With Nvidia (NASDAQ:NVDA) earnings now out of the way, investor focus turns to today’s personal consumption expenditures (PCE) report and next week’s busy economic calendar, including a highly anticipated August employment report and the Institute for Supply Management Purchasing Managers’ Index manufacturing and services survey data. These data points — especially the September 6 payrolls report — will help write the narrative for the Federal Reserve’s (Fed) next meeting on September 18.

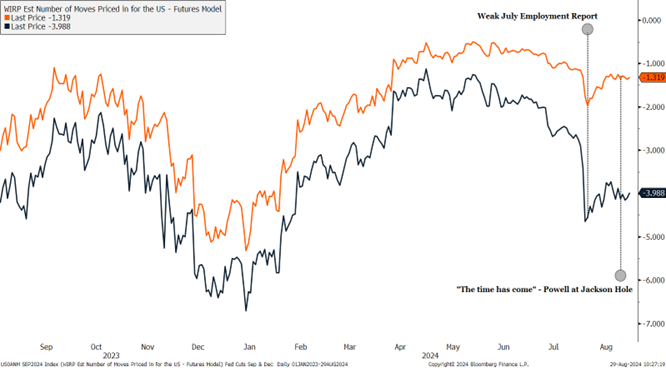

As highlighted in “It’s Go Time for the Federal Reserve”, Fed Chair Jerome Powell stated, “The time has come for policy to adjust,” citing diminishing upside inflation risk and rising downside risk to employment as catalysts for the policy pivot. As highlighted below, the fed funds futures market has fully priced in a 0.25% cut next month, with odds for a 0.50% reduction running at around 32%. Implied probabilities point to four 0.25% cuts by year-end.

Rate Cut Narrative Pivots From When to How Many

Source: LPL Research, Bloomberg 08/29/24

What Happens Next?

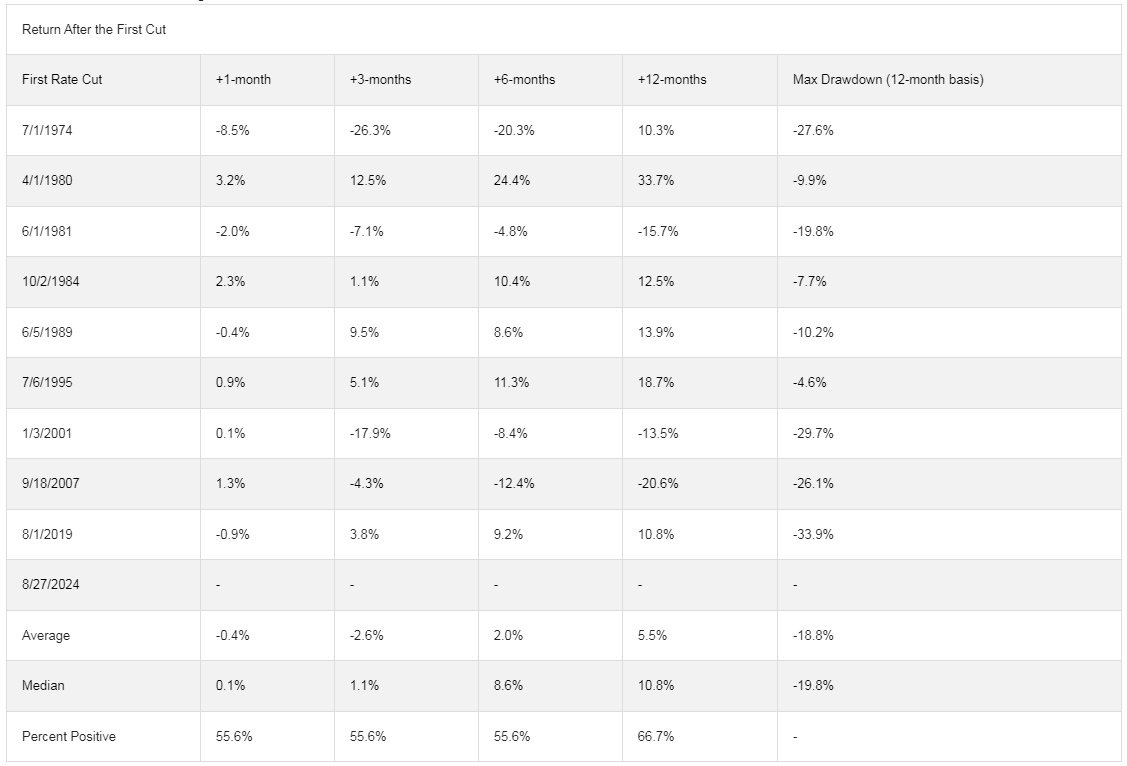

With monetary policy widely expected to pivot to rate cuts next month, the next big question is what happens after the Fed begins to cut interest rates. Based on the last nine major rate hiking cycles since the 1970s, the S&P 500 has generated mixed, modest returns over the three months following the first cut, with 12-month average and median returns of 5.5% and 10.8%, respectively.

Furthermore, 12-month maximum drawdowns following the first cut have been around 19%–20%, larger declines than the average maximum drawdown for all years since 1974 of 14.4%. Of course, how the economy holds up and if we enter or avoid a recession will ultimately dictate how stocks perform over the longer term.

S&P 500 Performance Following First Rate Cut

Source: LPL Research, Bloomberg 08/29/24

What About Bonds?

Using the same rate-cutting periods from above, we also analyzed how 10-year Treasury yields historically progress after the Fed starts cutting rates. As highlighted below, yields tend to decline over the following 12 months, falling by an average of around 25 basis points (bps). The lows for the 10-year occurred at the six-month mark, where the average decline reached 46 bps, with eight of nine periods posting lower yields, marking the lowest positivity rate across the 12-month time frame.

Progression of 10-year Treasury Yields After First Cut

Source: LPL Research, Bloomberg 08/29/24

Disclosures: Past performance is no guarantee of future results. All indexes are unmanaged and can’t be invested in directly.

Progression data based on cuts cited in the previous table, ranging from 1974–2019

Summary

Investors are preparing for the first rate cut in over four years. Today’s inflation report and next week’s jobs data could dictate the size of the September cut — another weak employment report would likely push probabilities toward a 0.50% reduction.

We believe a soft landing is still viable but not guaranteed, setting stocks up for a potential volatile fall, likely exacerbated by the November election. Stocks have historically traded flat to negative in the first few months after a rate-cutting cycle begins but tend to move higher over the following 12 months.

Drawdowns during these 12 months also tend to be more severe. Treasury yields historically trade lower after the Fed starts cutting rates, a catalyst behind LPL’s Strategic and Tactical Asset Allocation Committee (STAAC) recommendation for a modest overweight to fixed income, funded from cash. The STAAC also maintains its neutral stance on equities.

***

Important Disclosures:

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors. To determine which investment(s) may be appropriate for you, please consult your financial professional prior to investing.

Investing involves risks including possible loss of principal. No investment strategy or risk management technique can guarantee return or eliminate risk.

Indexes are unmanaged and cannot be invested into directly. Index performance is not indicative of the performance of any investment and does not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

This material was prepared by LPL Financial, LLC. All information is believed to be from reliable sources; however LPL Financial makes no representation as to its completeness or accuracy.

Unless otherwise stated LPL Financial and the third party persons and firms mentioned are not affiliates of each other and make no representation with respect to each other. Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services.