Market Brief

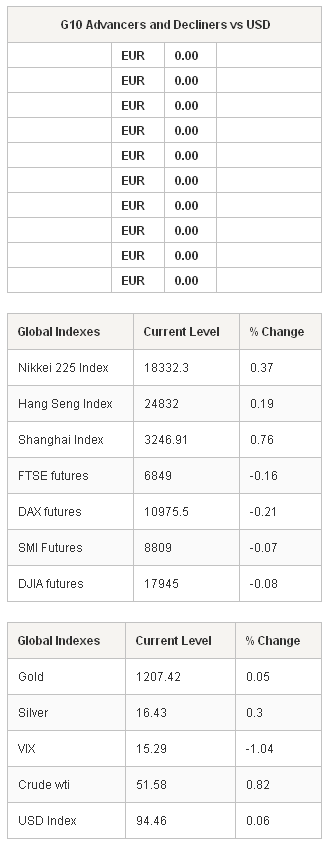

Berlin rejects the Greek formal request for a six month extension to its current loan agreement, calling it cash without reform. In a statement, German FM spokesman Martin Jaeger stated that a proposal from Greece's government "is not a substantial proposal for a solution" and suggested amounts to a plan "for bridge financing without fulfilling the demands of the (bailout) program. In response, the Greek government official said the Thursday request was only made to provide a safety net for the under siege banking system. And this way why the requested failed to extend controversial spending cuts, tax increases and other reforms that were conditions of the bailout program. The Eurogroup is meeting today yet expecations for a Greek deal is extremely low. This suggests the drama will drag into next week. Despite the risk increase of Greece leaving the EU, financial markets remain stable in thin trading. The holidays help back participation in Asia equity markets. The Nikkei 225 gapped on the open then quickly rose to 18,297.92 new 15-years high, while the Sensex 30 fell -0.75 and ASX rose 0.45. In FX markets traders were in a hold pattern waiting for developments from EU – Greek situation. USD/JPY was slightly weaker trading between 118.85 to 119.10, support being provide by the bullish equity sentiment. EUR/USD held in a tight range after consolidating recent loses. EUR/USD traded between 1.1357 to 1.1375. AUD/USD grinded higher from 0.7789 to 0.7810 while AUD/NZD consolidated between 1.0360 and 1.0370 after bouncing off new lows at 1.0299 yesterday.

Outside the fluid EU – Greek situation traders will be watching Euro Area Flash PMIs. Markets expected Euro area flash composite PMI to improve to 53 from 52.6, manufacturing PMI to improve to 51.5 from 51.0 and service PMI 53.0 from 52.7. German PMI should also be positive. The topline manufacturing is expected to rise to 51.5, and services PMI to 54.4. EUR/USD pricing will be subject to new flow from negotiations between Greek government and the Eurogroup. Spikes higher could be a good time to reload on shorts in anticipation of the start of the ECB QE program and repricing of the not so dovish FOMC meeting minutes.

In the UK retail sales x-auto is likely to increase 0.3mm after rising 0.2 in December. We continue to be constructive on GBP against the EUR, as yield seeker favor UK debt.

| Today's Calendar | Estimates | Previous | Country / GMT |

|---|---|---|---|

| GE Jan PPI MoM | - | -0.70% | EUR / 07:00 |

| GE Jan PPI YoY | - | -1.70% | EUR / 07:00 |

| JN Jan Convenience Store Sales YoY | - | -1.20% | JPY / 07:00 |

| SW Feb Consumer Confidence | - | 98.6 | SEK / 08:00 |

| SW Feb Economic Tendency Survey | - | 105.6 | SEK / 08:00 |

| SW Feb Manufacturing Confidence s.a. | - | 107.3 | SEK / 08:00 |

| FR Feb P Markit France Manufacturing PMI | - | 49.2 | EUR / 08:00 |

| FR Feb P Markit France Services PMI | - | 49.4 | EUR / 08:00 |

| FR Feb P Markit France Composite PMI | - | 49.3 | EUR / 08:00 |

| DE Jan Retail Sales MoM | - | -0.50% | DKK / 08:00 |

| DE Jan Retail Sales YoY | - | 2.30% | DKK / 08:00 |

| GE Feb P Markit/BME Germany Manufacturing PMI | 51.3 | 50.9 | EUR / 08:30 |

| GE Feb P Markit Germany Services PMI | 54.5 | 54 | EUR / 08:30 |

| GE Feb P Markit/BME Germany Composite PMI | - | 53.5 | EUR / 08:30 |

| EC Feb P Markit Eurozone Manufacturing PMI | 51.3 | 51 | EUR / 09:00 |

| EC Feb P Markit Eurozone Services PMI | 53 | 52.7 | EUR / 09:00 |

| EC Feb P Markit Eurozone Composite PMI | - | 52.6 | EUR / 09:00 |

| UK Jan Public Finances (PSNCR) | - | 21.4B | GBP / 09:30 |

| UK Jan Central Government NCR | - | 23.7B | GBP / 09:30 |

| UK Jan Public Sector Net Borrowing | - | 12.5B | GBP / 09:30 |

| UK Jan PSNB ex Banking Groups | - | 13.1B | GBP / 09:30 |

| UK Jan Retail Sales Ex Auto MoM | - | 0.20% | GBP / 09:30 |

| UK Jan Retail Sales Ex Auto YoY | - | 4.20% | GBP / 09:30 |

| UK Jan Retail Sales Incl. Auto MoM | 0.10% | 0.40% | GBP / 09:30 |

| UK Jan Retail Sales Incl. Auto YoY | 6.30% | 4.30% | GBP / 09:30 |

| IT Jan CPI FOI Index Ex Tobacco | - | 107 | EUR / 10:00 |

| SW Bloomberg Feb. Sweden Economic Survey | - | - | SEK / 10:00 |

| DE Bloomberg Feb. Denmark Economic Survey | - | - | DKK / 10:10 |

| US Revisions: Consumer Price Index | - | - | USD / 13:30 |

| CA Dec Retail Sales MoM | - | 0.40% | CAD / 13:30 |

Currency Tech

EUR/USD

R 2: 1.1534

R 1: 1.1443

CURRENT: 1.1330

S 1: 1.1262

S 2: 1.1098

GBP/USD

R 2: 1.5620

R 1: 1.5486

CURRENT: 1.5393

S 1: 1.5317

S 2: 1.5197

USD/JPY

R 2: 121.85

R 1: 120.83

CURRENT: 118.64

S 1: 118.18

S 2: 116.66

USD/CHF

R 2: 0.9831

R 1: 0.9554

CURRENT: 0.9521

S 1: 0.9385

S 2: 0.9284