There’s a saying that bear markets make fools of bulls and bears alike. This is because, at their start, bulls don’t take them seriously enough, and when they are well underway, bears can massively underestimate the strength of bounces against the trend.

Renowned hedge fund manager Stanley Druckenmiller recently commented when explaining his recent inactivity. He said,

“I’ve lived through enough bear markets, that if you get aggressive in a bear market on the short side, you can get your head ripped off in rallies."

Another thing you will start to notice when watching markets for long enough is that most market commentary news follows closely to the prevailing narrative; in other words, what the majority has already accepted as self-evident. And it’s at these moments, when sentiment and investor positioning is overwhelmingly one-sided, that surprises can occur.

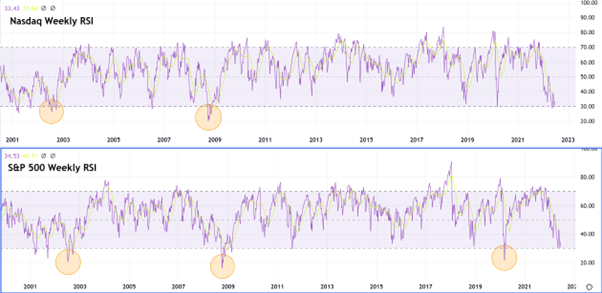

RSI Historically Oversold

Using weekly RSI to compare just how oversold the S&P 500 and NASDAQ currently are in relation to previous bear markets, we notice that only in the COVID crash of 2020, the depths of the Great Financial Crisis, and in the Dotcom Crash, do we get lower oversold readings than presently.

In fact, of the two indices, only the S&P 500 dipped lower than 30 (the traditional interpretation of oversold RSI) in March of 2020. The NASDAQ bounced off the 30 level back then and dipped below this level in May 2022.

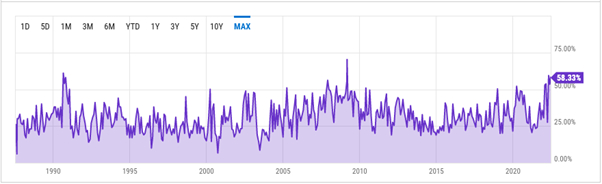

US Investor Sentiment

Looking at these extremes from a slightly different perspective, the AAII Sentiment Survey affords us a helpful gauge of US investor sentiment over quite an extended period. As you can see below, US investor bearish sentiment is currently hitting decade highs.

The only two times US bearish investor sentiment hit a higher level since the late 1980s was in August 1990 and March 2009. Even the pandemic failed to get us to these elevated levels.

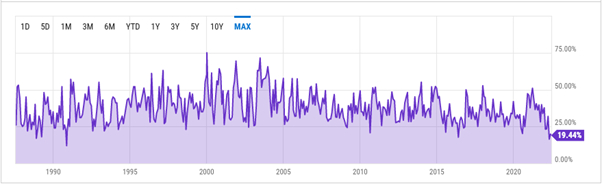

Above you’ll see almost a mirror image, with US investor bullish sentiment currently at multi-decade lows. In many ways, the lack of a bullish perspective in markets is even more alarming. April’s US bullish investor sentiment reading of 16.44% (currently at 19.44%) is the lowest this indicator has been since the November 1990 reading of 12%.

Investors Should Be Cautious

All this is to say that it’s prudent to be cautious; these are very extreme sentiment conditions compared to multiple decades and numerous market regimes. If history teaches us anything, it’s that extremes in sentiment are challenging to maintain, even when factoring in a more prolonged recessionary period. Traders must take stock of how far down we have already come before allowing the constant sounding of the recession alarm to influence their short- to medium-term trading decisions.

Even in 2008, we saw a +20% bounce followed by a +10% bounce in the NASDAQ before capitulation to the lows of that particular market cycle. Now, there’s certainly an argument for expected market events that rarely play out according to plan. Still, even if we are moving headlong into a recession, markets rarely move in just one direction. There are genuine risks in being too bearish at the extremes, just as opportunities for short-lived bullish reversals.

Finally, if you are more of the fundamental mindset, consider that when sentiment and positioning are overwhelmingly bearish, the chances of a positive shock increase. This is a case in which any unexpected news that’s bullish can have an outsized effect.

Disclaimer: Contracts for Difference (‘CFDs’) are complex financial products traded on margin. Trading CFDs carries a high degree of risk. It is possible to lose all your capital. These products may not be suitable for everyone, and you should ensure you understand the risks involved. Seek independent expert advice if necessary and speculate only with funds you can afford to lose. Please think carefully whether such trading suits you, considering all the relevant circumstances and your resources. We do not recommend clients post their entire account balance to meet margin requirements. Clients can minimize their level of exposure by requesting a change in leverage limit. For more information, please refer to HYCM’s Risk Disclosure.