A surprisingly solid ISM manufacturing index presented traders with a looming conundrum on Monday. The US dollar was the top performer on the first trading day of the month. Today, GBP is down across the board on weaker than expected construction figures. The focus now shifts to the Fed's John Williams speech on Tuesday. A new trade has been issued on Monday with three supporting charts and notes.

A series of poor regional numbers failed to predict the national manufacturing survey from the ISM on Monday. It was at 51.7 compared to 51.0 expected. The contraction in the prices paid component may provide luster for the doves. The commentary suggested the Mexican trade kerfuffle at the start of the month weighed and that's something that's since been reversed. The better China news will also add a lift this month.

The US dollar was higher ahead of the data but continued to strengthen after it. Nonetheless, equity markets gave back some gains after the data. The issue for risk trades is that if the good news mounts, it will change the plan of attack for the Fed. It already appears wholly unlikely the Fed will cut by 50 basis points at the end of the month, despite the market pricing in a 15% chance of it.

More importantly, is the message from the Fed speakers in the weeks to come ahead of the Jul 31st decision and later in the year. In the day ahead we will hear from Williams and Mester, both of whom are scheduled to talk about the economy. Will they refer to an insurance cut, or will receding uncertainty keep the bid under the US dollar. A detailed analysis about the Fed was issued in Monday's Premium trade.

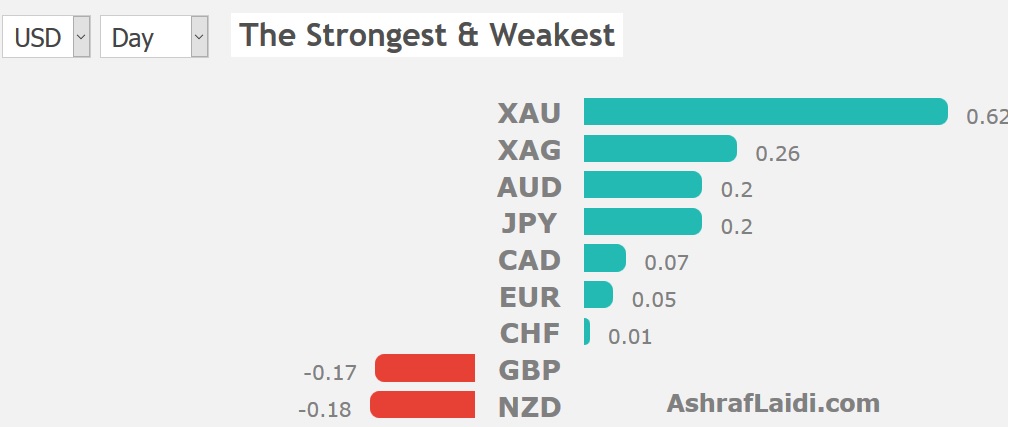

Looking at July more broadly, the seasonal trend over the past decade has been US dollar weakness, particularly against the yen and commodity currencies. It's also the best month for the S&P 500 and FTSE 100.