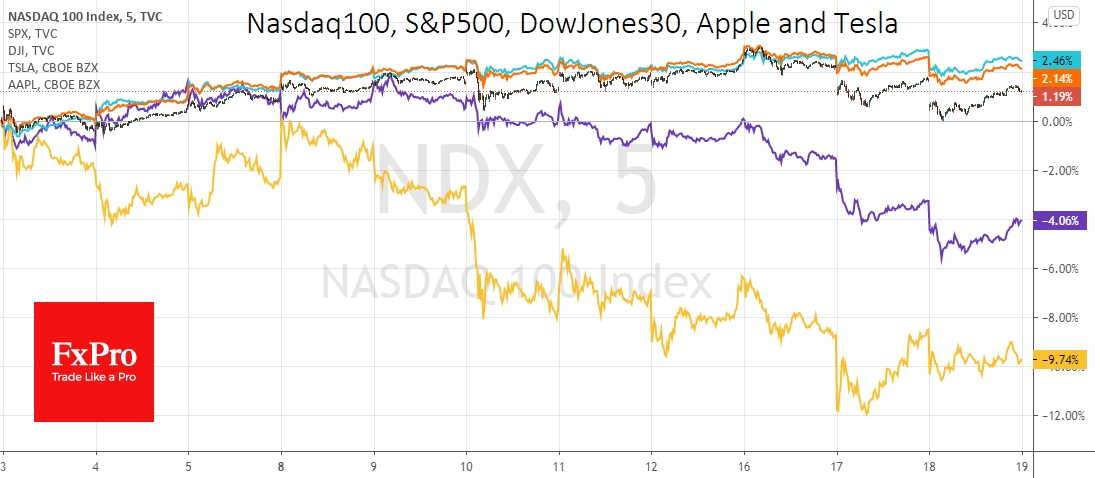

Global markets are intensifying trends of profit-taking from the gains of previous months. This is clearly visible in the weaker performance of the NASDAQ 100 (-0.7%) compared to the S&P500 (-0.44%) and Dow Jones (-0.38%). Against this backdrop, Asian indices retreated from all-time peaks on Friday.

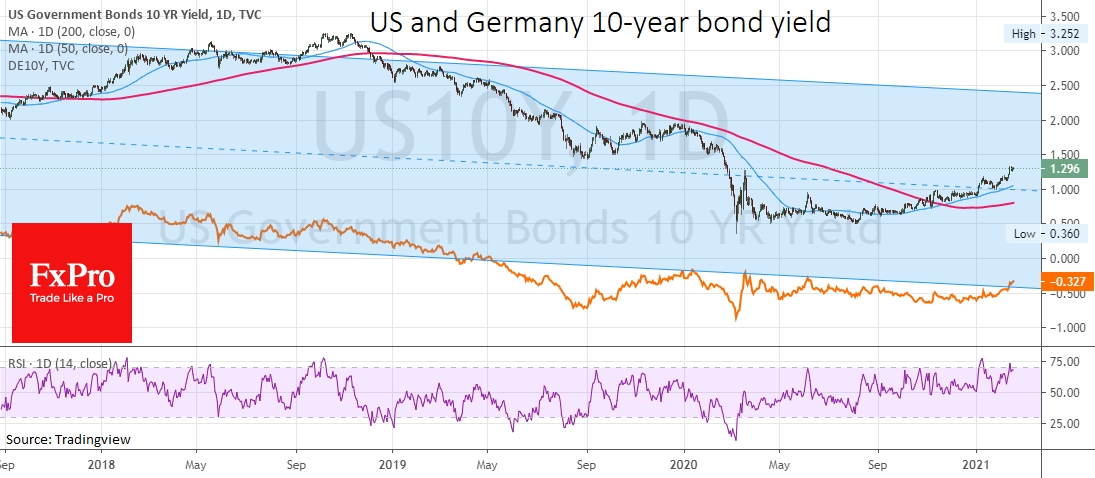

The decline in the equity market is accompanied by continued pressure in the debt markets. US 10-year government bond yields are above 1.3%, having recovered to the levels of late February last year. A higher yield means a lower price. An important watershed line looks to be the yield level of 1.5%, which acted as support in 2019.

Surprisingly, rising yields are now swaying investor confidence, compared to the situation last year when we saw a great demand for defensive bonds vs an uncertain outlook for stocks.

German 10-year bonds yield are also rising to the highs since July's -0.34%, but overall these are swings near the centre of the 2.5-year trading range.

Stock indices have been overheated and are now under moderate pressure, which is intensifying amid a mass of reports that investment gurus have been taking profits from the rise of market stars such as Apple (NASDAQ:AAPL) and Tesla (NASDAQ:TSLA). All this adds to the pressure on indices with a high proportion of high-tech stocks, such as the Nasdaq, where trading volumes are rising as the index declines.

The quiet selling of last year's market star shares and the persistent rise in yields are all the hallmarks of the large funds, which were the first to buy the idea of a V-shaped recovery and are now selling this fact to the broader masses.

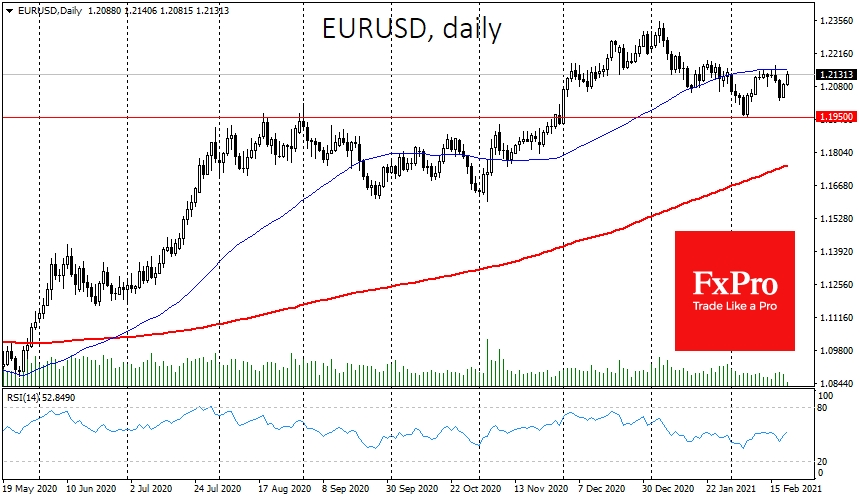

The big question for short-term investors is what asset are the big funds exiting into by selling stocks and bonds? What if it is an exit into the dollar?

We see EUR/USD remaining below its 50-day average and USD/JPY breaking above the 200-day, having been rising for almost two months.

USD/CNH has stabilised in the 6.40-6.50 range. USD/CAD has been hovering around 1.27 for more than two months and USD/MXN for more than three months, despite the surge in oil prices.

The NZD and AUD have also been having a hard time rising for the last two months, despite the commodity price march. All this reflects the sellers' strength and could be a precursor for a reset of the dollar, at least in terms of a few weeks to months.

The FxPro Analyst Team

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Hidden Dollar Demand On Declining Stocks And Bonds

Published 02/19/2021, 05:53 AM

Hidden Dollar Demand On Declining Stocks And Bonds

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.