5 Trade ideas excerpted from the detailed analysis and plan for premium subscribers:

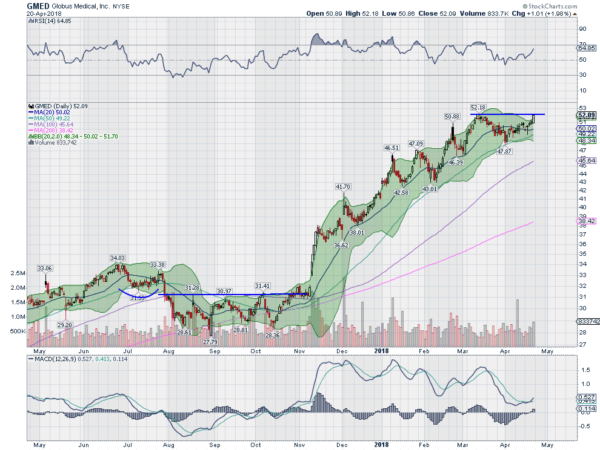

Globus Medical (NYSE:GMED)

Globus Medical, $GMED, rose out of consolidation in November and moved higher to a top in March. It had a shallow pullback from there, near the 50 day SMA, and then bounced. Now it is back at that top. The RSI is bullish and rising with the MACD crossed up. Look for a new high to participate higher…..

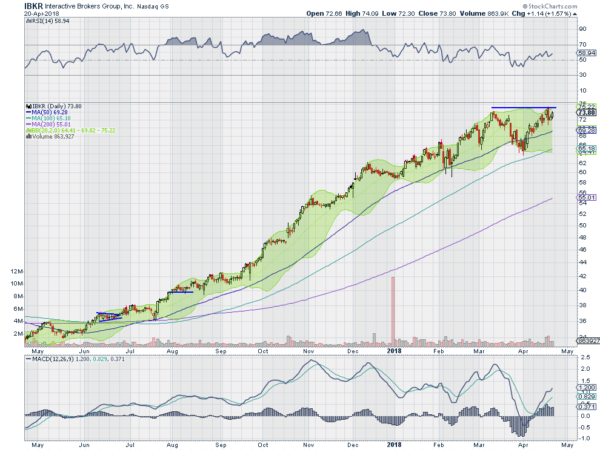

Interactive Brokers Group Inc (NASDAQ:IBKR)

Interactive Brokers, $IBKR, has moved steadily higher since June of 2017. In March it started to pullback from a high and did not stop until making its first lower low in this streak, under the 50 day SMA. But since then it has reversed higher and is back at that March high. The RSI is rising and bullish with the MACD moving higher. Look for a new high to participate…..

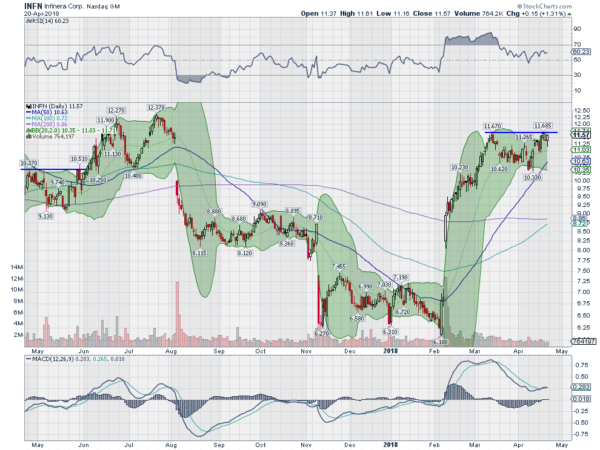

Infinera Corporation (NASDAQ:INFN)

Infinera, $INFN, rose out of consolidation with a gap up in February. It continued to a top in March before a minor pullback. Last week it pushed higher off of the lower Bollinger Band® and closed the week at the prior high. The RSI is in the bullish range and the MACD is crossing up. Look for a new high to participate…..

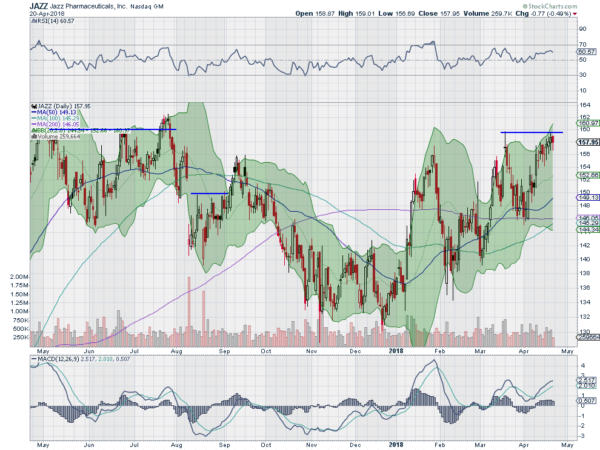

Jazz Pharmaceuticals PLC (NASDAQ:JAZZ)

Jazz Pharmaceuticals, $JAZZ, has been a choppy stock, falling to a low in November. It consolidated there for 2 months before a push higher. That failed at a lower high and fell back, but to a higher low. The next leg higher made a higher high before pulling back to another higher low. Now it is back at that high with the RSI in the bullish zone and the MACD rising. Look for a new high to participate…..

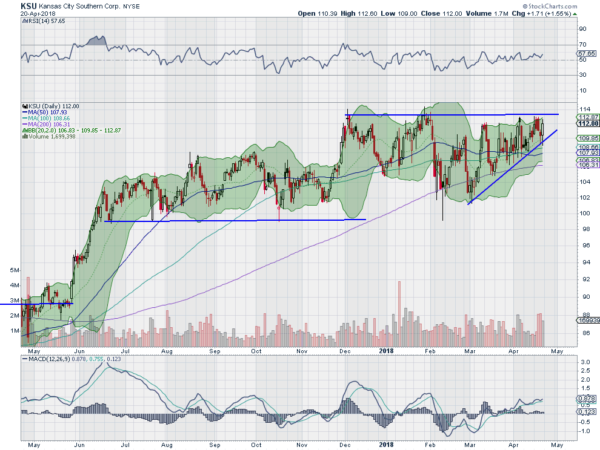

Kansas City Southern (NYSE:KSU)

Kansas City Southern, $KSU, reported earnings last Friday morning and opened at support. It ran higher all day and finished at the recent resistance range. The RSI is holding just under the bullish range with the MACD rising and positive. Look for a push through recent resistance to participate higher…..

Up Next: Bonus Idea

After reviewing over 1,000 charts, I have found some good setups for the week.These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which with April options expiration in the rearview mirror sees the markets head into the last full week of April trading. Here in Northeast Ohio the weather is mixed with sunshine but very cold temperatures and some snow, hardly spring time, and stocks look the same, confused, sometimes strong and then weak again.

Elsewhere look for Gold to consolidate in a broad range while Crude Oil continues to be the strongest market rising higher. The US Dollar Index churns along sideways while US Treasuries are now in a downtrend. The Shanghai Composite has also turned downward while Emerging Markets continue to mark time at the highs.

Volatility has been stuck in a more normal range and does not look to be changing that anytime soon. This has left the equity index ETF’s SPDR S&P 500 (NYSE:SPY) iShares Russell 2000 (NYSE:IWM) and PowerShares QQQ Trust Series 1 (NASDAQ:QQQ) to blaze their own path. Their charts continue to frustrate in the short term, falling back from lower highs, but longer term continue to consolidate in broad ranges at the top. Use this information as you prepare for the coming week and trad'em well.

DISCLAIMER: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.