German Gfk Consumer Confidence Survey (Mar) was 10.8 v an expected 10.9, from a prior number of 11.0.

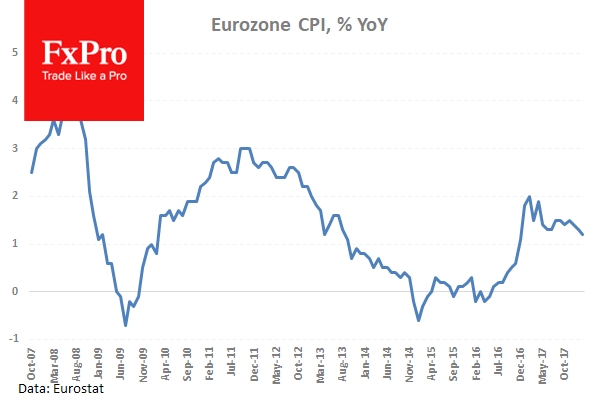

French Consumer Price Index (EU norm) (YoY) (Feb) was 1.4% v an expected 1.5%, from a prior number of 1.5%. EUR/USD moved lower from 1.22370 to a low of 1.22000.

Swiss KOF Leading Indicators (Feb) was 108.0 v an expected 106.1, from 106.9 previously.

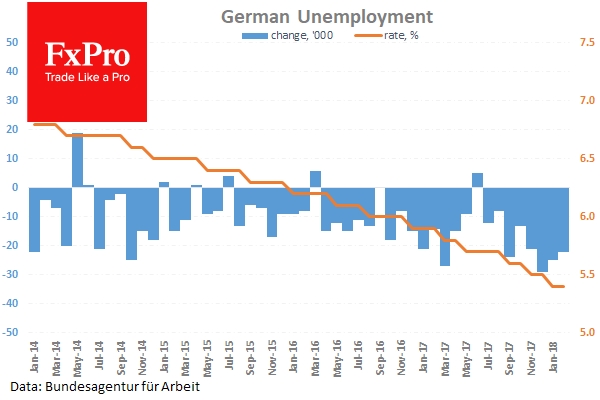

German Unemployment Change (Feb) was -22K v an expected -15K, from -25K previously. Unemployment Rate s.a. (Feb) was as expected, unchanged at 5.4. EUR/USD moved higher from 1.21983 to 1.22250 after this data was released.

Swiss ZEW Survey – Expectations (Feb) data was released at 25.8 from 34.5 previously.

Eurozone Consumer Price Index – Core (YoY) (Feb) was 1.0% v an expected 1.1%, from 1.0% prior. Consumer Price Index (YoY) (Feb) was as expected at 1.2%, from 1.3% previously.

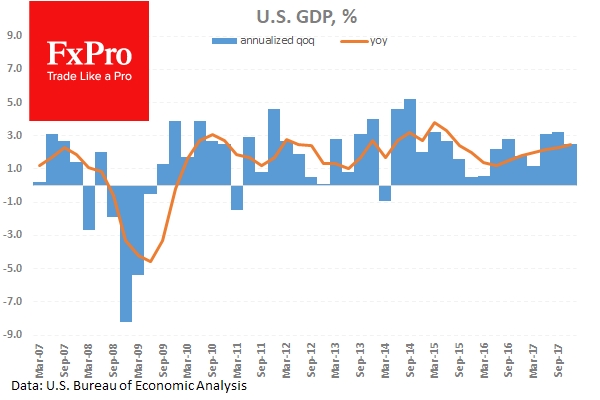

US Gross Domestic Product Annualized (Q4) was as expected at 2.5%, from 2.6% previously. Gross Domestic Product Price Index (Q4) was 2.3% v an expected 2.4%, from 2.4% previously. Personal Consumption Expenditures Prices (QoQ) (Q4) was 2.7% v an expected 2.8%, from 1.5% previously, which was revised up to 2.8%. Core Personal Consumption Expenditures Prices (QoQ) (Q4) was as expected at 1.9%, from 1.3% previously, which was revised up to 1.9%. EUR/USD fell to a low of 1.22021 before moving higher to 1.22278 as a result of this data.

US Chicago Purchasing Managers’ Index (Feb) was 61.9 v an expected 64.2, from a prior reading of 65.7.

US Pending Home Sales (YoY) (Jan) was -1.7% v an expected -1.8%, from a prior reading of -1.8%. Pending Home Sales (MoM) (Dec) was -4.7% v an expected 0.3%, from a prior reading of 0.5%.

Australian AIG Manufacturing Index was released, coming in at 57.5 against 58.7 previously. AUD/NZD moved up from 1.07594 to 1.07748 as a result of this data.

Foreign Investment in Japanese Stocks (Feb 23) was ¥-53.6B from a previous number of ¥-127.1B, which was revised up to ¥-127.2B. Foreign Bond Investment (Feb 23) was ¥-201.3B from ¥-553.1B previously. The report is released by the Ministry of Finance, detailing the flows from the public sector excluding the Bank of Japan. The net data shows the difference of capital inflow and outflow. A positive difference indicates net sales of foreign securities by residents (capital inflow), and a negative difference indicates net purchases of foreign securities by residents (capital outflow).

EUR/USD is up 0.10% overnight, trading around 1.22055.

USD/JPY is up 0.08% in early session trading at around 106.744.

GBP/USD is up 0.06% this morning, trading around 1.37681.

Gold is down -0.30% in early morning trading at around $1,314.10.

WTI is up 0.23% this morning, trading around $61.65.

Major data releases for today:

At 08:00 GMT, Polish Purchasing Manager Index (Feb) is expected to be 54.1 from 54.6 previously.

At 08:15 GMT, Swiss Real Retail Sales (Jan) is expected to be 1.1% from 0.6% previously.

At 08:55 GMT, German Markit Manufacturing PMI (Feb) is expected to be unchanged at 60.3. EUR crosses could be affected by this data.

At 09:00 GMT, Italian Unemployment (Jan) data will be released and is expected to be unchanged at 10.8%.

At 09:00 GMT, Eurozone Markit Manufacturing PMI (Feb) is expected to be unchanged at 58.5. EUR crosses could be moved by this data.

At 09:30 GMT, UK Markit Manufacturing PMI (Feb) is expected to be 55.0 from 55.3 previously. Consumer Credit (Jan) is expected to be £1.40B against a prior £1.52B. Mortgage Approvals (Jan) is expected to be 62.000K from a previous 61.039K. GBP pairs may be moved by this release.

At 10:00 GMT, Eurozone Unemployment Rate (Jan) data will be released, with an expected reading of 8.6% from 8.7% previously.

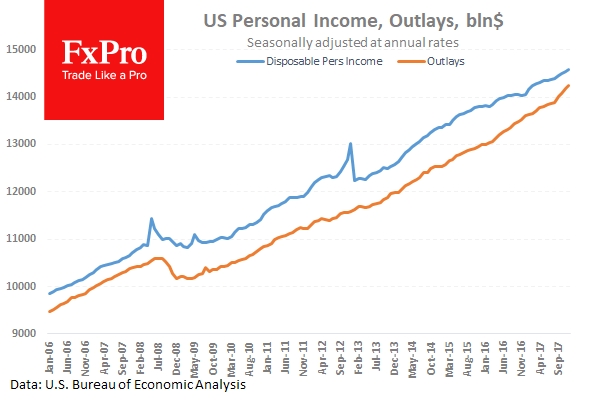

At 13:30 GMT, US Personal Consumption Expenditures – Price Index (YoY) (Jan) is expected to be 1.6% from 1.7% previously. Core Personal Consumption Expenditures – Price Index (MoM) (Jan) is expected to be 0.3% from 0.2% previously. Personal Consumption Expenditures – Price Index (MoM) (Jan) is expected to come in at 0.0% from 0.1% previously. Personal Income (MoM) (Jan) is expected at 0.3% v 0.4% previously. Personal Spending (Jan) is expected at 0.2% v 0.4% previously. Core Personal Consumption Expenditures – Price Index (YoY) (Jan) is expected to be unchanged at 1.5%. Continuing Jobless Claims (Feb16) is expected to be 1.930M from 1.875M previously. Initial Jobless Claims (Feb 23) is expected to come in at 226K from 222K previously. USD crosses may be heavily traded as a result of this data.

At 13:30 GMT, Canadian Current Account (Q4) is expected to be -17.80B from -19.35B prior. CAD pairs may be moved by this release.

At 14:30 GMT, Canadian Markit Manufacturing PMI (Feb) is expected to be 55.8 from 55.9 prior.

At 14:45 GMT, US Markit Manufacturing PMI (Feb) is expected to be unchanged 55.9.

At 15:00 GMT, US Fed Chairman Powell is again due to testify on the Semi-annual Monetary Policy Report before the House Financial Services Committee, in Washington DC.

At 15:00 GMT, US ISM Prices Paid (Feb) is due out with a consensus of 70.5 expected. The previous reading was 72.7. ISM Manufacturing PMI (Feb) is also out at this time, with an expectation for a number of 58.7 v 59.1 prior. Finally, Construction Spending (MoM) (Jan) is expected at 0.3% from the previous reading of 0.7%. USD crosses could be impacted by the volume of data releases at this time and turbulent price action may result.

At 16:00 GMT, US Fed’s Dudley is due to give a speech with his comments having the potential to impact USD and USD assets.

At 21:45 GMT, New Zealand Building Permits s.a. (MoM) (Jan) will be released, with a previous reading of -9.6%. NZD crosses may experience volatility during this time.

At 23.30 GMT, Japanese Job/Applications Ratio (Jan) is expected at 1.60 from 1.59 previously. Unemployment Rate (Jan) is expected at 2.7% from 2.8% previously. Overall Household Spending (YoY) (Jan) is expected at -0.3% from -0.1% prior. National CPI Ex Food, Energy (YoY) (Jan) is expected at 0.9% from 0.3% prior. JPY pairs may be moved by this data release.