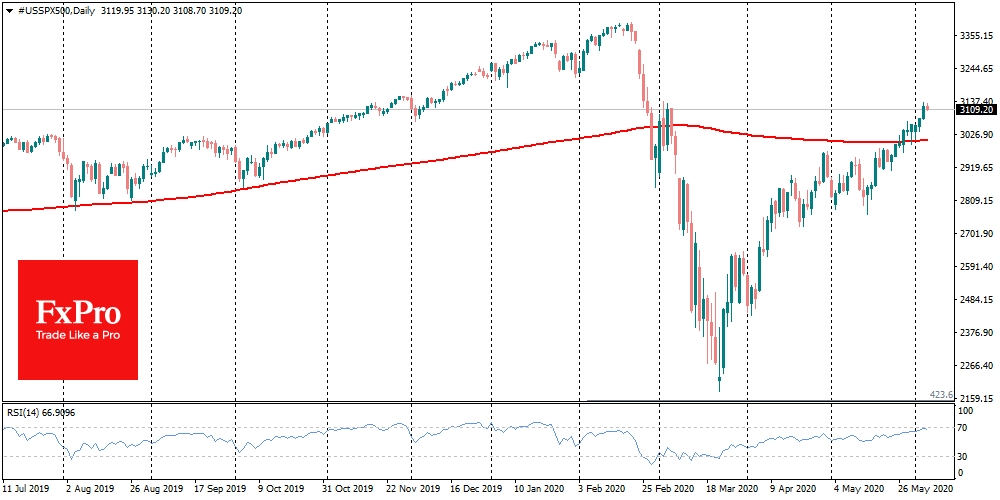

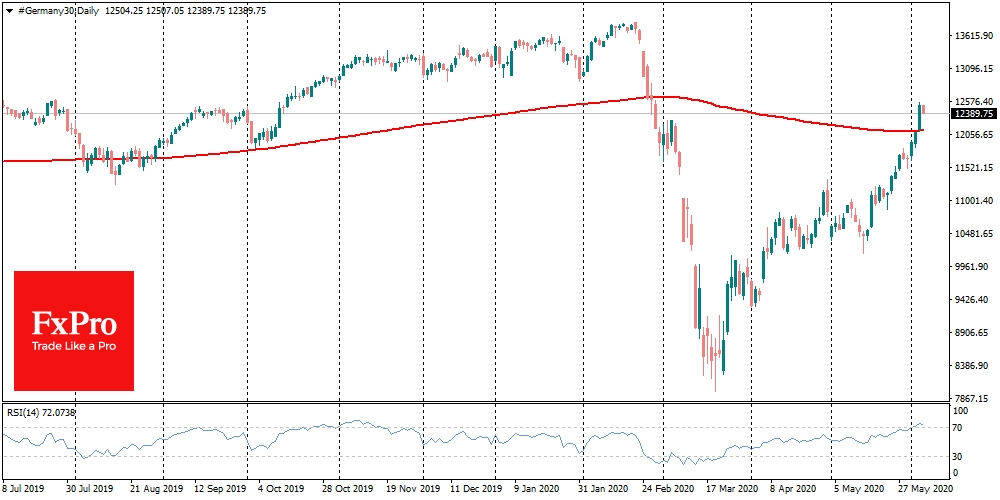

On Thursday morning, markets paused the impressive growth of stock indices the day before. The S&P 500 added 1.4% to 3115, which is in line with March’s high and only 7.8% below its historical highs. The German DAX was 10% below its peak, showing a 4% rally on Wednesday amid a new stimulus package of €120bn and defeating the 200-day average.

The difference between expectations and facts drives markets. Recently, market participants’ expectations look very optimistic, which increases the fragility of growth. Firstly, stock buyers are impressed by relatively strong employment in Europe and the US. But it continues to decline at a pace that exceeds the worst moments of the global financial crisis, despite the lifting of restrictions.

Besides, the unemployment rate in Europe is actually lower than reported due to the statistical features of the calculations. For example, in Italy, the unemployment rate in April fell (!) from 8.0% to 6.3%, only to since drop 745k out of the labour force. Similarly forced contraction of the labour market, in general, is taking place in other European countries, even if not in such a pronounced form.

In Europe, market participants are preparing for more support from the ECB later today. These plans for the easing of the central bank’s policy, as well as massive and rapid programs to help businesses in Europe, are already virtually priced in the stock index quotations. However, Europe has repeatedly delayed the launch of plans due to internal disagreements and bureaucracy. The support was accelerated only by the miserable situation in the markets, which is not now the case. Rapid growth is likely to give politicians time for reflections and discussions.

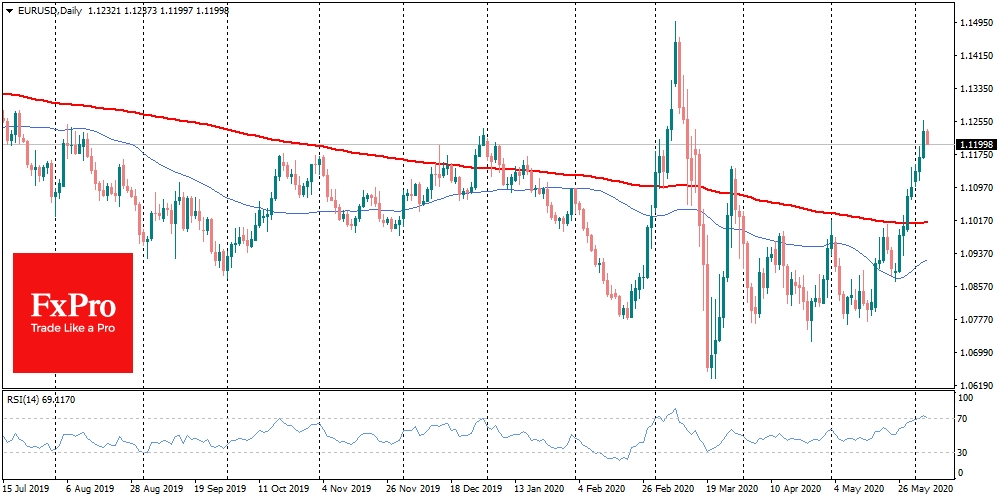

Often, the currency market is alarmed a little bit earlier than the stock market. And in the morning we are witnessing the dollar strengthening against a wide range of currencies.

The Chinese yuan gives up positions for the second day in a row, returning to the levels of the beginning of the month. EURUSD stalled on the way to growth above 1.1200. Similarly, the German DAX has been correcting slightly since yesterday’s spike in the morning.

It seems that the markets need not only a technical correction to reality but also a psychological one. And it may well happen this or next week on the background of ECB and Fed meetings and US employment data.

The FxPro Analyst Team

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

High Market Optimism Makes Growth Fragile

Published 06/04/2020, 05:17 AM

Updated 03/21/2024, 07:45 AM

High Market Optimism Makes Growth Fragile

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.