Gold Today –New York closed yesterday at $1,262.60.London opened at $1,265.00today.

Overall the dollar was stronger against global currencies, early today. Before London’s opening:

The USD/EUR was stronger at $1.1760 after the yesterday’s$1.1804: €1.

The Dollar Index was stronger at 93.61 after yesterday’s 93.36.

The yen was stronger at 109.75 after yesterday’s 110.58:$1.

The Yuan was much stronger at 6.6782 after yesterday’s 6.7059: $1.

The pound sterling was weaker at $1.3005 after yesterday’s $1.3035: £1

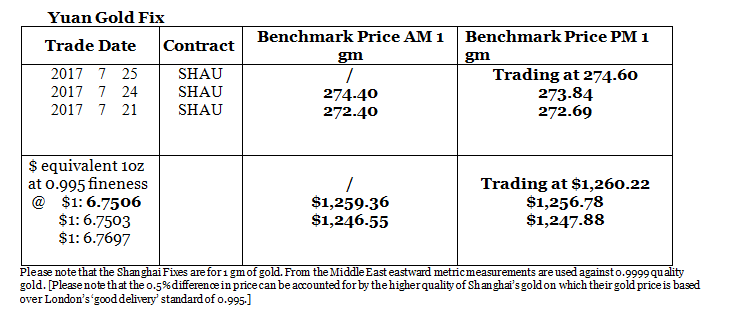

New York closed $2.80 higher than Shanghai’s close yesterday. Today, we are seeing the dollar stronger overall but the yuan is quite a bit stronger against the dollar. London is $7 lower than Shanghai.

Shanghai is on the front foot today and likely to pull London and New York higher today.

Silver Today –Silver closed at $16.38 yesterday after $16.25 at New York’s close Monday.

LBMA price setting: The LBMA gold price was set today at $1,267.95 from yesterday’s $1,261.45. The gold price in the euro was set at €1,080.30 after yesterday’s €1,067.85.

Just before the opening of New York the gold price was trading at $1,270.45 and in the euro at €1,082.43. At the same time, the silver price was trading at $16.71.

- Gold (very short-term) The gold price should consolidate again with a positive bias, in New York today.

- Silver (very short-term) The silver price should consolidate again with a positive bias, in New York today.

Price Drivers

The gold price in dollars is now at $1,270. Will it run higher in the $1,270? If so that would be very positive for future rises. Or will it be turned back again?

The currency markets are in a correction phase with the dollar rising but not against the Yuan or Yen. The gold price is higher in the euro but mainly as a result of the stronger dollar. This is why it rose more in the than in the dollar.

North Korea

We were around when the Cuba Missile Crisis brought the world to the brink of World War 3. Today this is one country, North Korea, against the U.S. to begin with. But in 1952 when the Korean War raged it became China plus North Korea that took on the Allies. We see a potential restart to the war again [which never officially ended] and a major deterioration of U.S. - China relations if it does. China will not accept the elimination of North Korea!

At the moment the markets are not discounting this likelihood. We may see China and Japan do so soon. In South Korea the atmosphere is moving towards fear quickly.

Gold will benefit if war does break out as the war hurts financial markets the whole world over.

- are up as high as they were before the 2008 crisis. While it is widely believed that the developed world banking system is repaired and capable of withstanding another financial crisis any financial accident that strikes now will have a devastating impact, more so than in 2008.

Gold ETFs – Yesterday there were no changes in the holdings of the SPDR Gold (NYSE:GLD) ETF or the Gold Trust (NYSE:GLDW) holdings yesterday. The SPDR gold ETF and Gold Trust holdings are at 786.869 tonnes and at 211.43 tonnes respectively.

Since January 4th 2016, 163.043 tonnes of gold have been added to the SPDR gold ETF and to the Gold Trust.

Since January 6th 2017, 0.283 of a tonne of gold has been added to the SPDR gold ETF and the Gold Trust. The gold acquisitions by these two funds in 2017 have returned to the negative and now stand at -4.412 tonnes in 2017.