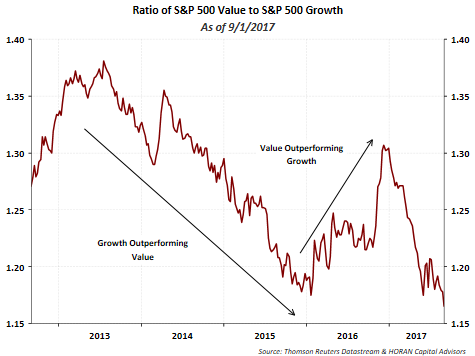

One style of the market that has outperformed, except in 2016, has been growth type equities. In 2016 value outperformed growth with a value outperformance burst subsequent to the election. Value's outperformance essentially ended at the beginning of this year though.

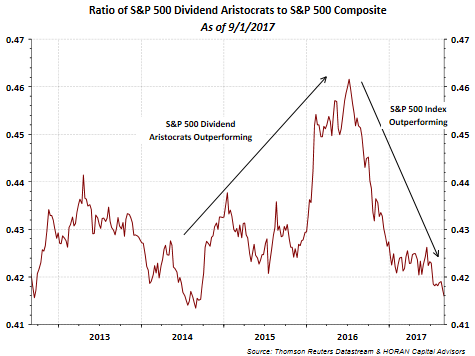

Also, higher quality companies as measured by S&P Dow Jones Indices Dividend Aristocrats, mostly outperformed for the two and half year period from 2014 to mid 2016. As S&P notes,

"the S&P 500 Dividend Aristocrats measure the performance of S&P 500 companies that have increased dividends every year for the last 25 consecutive years. The Index treats each constituent as a distinct investment opportunity without regard to its size by equally weighting each company."

Since mid year 2016 though, these dividend aristocrats have underperformed the broader S&P 500 Index.

One factor negatively impacting the Dividend Aristocrats' performance is an overweight to the consumer staples sector at 26% and an underweight to information technology at a 2% weighting. From a year to date performance standpoint, technology has been the best performing sector with the consumer staples sector performance near the bottom.

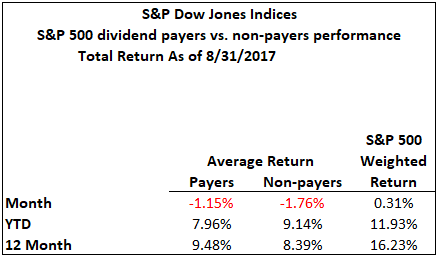

The underperformance of the Aristocrats is also reflected in the YTD underperformance of all S&P 500 dividend payers as well. The below table shows the YTD average return for the payers equals 7.96% versus the non payers return of 9.14%. The fact the large cap stocks in the S&P 500 Index have driven index returns this year, both the payers and non payers average return has not kept pace with the capitalization weighted S&P 500 Index return of 11.93%.

The current economic expansion is approaching the third longest on record as tracked by the National Bureau of Economic Research. An obvious fact is this economic expansion will come to an end at some point, although we do not foresee that occurring within the next 12-24 months, all else being equal. However, the fact growth type stocks are outperforming is one indication the economy may be in the later stages of the current expansion as we noted in a post a few years ago that highlighted stock style performance during various parts of the economic cycle.