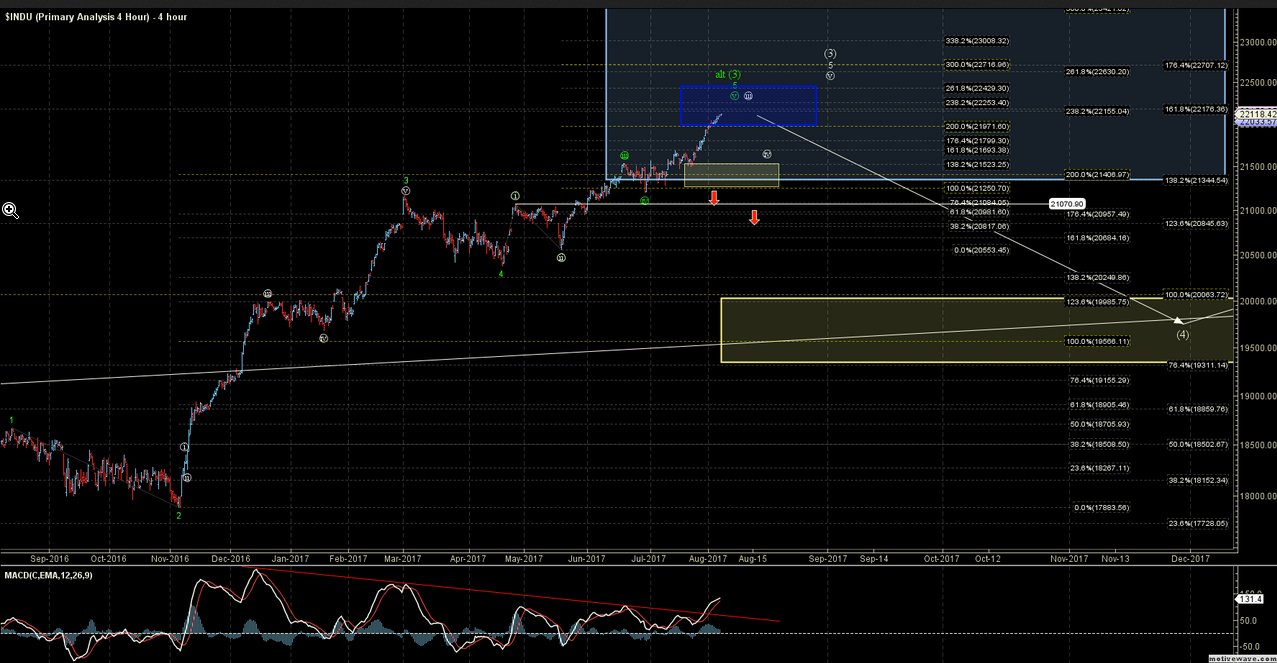

I have been writing for several weeks, now, that I was looking for an ideal shorter-term target zone of the 21,971–22,429 zone on the Dow Jones Industrial Average prior to seeing a top in the index. Last week the Dow crossed 22,000 for the first time and is now trading right in the middle of that target zone. Additionally, the path up to this zone since the May 17 low has been exceptionally smooth on a tight grind to these higher levels.

Now that we have hit this shorter-term target zone and have cleared the 22,000 level we look toward the future and ask: How much higher can the Dow really go?

Last week I noted the increased media attention on the Dow as it approached the 22,000 mark. As the markets defied most expectations in the face of ever increasing “bad” news, the focus simply became the milestone number itself.

On the day the Dow did indeed hit 22,000 there was quite a bit of attention from the media and even the president himself. On August 1, President Trump tweeted, “Stock Market could hit all-time high (again) 22,000 today. Was 18,000 only 6 months ago on Election Day. Mainstream media seldom mentions!” In that tweet, President Trump made a reference to the mainstream media. The media had certainly been mentioning the stock market over past 8 months, although likely not in the way Mr. Trump would have preferred.

Prior to the election, we heard from the majority of the media that if Donald Trump were to be elected it would “cause” the market to crash. After he was elected and this did not occur we then heard that it was actually good for the market. This was because Mr. Trump would be a pro-business President with pro-business policies. When there were many “tumultuous” events in Washington, we then heard that this was again bad for the markets.

Of course, in the end, none of this mattered and the market just simply continued to move higher and higher. In fact despite all of this “turmoil” in Washington the market has been the calmest it has ever been as it reaches new high after new high.

The bottom line is that it’s not the news that is “causing” the market to move, but rather the positive social mood that is driving the market to new record highs week after week. So powerful is this positive social mood that despite all of the “turmoil” being presented by the media, the market simply shrugs it off and continues break record after record. When the mood begins to turn negative then the markets will once again correct. Until that shift occurs the market will continue to simply move higher regardless of what bombs are thrown at it.

The Dow has now traded in the middle of the target zone that I had laid out several weeks ago and closing on a cluster of Fibonacci resistance levels. These levels represent Fibonacci price targets on varying wave degrees and come in at the 22,155–22,253.

If the Dow is able to hold under these price cluster levels and move lower then I would be watching the smaller degree support zone which now resides in the 21,523–21,250 zone. A break of the lower end of this zone at the 21,250 level would be the initial signal that the Dow may have topped. Further confirmation of a top would come with a break back under the 21,070. Alternatively, if the Dow is able to break through the 22,253 level without seeing a retracement first, then it may simply continue to grind its way closer to the upper end of the shorter term target zone which comes in at the 22,429 level.

While the media and president were focused on 22,000 we simply continued to follow our Fibonacci price targets. Those price targets have proved to be a much better gauge than reacting to every news event coming out of Washington. This will continue to be my approach moving forward. For now, I simply watch for a break of the smaller degree support zone to signal that the larger degree correction is under way. So while I remain cautious as we now trade in our target zone, until we see a break of the 21,250 level this move to the upside is still not yet done.

Mike Golembesky is a widely followed Elliott Wave technical analyst, covering U.S. Indices, Volatility Instruments, and Forex on ElliottWaveTrader.net (www.elliottwavetrader.net), a live Trading Room featuring intraday market analysis (including emini S&P 500, metals, oil, USD & VXX, interactive member-analyst forum, and detailed library of Elliott Wave education.