The price of gold dropped below $1,900 amidst COVID-19 cases increases in the West and the U.S. dollar appreciation. So, what happens next with the yellow metal?

For the time being, things are not looking good, my bull friends. The bearish trend in the gold market continues. As the chart below shows, we saw a significant selloff on Monday with gold prices decreasing from above $1,950 to $1,909. To make matters worse, the decline continued on Tuesday and Wednesday, with the price of gold dropping below the critical level of $1,900, for the first time since the end of July.

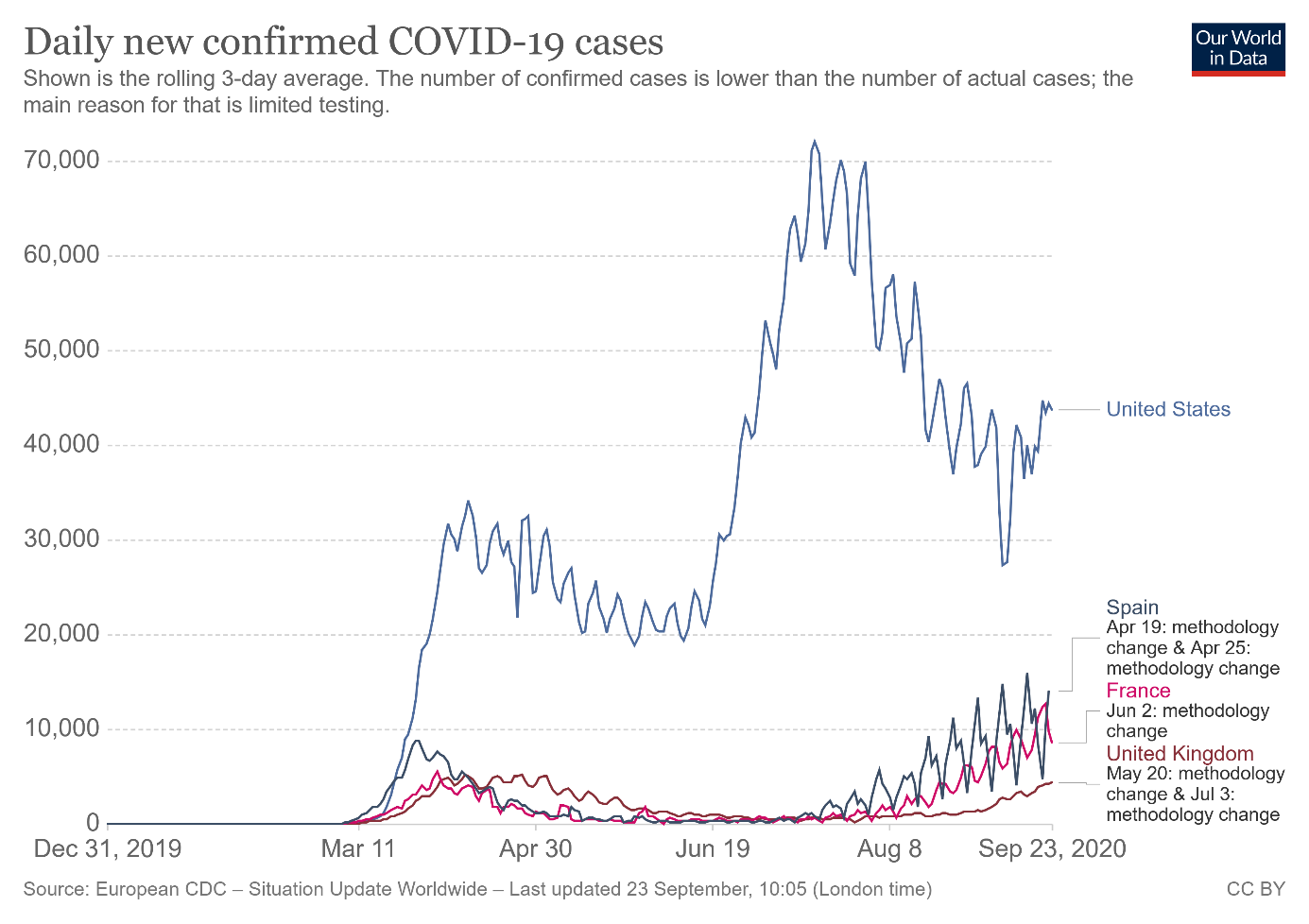

So, what exactly happened here? Well, as we wrote in Tuesday’s Fundamental Gold Report, the coronavirus just came back with another wave. As pointed out in the chart below, the daily new confirmed COVID-19 cases are increasing again in several European countries, and the United States.

Yes, even UK Prime Minister Boris Johnson has already introduced some new restrictions, including 10 p.m. curfews for pubs and restaurants in England. Can you imagine pubs in England opened only until 10 p.m.? That’s not just a crisis, it’s a disaster!

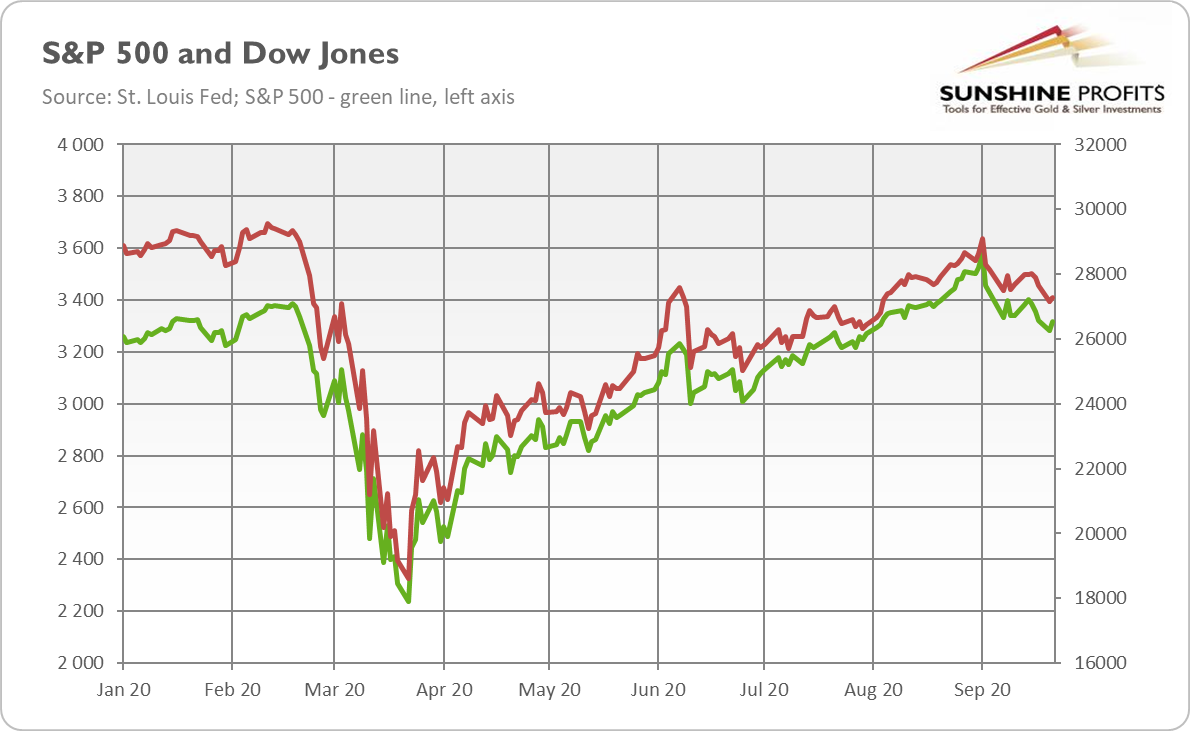

As a result, the recent COVID-19 cases resurgence renewed the global concerns about the reinstatement of lockdowns or other constraining measurements that can hamper the pace of the economic recovery (I warned you that there is no point in expecting a V-shaped rebound). This anxiety caused was the main reason behind the recent stock market declines, pushing down the S&P 500 and Dow Jones from 3319 and 27657 to 3281 and 27148, respectively (see the chart below).

Moreover, the negative market sentiment intensified U.S. dollar’s safe-haven demand, which rose to the two-month high. Consequently, the EUR/USD exchange rate dropped to a two-month low of $1.1671 on Wednesday morning.

Although the new cases are increasing in America, infections are spreading incredibly rapidly in Europe, strengthening the greenback‘s position against the euro. The recent cases resurgence across Europe have coincided with the weak economic Eurozone indicators: for example, the business growth ground to a halt in September.

Implications For Gold

So, what does the above mean for the gold market? Well, the renewed global concerns about the second COVID-19 wave of infections, primarily in Europe, along with its economic implications, pushed investors toward the US dollar. It is all normal – in every crisis, cash is always the king. But in a global or European crisis such as the current one, the greenback is the tsar.

Several other risks have accumulated recently. Let's not forget that the U.S. presidential elections are quickly approaching. It is likely that the elections' results will be disputed, as Trump already suggested that mail-in voting could be rigged. Moreover, the fight over Supreme Court Justice Ruth Bader Ginsburg’s successor adds up another volatile element, as it decreases the chances of a quick deal on the new stimulus measurements. You see, if Trump manages to install a conservative replacement in time, the new judge could help resolve any dispute in his favor. These risks supported the U.S. dollar, which put downward pressure on the gold prices as a result.

Therefore, the market sentiment is clearly bearish right now, and it appears that the yellow metal needs a real spark to re-enter a bullish trend. Indeed, it seems that both the stock and gold market await patiently for the upcoming fiscal and monetary stimuli. Unfortunately for the gold bulls, the market expectations for a new Congress or the Fed support have declined in recent days. That is why the fears about the second wave of infections and the renewed sanitary restrictions are so acute – there is no government or central bank’s help on the horizon that can protect and solidify the economy.

But still, gold bulls shouldn’t give up. Remember the first wave of the pandemic? Gold also plunged, only to soar afterward, resulting in a record high. The fundamental outlook for gold is still bullish: the real interest rates are negative, the public debt is ballooning, while the Fed’s monetary policy is very dovish. Although right now, both the Congress and the central bank could potentially disappoint investors, they will have no choice but to provide additional support as they always do indulge the Wall Street – and, although somewhat unintentionally, gold bulls.