On March 9, 2015, the Public Sector Purchase Programme was initiated.

This eurozone bond-buying program, also known as quantitative easing (QE), is meant to reinvigorate Europe’s lethargic economies and prevent deflation.

Clearly, this central planning maneuver isn’t going to solve the myriad structural problems in the eurozone: a flawed currency system, debt overhangs in peripheral countries, aging populations, shockingly high youth unemployment rates, etc.

But here’s what this “monetary morphine” will do…

Stimulus Injection Pathways

Traditionally, QE is thought of as a way to reduce yields on government bonds. But most European rates are already at their lowest levels in recorded history. Seventy-eight of the 346 securities in the Bloomberg Eurozone Sovereign Bond Index already have rates below zero.

Ironically, the one country with high rates – Greece – isn’t going to directly benefit from the bond buying. The European Central Bank (ECB) doesn’t intend to purchase Greek government bonds, at least in the short term, as Greece is still undergoing a bailout review. Greek 10-year government bonds are currently yielding 10.4%.

Instead of bringing down onerous interest rates, Mario Draghi and the ECB are hoping that stimulus is transmitted through other pathways.

The anticipation and implementation of QE has led to significant currency weakness. The euro is getting annihilated, hitting a fresh 12-year low against the U.S. dollar yesterday.

Unfortunately, currency depreciation isn’t going to have the full desired effect. A significant amount of eurozone exports are to other eurozone countries. In other words, Europe does a lot of trading with itself.

Stimulus is also aimed at encouraging investors to take on more risk. QE truly shines at this task. The scramble for yield is pushing investors up the risk curve and eventually into equities.

Japan is a perfect example of stimulus’ impact on the stock market. The Nikkei 225 has climbed around 80% since the end of 2012, despite the failure of “Abenomics” to revive the Japanese economy.

So, stimulus has a very good chance of marking a turning point for eurozone equities, especially considering that valuations across Europe are exceptionally low.

The Inexpensive Path to Wealth

Europe is actually the cheapest region (besides emerging Latin America) based on the CAPE ratio, according to this fantastic global stock market valuation dashboard from StarCapital.

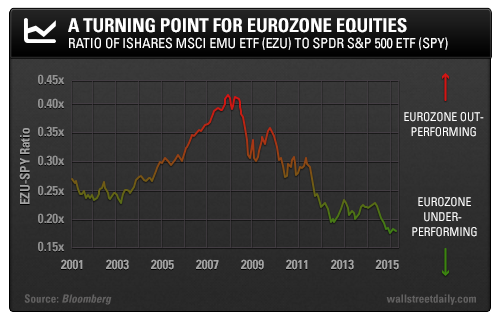

One of the primary reasons that European shares are cheaper than their U.S. counterparts is because they’ve underperformed.

The following chart shows the performance of the iShares MSCI EMU (NYSE:EZU) relative to that of the SPDR S&P 500 (ARCA:SPY) ETF:

Basically, a lot of bad news has been “priced in” to European stocks, making them cheap.

This is why Robert Shiller, economist and developer of the Shiller CAPE ratio, has invested in Italian and Spanish equities and is considering getting out of U.S. stocks completely.

Indeed, the case for European stocks grows even stronger when we consider both monetary stimulus and valuation aspects.

So if rising asset prices is one of the only significant benefits of QE, will it work based on the “wealth effect”?

Basically, the thinking is that higher financial asset prices (stocks and bonds) will make people feel wealthier, prompting them to spend more money on consumer goods.

In practice, though, it’s not quite that simple. Those who own the lion’s share of stocks tend to be wealthy already and have a low marginal propensity to spend. Therefore, the wealth effect is really just an exacerbation of inequality, not an economic tailwind.

So, European QE won’t solve Europe’s economic woes. However, don’t underestimate the ability of 1.14-trillion-euros worth of stimulus to boost European stock prices.

Remember, it’s the central planners’ world, and we’re just living in it.

Safe (and high-yield) investing,