Poll a bunch of stock analysts and you’ll get grossly mixed forecasts for gold. Even after its rip-roaring 27% climb in the first half of the year, many big banks have a target on gold of $1,300... $1,250... or even lower.

If you ask gold bulls, the usual forecast is that the metal will zig-zag higher. And sure, that’s how gold -- or anything -- often moves. (In life, we’re rarely treated to a perfectly straight uptrend.)

But what if we’re all about to get sucker-punched? And by that I mean, what if gold’s only been “playing dead” and is poised to leap higher?

I’m seeing some things that tell me it could happen now. We may soon get to the $1,519 target that I set in June.

Mind you, this is apart from the longer-term bullish picture for gold. This is a short-term sprint that could push gold to $1,519 or even $2,000 and higher.

And miners? On that kind of surge in the metal, miners could go ballistic. Let’s look at the evidence, shall we?

Gold’s Strong Second Half

Gold clocked a gain of 28% through the end of July. That’s great. Which means the rest of the year should be better than great.

After all, gold demand tends to move in seasons. Gold usually has much better performance later in the year because of buying patterns relating to festivals in the Middle East, India and China, as well as Christmas in the West.

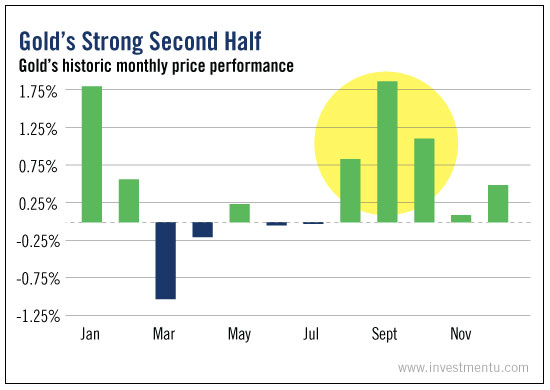

Take a look at this chart:

You can see that gold especially outperforms in September. But the entirety of autumn is a seasonally strong period.

Bulls Are Getting Impatient

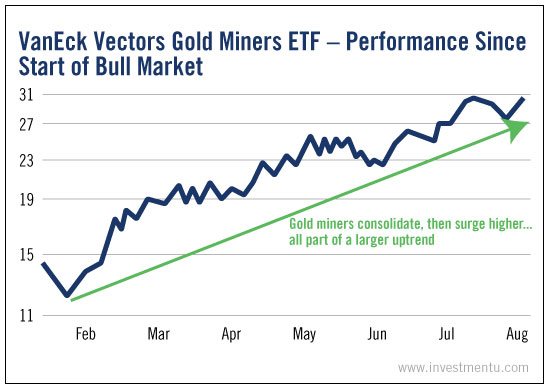

And speaking of patterns, my next chart shows the pattern in the VanEck Vectors Gold Miners (NYSE:GDX) -- the biggest gold-miner ETF -- since the start of the new bull market.

As you can see, the fund surges and then consolidates, followed by another surge. It has happened over and over again.

The other interesting thing about this chart? The periods of consolidation are getting shorter. That tells me buyers are getting impatient.

Between now and Christmas, I would not be surprised to see a blow-your-socks-off move to the upside.

And that move could easily be bolstered by the Fed.

Central Banks Are Hanging On by Their Fingernails

You probably know that the Fed left interest rates unchanged at its last meeting. The question is, when will it raise rates?

Fed governors have been promising that a rate hike is right around the corner -- if the data supports it.

But the Fed is probably done for the year. Just look at the latest numbers.

Data released last Friday showed gross domestic product rose at a 1.2% annualized rate in the second quarter. That’s less than HALF the 2.5% that was forecast.

Businesses don’t want to spend. They don’t see the demand. So they aren’t buying new equipment.

How can the Fed raise rates in that environment? Answer: It can’t.

The futures market -- the best gauge of what the smart money says -- is indicating we won’t see a rate hike until late next year. The first month where traders see better-than-even odds for an increase is September 2017.

But for gold prices, a low-interest rate environment is like a pool of gasoline. It’s ready to ignite!

A Pinch Of Overseas Uncertainty

The Bank of Japan is considering steps to expand monetary stimulus because its economy is stuck in the mud. Meanwhile, Europe is marching into uncharted territory with its sub-zero rates.

It’s just more fuel on the fire for gold.

Gold is a harbor of safety. When investors get scared, they buy gold. And based on what we’ve seen with S&P 500 earnings, that fear may be justified.

Miners Make Money When Others Don’t

According to recent data, the S&P 500 is either going to squeak out a small earnings gain in the current quarter or earnings will fall again year over year.

If the S&P 500 does report a year-over-year decline, it will mark the first time the index has reported five consecutive quarters of declines since the Great Recession.

But the slump isn’t affecting ALL stocks. One precious metal miner after another is reporting blowout earnings.

- First Majestic Silver (NYSE:AG) saw revenues rise 22% in the first quarter, and earnings swung from a loss to a profit at the same time. Second quarter estimates are ratcheting higher.

- Royal Gold (NASDAQ:RGLD) saw its earnings increase 20% year over year. The gold royalty and streaming company pays a nice dividend, too.

These are just three examples taken from an industry that’s shining brightly, even as hopes for the S&P 500 dim.

In fact, the ARCA Gold Miners (the index the VanEck Vectors Gold Miners ETF tracks) saw its earnings rise 215% in the most recent quarter.

Let that sink in. TWO-HUNDRED AND FIFTEEN PERCENT!

That’s one more thing that could kick gold and miners into overdrive. Thanks to the central banks, there is a lot of money sloshing around in the markets. That money is going to look for performance and value.

You can find both in precious metals miners.

Good investing,