Since the Brexit results were announced on June 23, stock traders and investors have been on a wild ride.

The Nasdaq 100 plunged sharply for two days, promptly reversed and has since erased nearly the entire news-driven decline.

But now that the NASDAQ is back in the vicinity of its pre-Brexit level, what happens next?

We firmly believe recent market action has created a pretty convincing case for near-term NASDAQ weakness over the next 1 to 2 weeks.

Accordingly, we see the potential for a rather profitable momentum trading opportunity in buying ProShares UltraPro Short QQQ ETF (NASDAQ:SQQQ), an inverse leveraged ETF that moves higher when the NASDAQ 100 moves lower.

Ready To React

As mentioned in our previous post, we always focus on reacting to market price action, rather than predicting it.

Nevertheless, when a high-probability chart pattern falls in your lap, you need to be prepared with a clear plan of action to profit when the time comes.

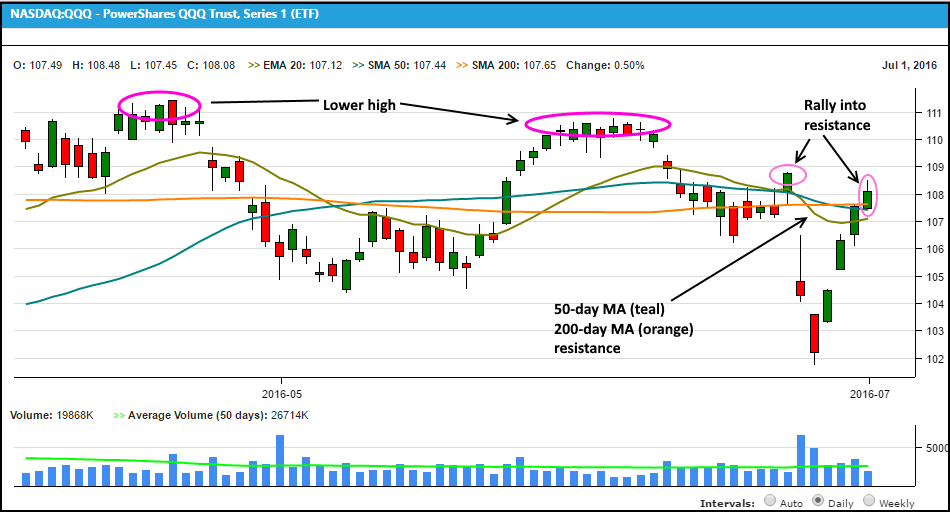

Before outlining our plan to buy SQQQ , let’s first review an annotated daily chart of PowerShares QQQ Trust Series 1 (NASDAQ:QQQ).

Although SQQQ is the actual ETF we are stalking for swing-trade entry, we prefer to focus our technical analysis on QQQ instead because it is a well-known ETF proxy that more closely mirrors the price action of the NASDAQ 100:

Chart from Morpheus Stock Screener

Five Reasons To Short QQQ Via SQQQ:

- Major prior resistance – Although QQQ has recently recovered most of its post-Brexit losses, the NASDAQ 100 now starts the week dealing with resistance of its 50- and 200-day moving averages, as well as overhead resistance from its prior June 23 highs.

- Bearish volume pattern – Volume on each of the recovery days was lighter than volume of the two big down days. This points to institutional distribution, which is selling among hedge funds, mutual funds and other financial institutions.

- Lower highs – QQQ already formed a significant “lower high” in early June, which may indicate decreased bullish momentum on the intermediate to longer-term. This helps make the case that another “lower high” could be formed near current levels before stocks head back down.

- Too quick – Odds of stocks at least retracing a substantial portion of their recent losses in the near-term are favorable. Past experience has taught me that a sharp selloff followed by too quick of a complete recovery frequently leads to at least one quick move lower (“shakeout”) before price advances further.

- Positive reward-risk ratio – Before entering any new stock or ETF trade, we first determine how the potential profit (reward) compares to the potential loss (risk). Based on the entry, stop and target prices detailed below, this setup offers a very favorable reward-risk ratio.

SQQQ: A Better Way To Short The NASDAQ

Thanks to the advent of inverse ETFs, which move higher as the underlying equity or index moves lower, you can now profit from a downward move in a stock or index without actually selling short.

Additionally, choosing a leveraged ETF as your trading vehicle to short the NASDAQ 100 offers the ability to get more “bang for your buck” on smaller trading accounts (be warned that leveraged ETFs are optimal only as only short-term trading vehicles because they may under-perform over longer holding periods).

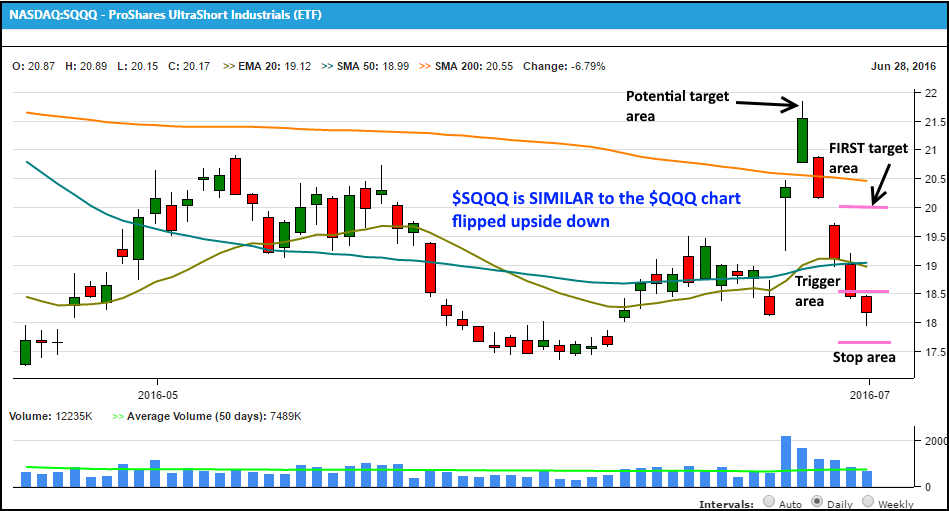

Below is a daily chart of SQQQ, which moves inversely to QQQ and at three times the percentage ratio:

Chart from Morpheus Stock Screener

Looking at the chart above, notice we have labeled the trigger, target and stop prices that comprise our plan for this momentum swing trade.

Trigger

As with all swing-trade setups, it is crucial to wait for the price action to confirm this analysis before entering the trade.

Therefore, you should wait until a bit of selling pressure in the NASDAQ 100 at least pushes SQQQ above its July 1 high of $18.48 before entering a position (remember that weakness in QQQ equates to strength in SQQQ).

Remember to wait for the chart pattern to show a bit of price confirmation in the right direction before assuming any risk.

Target

If SQQQ moves above its July 1 high, momentum could easily lead to a 50% Fibonacci retracement of the range from the June 24 high to the July 1 low.

There is also a band of horizontal price resistance from May of 2016 around the 50% retracement level.

This initial profit target -- if SQQQ triggers for buy entry -- equates to a price level around $20.

However, traders willing to hold a bit longer (more risk for greater potential gain) may even be rewarded for their patience with a full 100% retracement of the prior downward move (June 24 high is ~$22).

Again, remember this is merely a technical momentum-trade setup, not a substantial bearish call on the overall market.

Stop

If SQQQ rallies above its July 1 high, we do not want to see it dip back below that day’s low shortly thereafter.

However, a bit of volatility can be expected if bears re-enter the market, which means we need to give this ETF trade some “wiggle room” below its support level (July 1 low of $17.95).

If QQQ was the ETF in question, we would set the stop about 1% above its July 1 high.

The equivalent stop in SQQQ is roughly 3% below its July 1 low.

Be An Astute Trader

Although we have five solid reasons the NASDAQ 100 could head lower in the coming days, never forget the most important mantra for stock and ETF traders: Trade What You See, Not What You Think!

This means that the unexpected can and frequently does happen in the business of trading.

To protect yourself from unnecessary risk, don’t fall in love with any new trade idea at the detriment of not following your plan for managing the trade.

Above all, be patient and wait for the trade to generate a proper buy signal before entering the trade.