I could not care less about Greece in terms of its impact on the world markets. I have been on record with this view for several years. Greece is a place to go on vacation. If you have vacation plans already outside of Greece, and you do not live in Greece then shut up. Here is why in 4 charts.

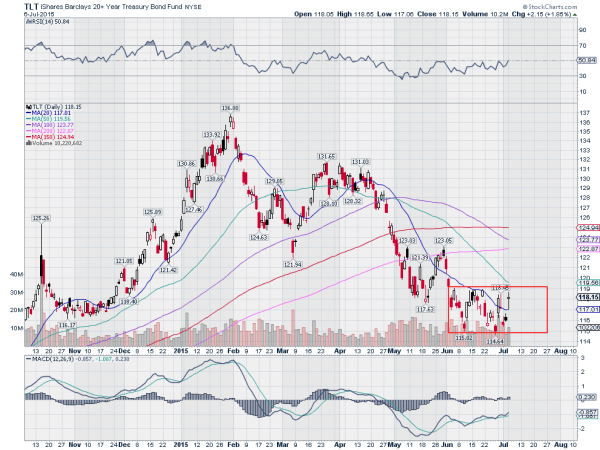

Us Treasuries are supposed to be the place where money flocks to in a financial crisis. Look at this chart of the iShares 20+ Year Treasury Bond (ARCA:TLT) since things started to heat up in Greece at the beginning of June. It has traded in a tight box. No panic. So you want to look at Bonds as a leading indicator of the crisis. Fine. Is that why they sold off the 4 months into this crisis?

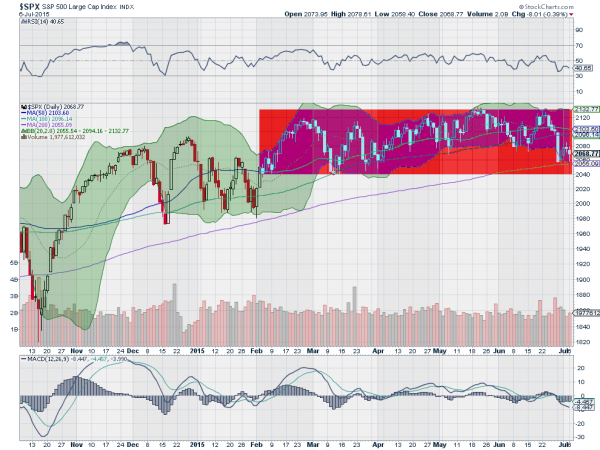

How about impact of the Greece chaos on the S&P 500. It has moved in a tight 100 point range since the beginning of February. Do you really want to suggest that the recent 70 point move, less than 3.5%, is because Greece is imploding? Was the 3.5% rising in 5 days in December because of Greece as well?

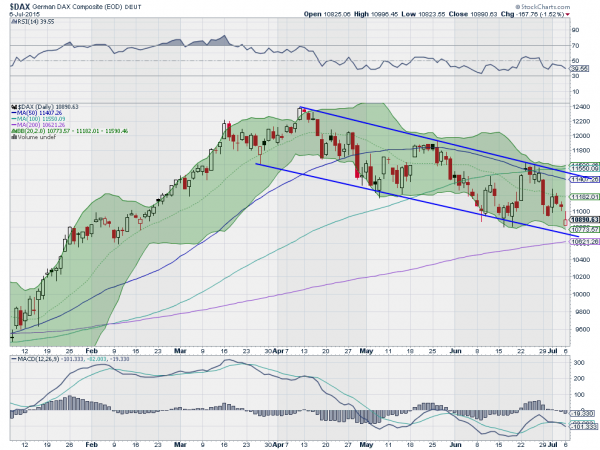

And the German DAX? It has been in a falling channel since the beginning of April. Sure it is off over 12% but it has moved in a pretty orderly fashion. And it has only retraced 50% of the leg higher since the start of the year. Crisis, Pffffttt.

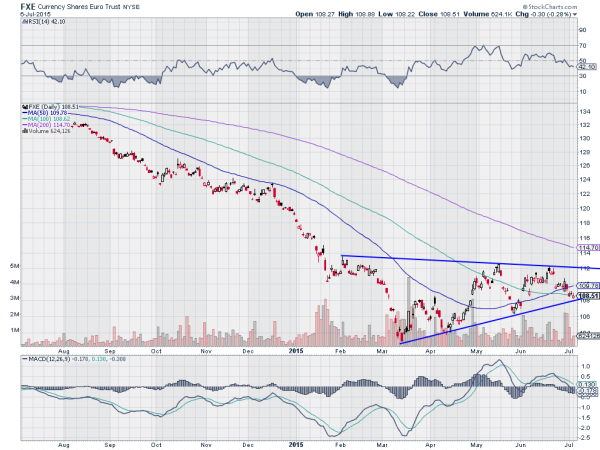

Finally the euro is barely budging. After embarking on a long road lower from last summer, it has been consolidating for the last 6 months in a tightening pattern. Let me repeat that. It has been consolidating, i.e. it stopped falling, as Greece was imploding.

So how important is Greece to the global markets. It is not as important as the media trying to make it. In fact it is not important at all.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.