Building a diversified portfolio of U.S. stocks is a delicate mix of risk and opportunity that is often driven by attention to the distant boundaries of market capitalization.

Large-cap stocks are almost always included as a solid foundation and to provide correlation with well-known benchmarks. These companies are often lauded for their established business practices, healthy dividends and sustainable advantages. Small-cap stocks may also be recommended for enhanced growth or burgeoning competitive opportunities. They are often subject to a greater degree of risk in conjunction with a higher expected future return.

In The Middle

The one category in the middle that is often overlooked are mid-cap stocks. Like the middle child in a 3-sibling household, these companies can offer notable rewards that are easily overshadowed by their higher profile peers. In fact, several diversified mid-cap indexes are demonstrating superior performance and momentum characteristics through the first seven months of 2016.

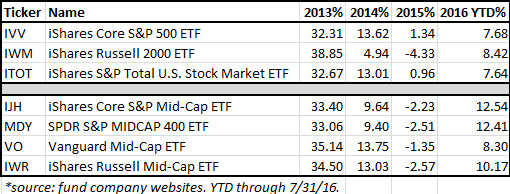

The table below shows a comparison of the most prominent mid-cap ETFs versus their small, large and total market peers over the last three years.

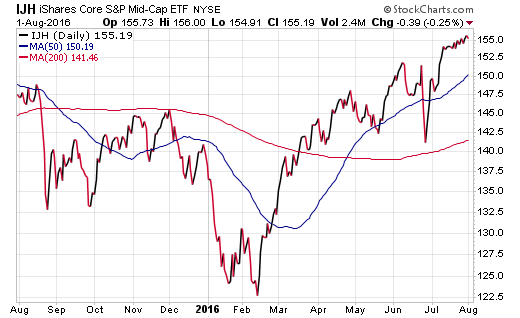

The largest fund in this category is the iShares Core S&P Mid-Cap ETF (NYSE:IJH), which tracks the S&P MidCap 400 Index. Qualities for inclusion in this index are publicly traded U.S. companies with a market capitalization between $1.4 billion and $5.9 billion.

IJH has significant exposure to financial, technology and industrial companies, which make up over 50% of the total sector allocations. Top holdings include: Mettler Toledo (NYSE:MTD), Duke Realty REIT (NYSE:DRE) and WhiteWave Foods (NYSE:WWAV).

IJH currently has $29.5 billion in assets under management and charges a very reasonable expense ratio of 0.12%. It is also one of the top performers for its category in 2016. Through the first seven months of the year, IJH has gained 12.54% versus a total return of 7.68% for the iShares Core S&P 500 ETF (NYSE:IVV) and 8.42% for the iShares Russell 2000 ETF (NYSE:IWM).

This mid-cap index also just hit new all-time highs and has managed to climb over 25% from its 2016 low established near the beginning of the year. It should also be noted that the well-known SPDR S&P 400 MidCap ETF (NYSE:MDY) tracks the same basket of companies as IJH.

For those looking for a different take on mid-cap stocks, the iShares Russell Mid-Cap ETF (NYSE:IWR) and Vanguard Mid-Cap ETF (NYSE:VO) are suitable alternatives. IWR owns a broader basket of nearly 800 stocks, while VO takes a more concentrated path with 344 underlying holdings. Both funds charge relatively small expense ratios of 0.20% and 0.08% respectively.

Investors considering a mid-cap ETF should closely evaluate how their underlying holdings and historical performance match up with their objectives and risk tolerance. Furthermore, index providers define upper and lower limits for “mid-cap” at differing levels, which may cast the net on varying pools of stocks.

It’s also worth noting that mid-cap stocks have been known to experience bouts of heighted volatility compared to their large-cap peers. Nevertheless, they can also offer exposure to companies on the verge of making the leap to new technologies or growth-oriented sectors.

The Bottom Line

One of the tremendous benefits to using ETFs is the ability to customize your portfolio exposure in limitless patterns. Using single-factor, size or style funds can allow you to tilt toward areas of the market that may be more attractive than a simple market-cap weighted allocation.