We are in the thick of the Q4 earnings season with 251 of the S&P 500 members having released their quarterly numbers (as of Feb 2) and another 92 scheduled to report.

Per the latest Earnings Preview, 80.5% of the S&P 500 companies that have reported have surpassed earnings estimates, 78.1% beat revenue estimates and 64.9% outpaced both earnings and revenues.

Further, total earnings for these companies have increased 16% from the same period last year on 10.5% higher revenues. The report projects a 13% year-over-year rise in earnings for the S&P 500 companies with total revenues likely to increase 7.7%. This compares favorably with the year-over-year increase of 6.7% and 5.9% for earnings and revenues, respectively, in the third quarter.

A Mixed Bag for Consumer Discretionary

While a few sectors are expected to put up a stellar show, the widely diversified Consumer Discretionary sector is likely to post mixed results.

Total earnings for the sector are likely to decline 3.7% year over year against 0.9% growth in the last quarter. Total revenues are projected to grow 3.7% year over year in Q4, slightly higher than the 3.5% growth recorded in the preceding quarter. Margins in the quarter are likely to decline 0.8% from the year-ago quarter, comparing unfavorably with the prior quarter’s decline of 0.3%.

The Toys - Games – Hobbies Industry under consumer discretionary is expected to have recorded growth in Q4 on rising demand for entertainment services, including video games. The industry performed remarkably well in the past year gaining 49.8%, outpacing the S&P 500’s 21.1%.

Traditional Toy Makers in a Fix

Toy companies have been grappling with declining demand for traditional toys for quite some time now. Pressure from the recent Toys ‘R’ Us bankruptcy have affected their third-quarter results and might have dented growth in Q4 as well.

As a result, we have seen Mattel (NASDAQ:MAT) report fourth-quarter 2017 adjusted loss of 72 cents per share, comparing unfavorably with the Zacks Consensus Estimate and the prior quarter’s earnings. Net sales also missed the consensus mark and declined year over year.

Meanwhile, another leading U.S. toymaker Hasbro (NASDAQ:HAS) is expected to deliver strong revenues and earnings owing to the company’s efforts to counter the prevailing challenges in the operating environment. The company is expected to report its quarterly results on Feb 7.

The consensus estimate for Q4 earnings is pegged at $1.82, mirroring nearly 11% year-over-year growth. We believe that this growth is attributable to the company’s efficient cost structure coupled with various sales-boosting efforts in some key markets.

Meanwhile, analysts polled by Zacks expect revenues of $1.73 billion, reflecting 6.4% year-over-year growth. The projected sales growth is primarily backed by strong performance of the company’s Franchise Brands, Partner Brand, Hasbro Gaming and Emerging Brand. Also, entertainment initiatives and higher consumer product sales are likely to drive revenues.

However, the Toys ‘R’ Us bankruptcy will keep Hasbro’s top line under pressure. The bankruptcy disrupted the company’s growth plans in Q4 and had even paused shipments for a short period. Taking the adverse impacts into account, the company has slashed its Q4 revenue growth guidance to a range of 4% to 7%. (Read More: Will Hasbro Record Revenue & Earnings Growth in Q4?).

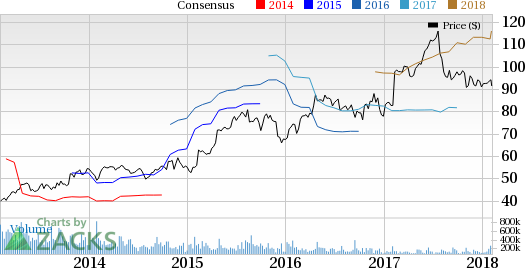

Hasbro has a Zacks Rank #3 (Hold) and an Earnings ESP of -0.29%, a combination that doesn’t suggest a beat. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Hasbro, Inc. Price and EPS Surprise

Video Game Developers Enjoy an Edge

Within the industry, th video game marketers and developers are well poised for growth. Strength in digital business and mobile games are key growth drivers for these companies.

A big name in the space, Electronic Arts (NASDAQ:EA) recently reported an earnings beat in third-quarter fiscal 2018. Meanwhile, Take-Two Interactive Software, Inc. (NASDAQ:TTWO) — a leading developer and publisher of video games and peripherals — is scheduled to report third-quarter fiscal 2018 results on Feb 7.

The company’s expectation of growth in digital revenues driven by higher sales of full-game downloads and increase in recurrent consumer spending is encouraging. Subsequently, the consensus estimate for third-quarter revenues is pegged at $673.28 million, reflecting a year-over-year increase of 41.3%.

The consensus estimate for EPS stands at $1, showing a year-over-year increase of 16.3%. We believe increased sales from the digital version of games are driving margins. Moreover, strength in franchises has backed the company’s earnings growth projection.

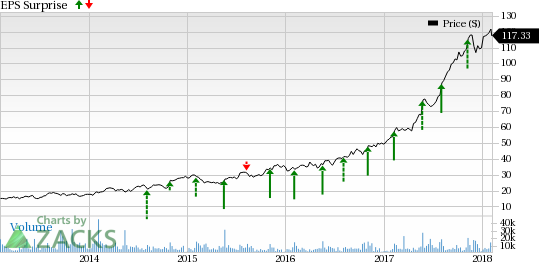

Take-Two Interactive has a Zacks Rank #3 and an Earnings ESP of +1.93, a combination that suggests a beat. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Take-Two Interactive Software, Inc. Price and EPS Surprise

To Conclude

The rising demand for video games and digital entertainment facilities are putting traditional toymakers in a disadvantageous position. Thus, Take-Two Interactive is poised for stronger Q4 earnings and revenue growth when compared with Hasbro.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Hasbro, Inc. (HAS): Free Stock Analysis Report

Mattel, Inc. (MAT): Free Stock Analysis Report

Take-Two Interactive Software, Inc. (TTWO): Free Stock Analysis Report

Electronic Arts Inc. (EA): Free Stock Analysis Report

Original post

Zacks Investment Research