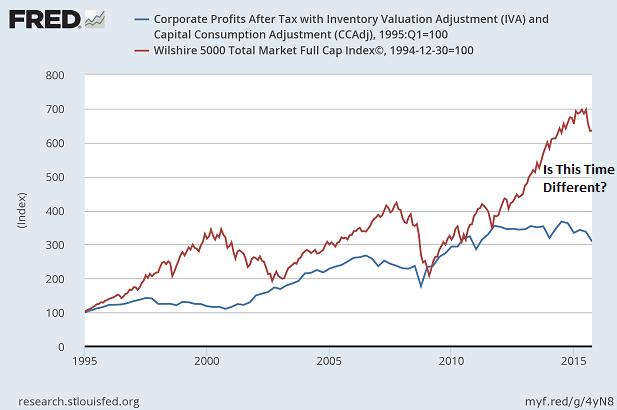

The tendency for prices to revert back to corporate profit trends and/or price trends should encourage investors to be mindful of additional evidence of stock overvaluation. For example, there was a time when Warren Buffett touted market-cap-to-GDP as his premier valuation tool. When the market capitalization of the Wilshire 5000 relative to gross national product (GNP) reached extraordinary heights in both 2000 as well as 2008, the subsequent reversions back to the longer-term average (mean) culminated in 50% price haircuts. What might a reversion to the market-cap-to-GNP ratio mean this time around?

Some readers will dismiss valuation concerns outright. Those folks will say that valuation is irrelevant when interest rates are low, when economic growth is modest and when central banks around the world implement/maintain stimulative monetary policies.

Then again, even the mildest of recessions might throw aggressively allocated stock enthusiasts for the proverbial loop. Consider the historical pattern for the Federal Reserve’s Labor Market Conditions Index (LMCI). According to Doug Short’s data, recessions begin anywhere from 3 to 17 months after the cumulative index has peaked (9 months on average). An economic downturn in the middle of 2017 would likely damage bullish euphoria here in 2016.

Valuations may not matter in the near-term when central banks promise ultra-accommodating rate policies. The same may be true with respect to employment stateside or global economic headwinds around the globe.

Nevertheless, when the investment community bring stock gains from the future into the present, there are less gains to be garnered down the road. Some of the most reliable valuation indicators (e.g., margin-debt-to-GDP, household-equity-to GDP, market-cap-to-GDP, P/E, P/S, etc.) collectively peg 10-year annualized stock gains going forward at roughly 3.5%.

Does that suggest you should expect 3.5% from stocks over the next decade? If your strategy is to hold 100% in U.S. equities… yes. In contrast, if you build yourself a cash cushion when prices are elevated – whether through aggressive cash savings or through “selling higher” – you will be far better positioned to take advantage of bargain prices during a panicky exodus from market-based securities.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients June hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.