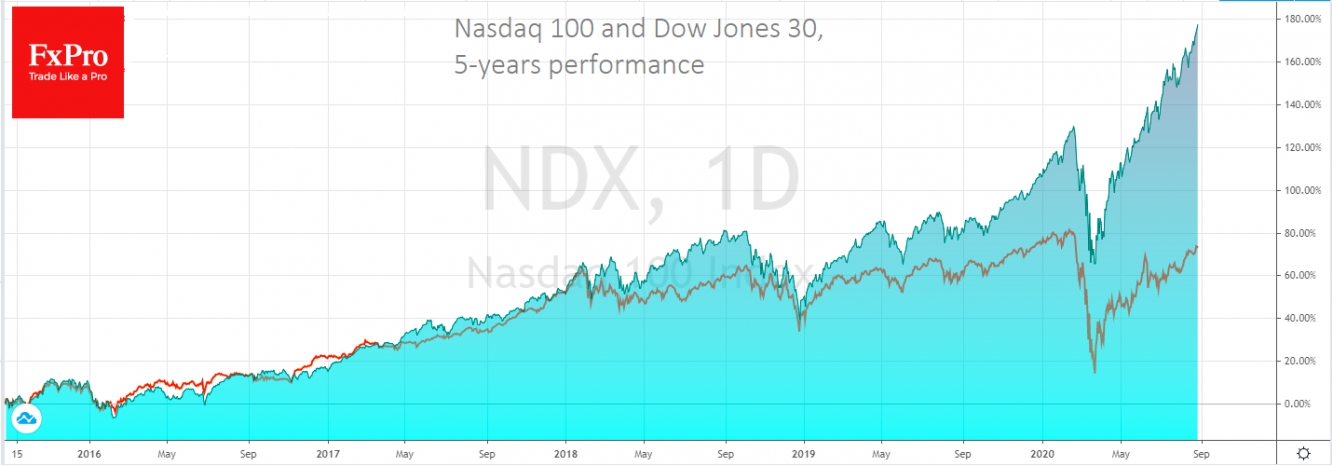

The phrase "winner takes it all" has never seemed as accurate for markets as it now, as recent times show high polarisation.

It is impossible to predict how long this shaky equilibrium may last. Potentially, it could be months or even years. However, history suggests that if it turns around, the decline could be long and painful. A strong reason for such a decline is the impact of accumulated debts.

Overnight, S&P 500 and Nasdaq 100 once again rewrote their historic highs. At the same time, Dow Jones 30 closed the day in red, remaining 4.7% below its February highs. The composition of the indices explains this difference: the bias in high-tech stocks within the Nasdaq explains its overperformance in the last year.

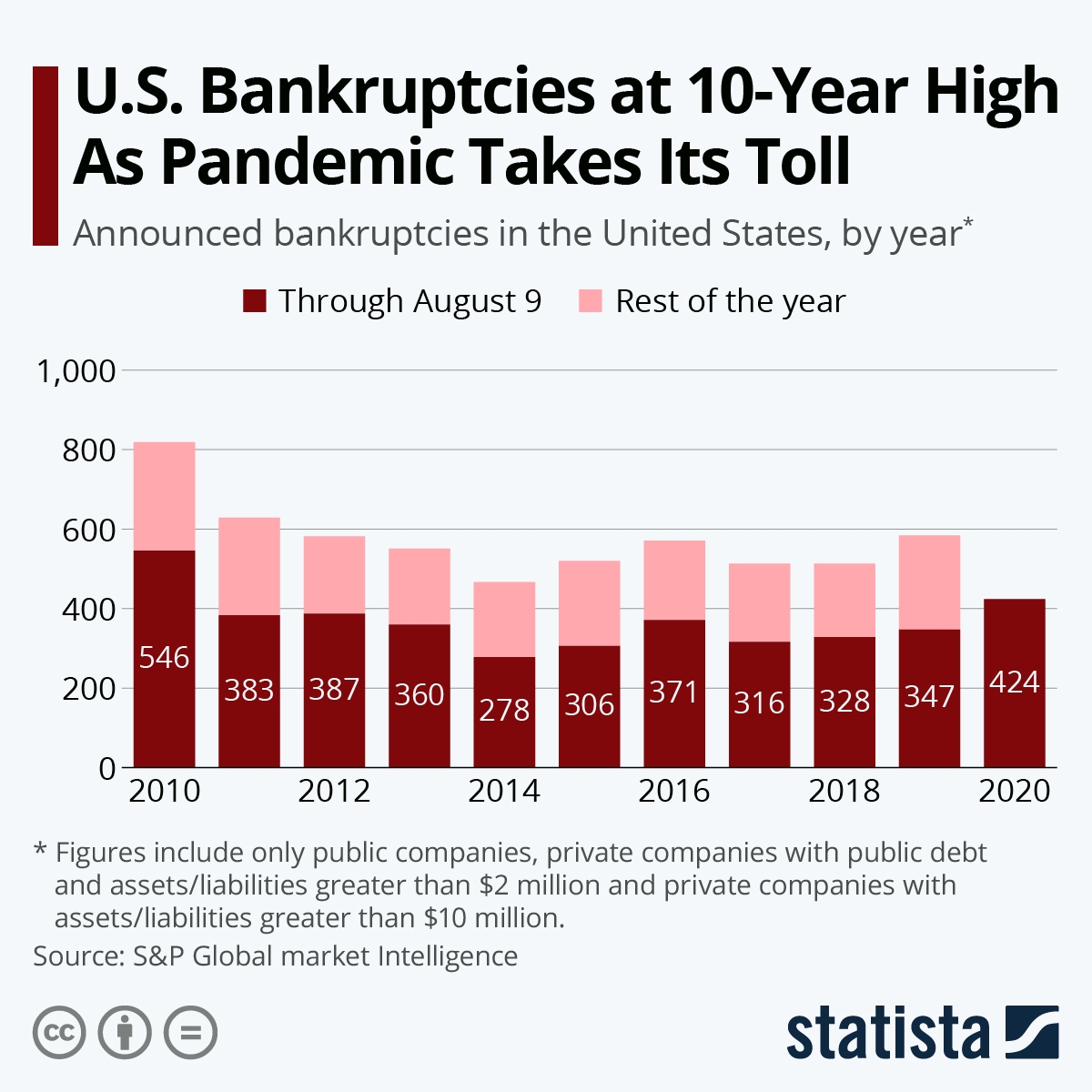

However, this growth in stock indices conceals bankruptcies, which year to date in the US has been the highest in 10 years.

The situation is no better in China, where there is an almost two-fold increase in bankruptcy applications compared to last year, reaching 9,700.

To varying degrees, the outlook is similar in other countries that have found themselves between the two economic poles.

This information does not harm the overall demand for assets, as we don't see loud and unexpected bankruptcies. After all, companies with any signs of life are actively placing bonds on debt markets at low rates.

Access to credit allows them to borrow more corporate debt. However, we should not forget about the Greek experience. Sooner or later, the burden accumulated becomes too heavy to bear, even amid low-interest rates.

In the mildest case, there is a long period of deleveraging, i.e. reducing the debt burden. This is a painful period of cost consolidation, which hurts the growth rate of the company or country and often forces investors to turn away from these assets.

History suggests that deleveraging stretches for an average of 7 years, the first half of which may be the most worrisome and cause major shifts in financial markets.

In particular, investors' favorites maybe those companies and economies that now have better debt characteristics. This should play in contrast to the approach currently popular: the more stimulus, the higher the potential.

The FxPro Analyst Team

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Growth In Markets Masks Debt Problems

Published 08/26/2020, 06:42 AM

Updated 03/21/2024, 07:45 AM

Growth In Markets Masks Debt Problems

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.