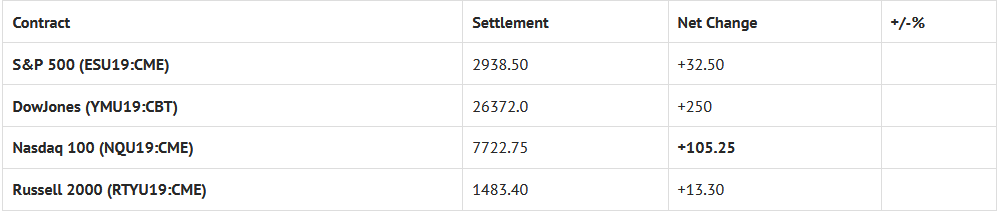

Index Futures Net Changes and Settlements:

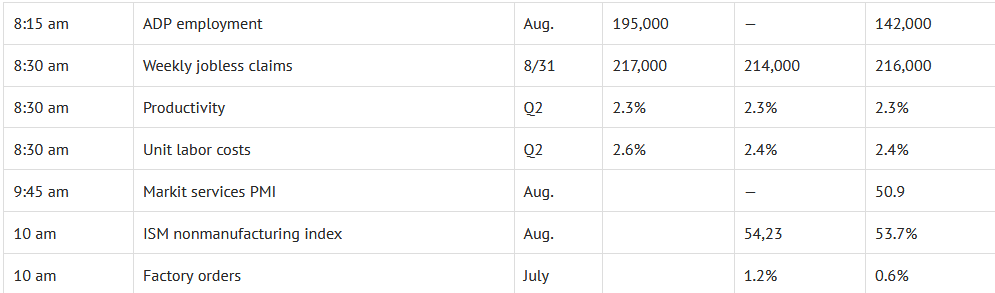

Today’s Economic Calendar:

S&P 500 Futures: Weak Economic Data And Trade Tensions Send Stocks Lower

After making an overnight Globex high of 2933.50, up at 9:08 am the (ESU19:CME) traded 2929.75 on Wednesdays at 8:30 futures open. After the ES traded up to 2931.50, sold off down to 2926.50, popped back up to a new high at 2932.25 at 9:46 and then got hit by a sell program that pushed the futures down to 2921.50. After the program, the ES rallied back up to 2928.25. The next move was back down below the vwap to 2925.25 and then up 2933.75 at 10:54 CT. After that, the ES pull back down to 2930.50 and then popped up to a new high at 2934.50. At 12:25 total ES volume was 878,000.

After a small pull back the ES ‘triple topped’ at 2934.50 and got hit by a few small sell programs and sold off down to 2929.75 and then down exactly to the vwap at 2929.00 and then ran up to new highs at 2935.50 as the early MiM started to show over $800 million to sell. After a slight pull back the MiM increased to over $900 million to sell the ES traded up to 2937.50 at 2:20 CT. As the MiM dropped to under $500 million to sell the ES popped up to 2938.50.

The ES traded 2937 on the 2:45 cash imbalance as the final MiM showed sell $ 493 million, traded 2934.50 on the 3:00 cash close and settled at 2939.00 on the 3:15 futures close. In terms of the ES’s overall tone the markets acted well but a big part of it was a short squeeze into the buy stops. In terms of the day overall volume 1.2 million futures traded which isn’t bad all considered.

Alan Greenspan: Negative Rates Coming Says It’s Just A Matter Of Time

Alan Greenspan’s made a comment during a televised speech to the American Enterprise Institute during the dot-com bubble of the 1990s warning that the stock market might be overvalued. He said, `Clearly, sustained low inflation implies less uncertainty about the future, and lower risk premiums imply higher prices of stocks and other earning assets. We can see that in the inverse relationship exhibited by price/earnings ratios and the rate of inflation in the past. But how do we know when irrational exuberance has unduly escalated asset values, which then become subject to unexpected and prolonged contractions as they have in Japan over the past decade? Greenspan’s spoke while Japan was open and the Nikkei fell 3% and market around the world followed. I remember this like it was yesterday. I was on the phone with Moore Capital selling 2,000 big S&Ps and UBS in the other ear doing index arb sell programs like they were going out of style. I know no one really listens to him anymore but that irrational exuberance comment will never be forgotten. Yesterday Greenspan was quoted saying:

“You’re seeing it pretty much throughout the world. It’s only a matter of time before it’s more in the United States,”

There are currently more than $16 trillion in negative-yielding debt around the world as central banks try to ease monetary conditions to sustain the global economy.

Personally I do not think it’s a good idea to lower rates until the economy shows more signs of stress/inflation and I don’t think we are at that point right now. The fed needs to use its bullets more appropriately, not when President Trump is pounding his Twitter to do so.

Our view, today is ‘crazy Thursday’ expect the unexpected. Like I said in the MTS forum, there is a big ling of buy stops that start around the 2935 level all the way up to 2955ish. Bob Proctor has 2975 as his upside objective. While we think higher prices we also do not want to get overly bullish into the rally. Buy the pullbacks and remember, the trend is your friend.