Gold Today –New York closed yesterday at $1,264.70.London opened at $1,260.00today.

Overall the dollar was slightly weaker against global currencies, early today. Before London’s opening:

The USD/EUR was slightly weaker at $1.1804 after the yesterday’s$1.1802: €1.

The US Dollar Index was slightly weaker at 93.36 after yesterday’s 93.38.

The yen was stronger at 110.58 after yesterday’s 110.81:$1.

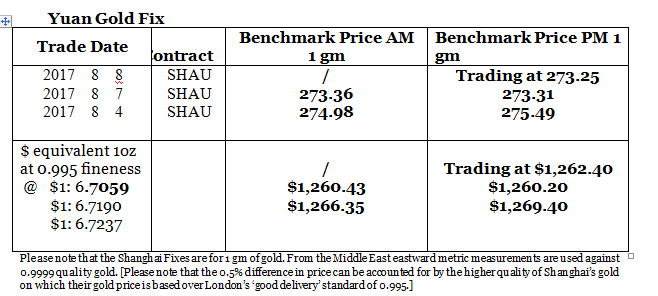

The yuan was stronger at 6.7059 after yesterday’s 6.7190: $1.

The Pound Sterling was weaker at $1.3035 after yesterday’s $1.3050: £1

New York closed $4.27 higher than Shanghai’s close yesterday. Today, we are seeing yesterday’s rallies stall and the dollar is slightly weaker. London’s discount to Shanghai has narrowed to $2.40, a negligible amount.

It would seem that the dollar is resuming its downward trend once more.

London opened $2.40 lower than Shanghai but Shanghai is dominating prices now.

Silver Today –Silver closed at $16.25 yesterday after $16.25 at New York’s close Friday.

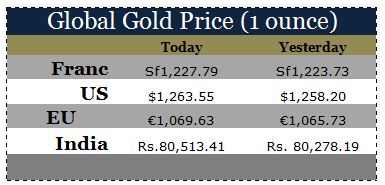

LBMA price setting: The LBMA gold price was set today at $1,261.45 from yesterday’s $1,257.55. The gold price in the euro was set at €1,067.85 after yesterday’s €1,065.90.

Just before the opening of New York the gold price was trading at $1,263.55 and in the euro at €1,069.63. At the same time, the silver price was trading at $16.37.

- Gold (very short-term) The gold price should consolidate again with a positive bias, in New York today.

- Silver (very short-term) The silver price should consolidate again with a positive bias, in New York today.

Price Drivers

The dollar gold price has turned up again in line with the weaker dollar. The gold price is not steady in any currency, so it cannot be accurately translated into any currency as though it solely reflected currency values, yet. For instance, the euro it dropped in the past week alongside its fall against the dollar and we expect it to rise in the euro and the dollar when it rises, which it has started to do now. With the Yuan, it move in the last week has been 2% against the currency’s move of 0.003%. We see this Chinese price of gold being where the physical demand and supply is being priced.

India

In the future it is going to get more and more difficult to gauge true Indian demand. Smuggling is rampant and un-gaugeable. This could be over 250 tonnes as it remains a very profitable business paying over 6% to the smugglers.

Even its seasonality is becoming more difficult to determine, because of the growth of the Indian middle classes and the fact that importers/wholesalers are able to buy well ahead of the seasonal demand. That’s why we are getting reports of Indian demand coming in now, out of season. The stock bought ahead of GST’s impositions has been sold and wholesalers have begun stocking up for the gold season already.

Bear in mind, that when Indian demand comes in it will be on top of robust Chinese demand.

We also see the fourth quarter of the year seeing renewed investment demand in the developed world markets for both gold and silver.

Gold ETFs – Yesterday there were small sales from the SPDR gold ETF of 0.275 of a tonne but no change in the Gold Trust holdings yesterday. The SPDR gold ETF and Gold Trust holdings are at 786.869 tonnes and at 211.43 tonnes respectively.

Since January 4th 2016, 163.043 tonnes of gold have been added to the SPDR gold ETF and to the Gold Trust.

Since January 6th 2017, 0.283 of a tonne of gold has been added to the SPDR gold ETF and the Gold Trust. The gold acquisitions by these two funds in 2017 have returned to the negative and now stand at -4.412 tonnes in 2017.