Gold Today –New York closed yesterday at $1,279.30.London opened at $1,278.00today.

Overall the dollar was stronger against global currencies, early today. Before London’s opening:

The USD/EUR was stronger at $1.1732 after the yesterday’s$1.1760: €1.

The US Dollar Index was stronger at 93.70 after yesterday’s 93.61.

The yen was weaker at 109.98 after yesterday’s 109.75:$1.

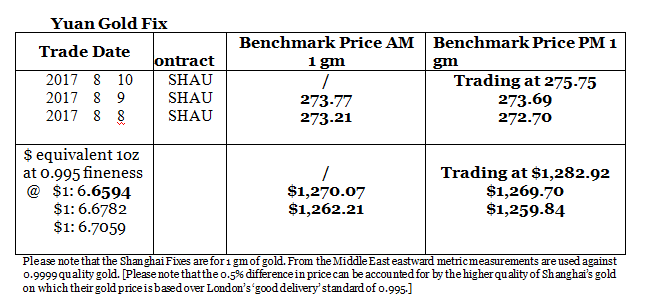

The yuan was much stronger at 6.6594 after yesterday’s 6.6782: $1.

The pound sterling was weaker at $1.2980 after yesterday’s $1.3005: £1

New York closed just under $10.00 higher than Shanghai’s close yesterday. Then today sees Shanghai lifting the gold price even higher as you can see. London is still lagging but not by much as it opened

We were looking to see if this was a jump on the back of the deteriorating situation with North Korea. We would have thought that if this were so, the gold price would have jumped higher. So far the evidence is not there.

London is $5 lower than Shanghai, but raced to catch up and at one point in London was the same as Shanghai’s earlier trading levels.

Silver Today –Silver closed at $16.86 yesterday after $16.38 at New York’s close Tuesday.

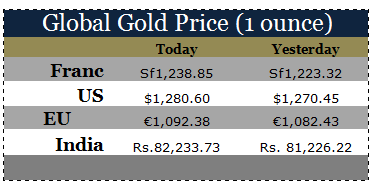

LBMA price setting: The LBMA gold price was set today at $1,278.90 from yesterday’s $1,267.95. The gold price in the euro was set at €1,091.03 after yesterday’s €1,080.30.

Just before the opening of New York the gold price was trading at $1,280.60 and in the euro at €1,092.38. At the same time, the silver price was trading at $17.10.

- Gold (very short-term) The gold price should plod higher, in New York today.

- Silver (very short-term) The silver price should follow gold high faster, in New York today.

Price Drivers

The gold price in dollars is now at $1,279, so the answer to yesterday’s question, “Will it run higher in the $1,270’?” was given in a day! So, where next?

The Yuan continues to strengthen strongly against the dollar, which itself is strengthening against other currencies.

The Fed

Members of the FOMC are talking to the media in very dovish manners. The evidence that inflation is falling has clearly disturbed them. After the 2015, 2016 steady building of inflation, it is falling back again. This implies that we will not see another rate hike in 2017. They still feel that a start to the Fed’s Balance Sheet tightening will be made. After all, it will be slight and the Fed believes it will have barely any impact on markets. While academically that may be true, psychologically it may be a mistake.

The recovery remains vulnerable and fragile. Any hint of tightening may well cause a market reaction when they broach that subject with action. Meanwhile, the earnings picture is pointing to it peaking in the near term, if it has not already done so. This makes equity markets toppy. They could turn mercurial if evidence arrives that tightening, even slightly, is about to happen.

Gold will benefit from a stalling of Fed tightening. Real interest rates continue to be negative but if inflation falls back further until rates are not negative, we fully expect the Fed to turn back to the easing path.

North Korea

It is apparent that North Korea is being fed propaganda that the US is its main enemy and about to invade the country. This distracts from the dire economic state of the country. President Trump is reinforcing that idea with his responses. His words would, in the North Koreans eyes, justify continuing on the threatening war path. The President of the country is obviously a psychopath and intent on going ahead with his threats.

China, on the other hand, will not allow that buffer state to be destroyed, bringing the US, militarily dominated South Korea to its doorstep. This formula will lead to conflict, we now believe. But the markets have not yet responded to this potential. Gold has not jumped as it would have done if markets were reacting. The rise overnight in the gold price in the US was not via physical buying but a dealer’s response to the North Korean situation. On the other hand the rise in Shanghai prices would be based on physical dealings. A $10 rise in Shanghai falls far short of a ‘war fear’ rise.

As we said yesterday, “Gold will benefit if war does break out as the war hurts financial markets the whole world over.”

Gold ETFs – Yesterday there were no changes in the holdings of the SPDR Gold (NYSE:GLD) ETF or the Gold Trust (NYSE:GLDW) holdings yesterday. The SPDR gold ETF and Gold Trust holdings are at 786.869 tonnes and at 211.43 tonnes respectively.

Since January 4th 2016, 163.043 tonnes of gold have been added to the SPDR gold ETF and to the Gold Trust.

Since January 6th 2017, 0.283 of a tonne of gold has been added to the SPDR gold ETF and the Gold Trust. The gold acquisitions by these two funds in 2017 have returned to the negative and now stand at -4.412 tonnes in 2017.