Market Brief

As expected the meeting of eurozone finance ministers in Riga last Friday has not resulted in an agreement that could potentially unlock the situation in Greece. Yanis Varoufakis, Greece’s finance minister, was seeking to access a portion of the remaining €7.2bn (out of €172bn) funds left for Greece’s bailout. However, it seems that his unconventional style and willingness “to end the vicious cycle” of bailout and borrowing by easing austerity measures in Greece didn’t pleased euro zone finance ministers.

EUR/USD is trading sideways slightly above the 1.0825 support (Fib 38.2% on March rally) as traders had already priced the failure of the Riga meeting. On the upside, the euro already failed once to break the 1.0906 level (high from April 2); the next resistance stands at 1.1052 (high from March 26). EUR/USD should find some support around the 1.0755/1.0825 area (Fib 50% and 38.2%).

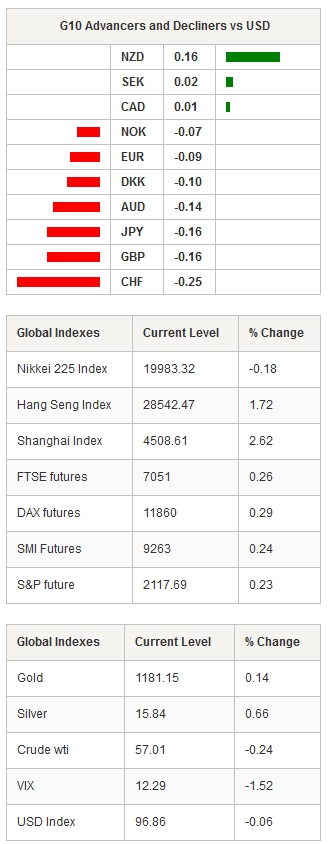

In the Asian session, the Nikkei edged down by -0.24%, while the Hang Seng and the Shanghai Composite were rallying as usual. Hong Kong’s equities are up 1.56% while Shanghai’s ones rose by 2.56% to 4,505.70. USD/JPY was treading water tonight and find some support around 118.72 (low from April 3). A lot of economic data from Japan are due this week. The party starts tomorrow morning with retails sales, industrial production and BoJ rate decision on the 30th, then March jobless rate and April inflation on the 1st of May.

AUD/USD is losing steam as it is testing the 0.7846 resistance (multi lows). The pair should find some hourly support at 0.7784 (Fib 61.8% on March sell-off) and further around 0.7736 (Fib 50%).

In Europe, equity futures are almost all blinking green on the screen. FTSE futures edged up by 0.26%, DAX 0.29%, SMI 0.24%, Euro Stoxx is flat while CAC 40 is down -0.16%. GBP/USD is still rallying and is currently sitting on the 1.5176 resistance level (Fib 61.8% on Feb-Mar sell-off). Fresh boost will be needed to clear the 1.5176/1.5252 area. On the upside, it is pretty open up to 1.5552 (high from Feb 26). EUR/USD was trading sideways last night and found some support on 0.7156 (Fib 61.8% on March rally). On the downside, one support lies at 0.7120 (multi lows) while the pair should find some buying interest above 0.7243 (Fib 38.2%).

USD/CHF is stuck in its declining channel and already erased gains generated by the SNB decision to tighten exemption rule on April 22. The pair is getting closer to 0.95, a break of this psychological level would pave the way towards 0.9376 (low from February 20). On the upside, the dollar will need some fresh boost to break 0.9728 resistance (Fib 38.2% on March sell-off). The publication of the US GDP figures on April 29 may provide some fuel. EUR/CHF is consolidating around 1.0370 as traders are waiting US economic data and try to guess the SNB’s next move to support the Swiss francs.

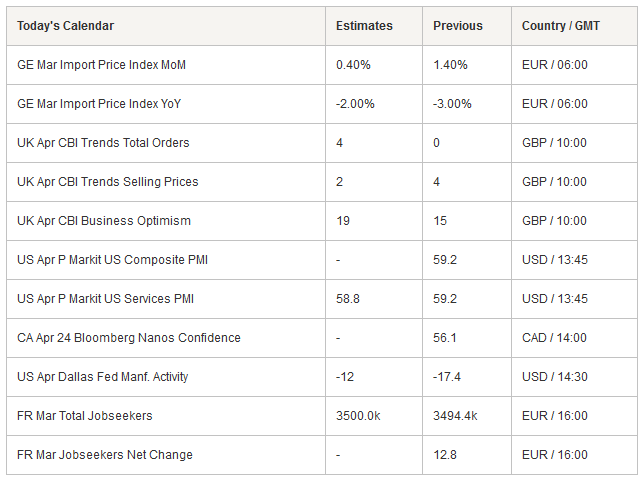

Today traders will watch unemployment rate and trade balance from Mexico, Markit PMI and Dallas Fed Manufacturing Outlook from the US while jobs data are due from Paris later today.

Currency Tech

EUR/USD

R 2: 1.1114

R 1: 1.1052

CURRENT: 1.0859

S 1: 1.0685

S 2: 1.0504

GBP/USD

R 2: 1.5560

R 1: 1.5200

CURRENT: 1.5167

S 1: 1.4750

S 2: 1.4600

USD/JPY

R 2: 121.52

R 1: 120.18

CURRENT: 119.26

S 1: 118.33

S 2: 117.95

USD/CHF

R 2: 0.9948

R 1: 0.9754

CURRENT: 0.9538

S 1: 0.9481

S 2: 0.9450