Market Brief

The latest batch of US data surprised mostly to the upside on Friday and provided a strong boost to US rates across the curve. Retail sales printed at a solid 0.6%m/m in June, beating market expectations of 0.1%. However, the previous month's reading was downwardly revised to 0.2% from 0.5%. On the inflation side, headline CPI came in slightly below the median forecast at 1.0%y/y versus 1.1% and expected. The core gauge, which excludes the most volatile components such as energy, edged up 2.3%y/y in June compared to 2.2% expected. In New York, the Empire manufacturing index collapsed to 0.55 versus the 5.0 expected by market participants, suggesting that a recovery is not on the cards just yet. Finally, industrial production also surprised to the upside as it printed at 0.6%m/m, beating median forecasts of 0.3%. However, since the gauge has been crossing the zero line back and forth over the last few months, it will take more than a single encouraging reading to revive the market’s optimism in the US industrial sector.

The entire US yield curve shifted to the upside on Friday afternoon amid the release of the economic data. The monetary sensitive 2-year yields hit 0.7098%, while the 10-year rose to 1.5990%.

However, the breaking news of an ongoing coup in Turkey raised global level uncertainty and encouraged investors to return to safer assets such as bonds, bringing US yields back down. EUR/USD opened higher in Asia before treading water at around 1.1050.

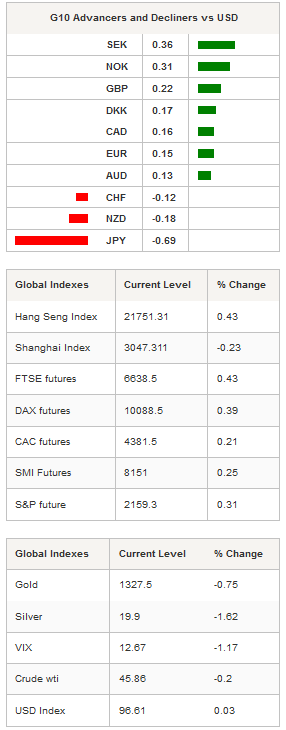

The Japanese yen fell sharply at the opening on Monday morning with USD/JPY opening at 105.40. The pair is now testing its 50dma, which currently stands at 106.25. Given the strong likelihood of another round of stimulus in Japan, traders will most likely avoid taking the risk to go against the flow and will instead continue to liquidate their long JPY positions.

In New Zealand, Q2 inflation missed the market and the central bank forecast as it printed at 0.4%y/y versus 0.5% expected, increasing the odds of an interest rate cut at its next meeting in early August. NZD/USD dropped 1.20% on anticipation of lower interest rate and moved as low as 0.7069. The fall should continue at a sustainable pace with NZD/USD returning to 0.67 as a first step.

In the equity market, most Asian regional markets were trading in positive territory on Monday, with the exception of mainland Chinese shares, which were blinking red, while Japanese markets were closed due to Sea Day. Hong Kong’s Hang Seng was up 0.43%, while Taiwan’s Taiex rose 0.65%. On the continent, the CSI 300 was down 0.25%. Finally, European shares are set to open higher as European futures are blinking green across the screen.

Currency Tech

EUR/USD

R 2: 1.1428

R 1: 1.1186

CURRENT: 1.1061

S 1: 1.0913

S 2: 1.0822

GBP/USD

R 2: 1.3981

R 1: 1.3534

CURRENT: 1.3240

S 1: 1.3106

S 2: 1.2798

USD/JPY

R 2: 107.90

R 1: 106.84

CURRENT: 105.77

S 1: 103.91

S 2: 99.02

USD/CHF

R 2: 1.0328

R 1: 0.9956

CURRENT: 0.9834

S 1: 0.9685

S 2: 0.9522