We saw a few leading stocks act pretty solid this past week on earnings while most aren’t acting so good from what I see.

The Nasdaq has been doing well as a result of just a few stocks, while the S&P and Russell are fading off support and breaking below their breakout areas.

This has me thinking we need more time for bases to complete before the next leg higher.

The metals didn’t fare so well but do look to be turning up off a higher low type of pattern but time will tell.

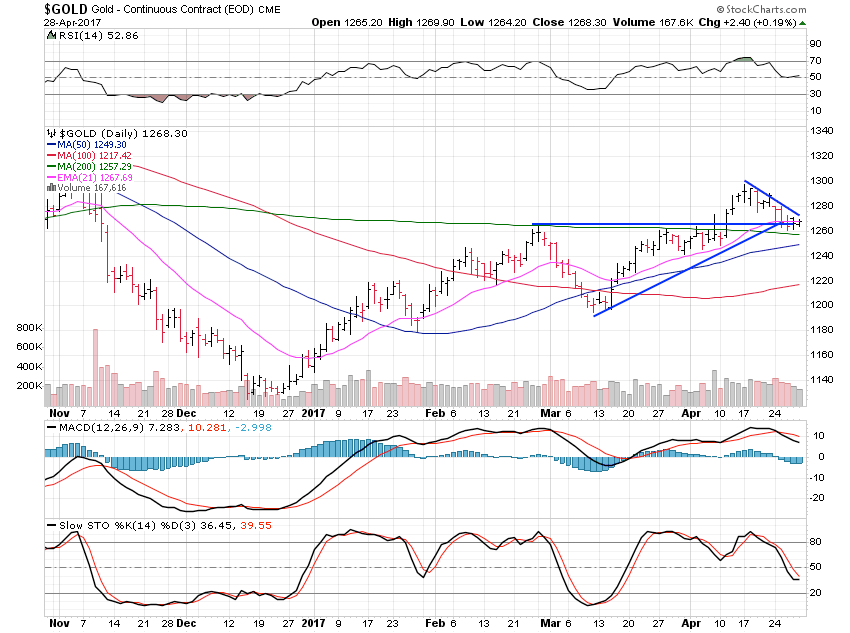

Gold slid 1.61% this past week but held up relatively well considering the elections in France and a focus on earnings season.

Let’s see if we can break this small downtrend line and move higher now from the $1,260 support area.

Silver lost 3.33% and closed below its 100 day moving average which isn’t so hot.

I’ve got to see silver move back above $17.40 by Tuesday or we will be looking to $16.75 as the next support area, and below that, $16.25.

Platinum fell 2.96% and is now at support, where it should turn higher.

$940 is a decent support area and should hold as long as gold holds or moves higher.

Palladium was the sole and big winner this past week, gaining 4.55%.

Solid action from palladium for sure, breaking out on increasing volume.

The odd time, palladium can lead the metals so this may be one of those times.

I remain on the road, on a bike trip, working some evenings and this weekend from a library in small town Tennessee, on the border with North Carolina.

Beautiful area with great roads I highly recommend.

It’s great to get away while the action is suspect.