From Contrarian Outlook: Is retail dead? It depends. While Amazon.com (NASDAQ:AMZN) is indeed making life miserable for many brick-and-mortar outfits, I’d like to show you five dividend stocks in the space that could be a month or two away from getting a big shot in the arm.

So say the holiday crystal balls.

Salesforce.com (NYSE:CRM), which provides annual holiday industry insights, recently issued its 2017 forecast, saying this year’s Black Friday will be the “busiest digital shopping day in U.S. history” – outdoing even Cyber Monday. It’s a tech dream report that includes stats such as 40% of orders coming from mobile phones, and millennials using Amazon’s Alexa and Apple Inc's (NASDAQ:AAPL) Siri in droves. But while that does bode well for AMZN, don’t lose sight of the bigger picture – that’s also good news for brick-and-mortar retailers that have gotten their dot-com operations in shape.

That brings us to Deloitte, which sees not just good things for e-commerce sales, but holiday sales as a whole. It’s forecasting a 4.5% bump that outclasses 2016’s 3.6% growth, with Deloitte’s Rod Sides telling CNBC that “sentiment and spending indicators are firing on all cylinders.” Better still, “Even the big retailers continue to pick up e-commerce share.”

No, retail isn’t dead – you just need to pick your shots carefully. That’s why I have my eyes on these five retail dividend stocks yielding up to 7.4%. Their potential for a strong seasonal surge is nice, but they also boast several qualities that make them attractive, Black Friday bonanzas or not.

Best Buy (BBY)

Dividend Yield: 2.5%

Best Buy (BBY) is done playing the victim.

You probably can’t remember back to a time when Best Buy wasn’t seemingly days away from crumbling under the massive weight of Amazon. That has been the narrative for years, and for good reason. Best Buy’s revenues have been in decline for years, eaten away by Amazon on the left, but also big-box behemoths Wal-Mart (NYSE:WMT) and Target Corporation (NYSE:TGT) on the right.

And who can forget “showrooming” – that embarrassing practice of having someone walk into your store to check out the merchandise, then buy it online later on from home?

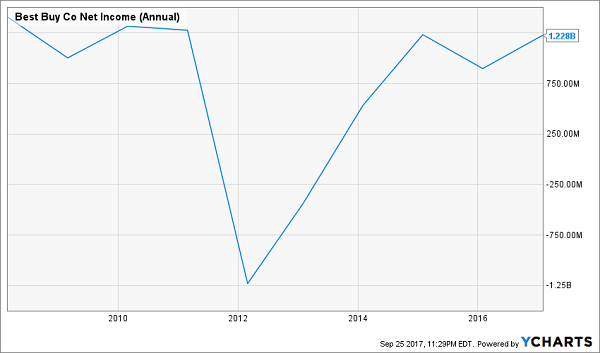

But sometimes the narrative is lazy and misses out on the finer details. I extolled the virtues of Best Buy last year – the company boasted steady cash flow and a healthy balance sheet – and I said profit growth should return as the retailer continues its “Renew Blue” turnaround. Indeed it did, with net income perking up almost 50% last year, and overall continued operational improvement helped shares crack all-time highs earlier this year.

Best Buy should get some help thanks to new iPhones, Nintendo Co (T:7974) ADR (OTC:NTDOY) products and the Microsoft (NASDAQ:MSFT) Xbox One X … and it’s also taking an aggressive swipe at Walmart and Amazon by offering same-day shipping in 40 markets by this holiday season.

Don’t sleep on this old-guard retailer. Those who already have are regretting it.

Best Buy (BBY) Is on the Bounce

Williams-Sonoma Inc (NYSE:WSM)

Dividend Yield: 3.2%

Yes, Williams-Sonoma (WSM) might put together some of the most cringe-worthy catalog entries in the home-goods space, but the owner of the W-S, Pottery Barn and West Elm brands is one of the premier names in upscale kitchen and décor.

It’s also pretty darn web-saavy.

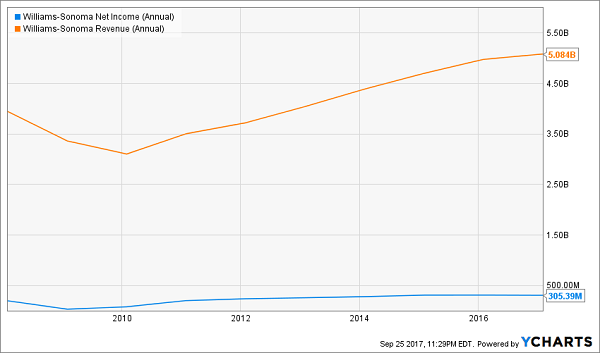

While Williams-Sonoma stores are still a draw thanks to their artisan samples and superior service, there’s no question that WSM is a digital powerhouse. At the end of 2016, W-S crossed an important threshold that saw e-commerce sales surpass in-store sales as a percentage of revenue, at 51.1%. While that came in a slightly down quarter, full-year 2016’s top line grew by 2%, and analysts project roughly 3% sales growth over the next few years.

In other words, Williams-Sonoma isn’t just growing its e-commerce business – it’s growing its overall business. And the retailer continues its advances, with CEO Laura Alber saying at the end of last year that in 2017, W-S would be “implementing digital tools such as next-generation product information pages, 3-D product visualization and increased personalization to deepen online engagement of both new and loyal shoppers.”

That makes WSM a likely winner in a tech-happy 2017 holiday shopping season. A well-funded dividend that represents just 40% of next year’s projected earnings make Williams-Sonoma a safe income play going forward.

Williams-Sonoma (WSM) Turns Table Runners Into Gold

United Postal Service (UPS)

Dividend Yield: 2.8%

United Parcel Service (NYSE:UPS) isn’t a retailer, of course, but it still benefits from consumers shopping in their jammies.

Someone has to deliver all those online orders.

UPS is approaching all-time highs set in 2016, though it has been a bumpy path. The stock was clobbered at the end of January amid what a disappointing fourth quarter despite brisk delivery business. The main issue was a heavy surge in business-to-consumer business (read: when you order something from Amazon) – a much costlier type of delivery for UPS that weighed on margins.

As a result, UPS announced it would pour money into its operations to better handle the continued breadth of e-commerce business, which dampened spirits in the stock. However, it’s shorter-term pain for longer-term gain, and UPS softened those prospects a bit by announcing this summer that it would charge more for holiday deliveries this year.

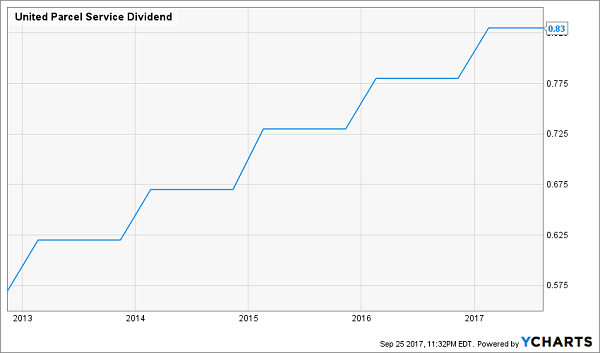

UPS, then, should take full advantage of a boffo holiday season for e-commerce. Meanwhile, longer-term investors enjoy the benefits of a payout that has grown nearly 50% in the past five years, and only represents half the company’s profits.

United Parcel Service (UPS) Delivers Dividend Growth Like Clockwork

Home Depot (NYSE:HD)

Dividend Yield: 2.2%

Home Depot (HD) is a must-buy ahead of the holiday buying season, and in fact, its attractiveness has nothing to do with the holidays.

For one, Home Depot’s Christmas isn’t Christmas – it’s spring. While most brick-and-mortar retailers announce tens of thousands of workers to help staff stores in November and December, HD stocks up on additional personnel to get ready for the homebuilding and home improvement season.

No, the timing here is purely coincidental. The reason to buy Home Depot is for a much more somber reason – rebuilding.

Hurricanes Harvey, Irma and Maria have decimated parts of Texas, Florida and Puerto Rico – all places where Home Depot has put down roots. All told, the company has more than 300 stores across the territory and pair of states, making it one of the likeliest beneficiaries as families, businesses and the government begins repairing homes, shops and infrastructure.

HD isn’t a terribly high yielder at just north of 2%, but it’s rapidly expanding its payout. Home Depot’s dividend has more than tripled in the past five years, and that includes a 30% jolt to the distribution at the beginning of 2017.

Home Depot (HD) Is Building an Impressive Dividend Growth Story

GameStop (NYSE:GME)

Dividend Yield: 7.4%

GameStop (GME) is the highest-yielding play among these five dividend stocks – and it’s also the trickiest.

On the one hand, I’m on the record as saying I think the video-game retailer’s payout is among a few dividends that could disappear some years down the road. But I don’t think we’re talking this year or next year … maybe not even for a decade or more.

And right now, GME might be on the verge of a perfect storm.

A few poor earnings reports have sent GameStop shares down a brutal 20% year-to-date. As a result, however, the stock trades at just 6 times forward earnings estimates, and at a yield north of 7%.

GameStop (GME) Has Been Driven Into Value Territory

Meanwhile, GameStop enters a holiday season that should see the Nintendo Switch console continue selling like hotcakes, and as I mentioned before, Microsoft is launching its new Xbox One X – complete with first-in-class 4K Ultra-HD video gaming capability – in early November, and presales for that are clobbering any other Xbox console.

That’s potentially good for a quick pop, but these consoles should drive sales well past the next few years, and Sony (SNE) is likely to drop its Xbox One X competitor within the next couple years, putting GameStop back on the right side of the console upgrade cycle. That, and a generous dividend, makes GME worth a flier.

How to Earn 12% Annual Returns For Life!

While I appreciate the usefulness of an occasional moonshot like GameStop, the path to a well-funded retirement isn’t paved with risky bets. The only way you can really retire with a sense of security is by compiling a portfolio that generates enough in total returns to both pay the monthly bills and grow your nest egg.

In short, you need to be targeting 12% in safe, annual returns.

But how do you actually get there?

It’s not easy. I’ve been buried for months trying to track down the kind of portfolio that offers the high current yield, dividend growth track and capital gains potential possible to reach double-digit returns … without betting the farm on yield traps whose payouts could collapse at any moment.

But I’ve compiled a set of stock picks that will reap at least 12% in annual returns – which is what you need to ensure the kind of no-worries retirement you’ve been busting your hump to achieve for the past few decades.

My “12% for Life” portfolio is not your garden-variety dividend portfolio.

You’re not going to find pundit favorites like Exxon Mobil (NYSE:XOM), Coca-Cola or any other “safe” but slow-growth blue chips with mediocre yields. You’re going to find these kinds of picks instead:

- A stock that has already boosted its dividend payments more than 800% over the past four years, and has at least another decade of double-digit growth left in the tank!

- A “double threat” income-and-growth stock that rose more than 252% the last time it was anywhere near as cheap as it is right now!

- A 9%-plus payer that raises its dividend more than once a year, and will double its payout by 2021 at its current pace!

This portfolio is retirement catnip, because it provides the best aspects of numerous types of investment strategies – income, growth and even nest egg protection! This basket of seven conservative investments includes under-the-radar stocks that can return 12% annually, which is enough to double your portfolio in six years. It also is built to be more durable against market downturns like 2008-09, which ruined retirement for countless Americans.

And best of all: It provides three times more income than most retirement experts say you need!

The real-life benefits are plain as day. This retirement portfolio will allow you to pay your bills from dividend income alone, with enough left over for all the extras – the vacation timeshare, the European cruise or the patio extension you’ve waited too long to build. All the while, you’ll be able to grow your nest egg, which acts as extra protection against life’s ugly surprises.

The ProShares S&P 500 Dividend Aristocrats (NYSE:NOBL) closed at $59.45 on Friday, up $0.06 (+0.10%). Year-to-date, NOBL has gained 11.07%, versus a 13.43% rise in the benchmark S&P 500 index during the same period.

NOBL currently has an ETF Daily News SMART Grade of A (Strong Buy), and is ranked #14 of 123 ETFs in the Large Cap Blend ETFs category.