Investing.com’s stocks of the week

Market Brief

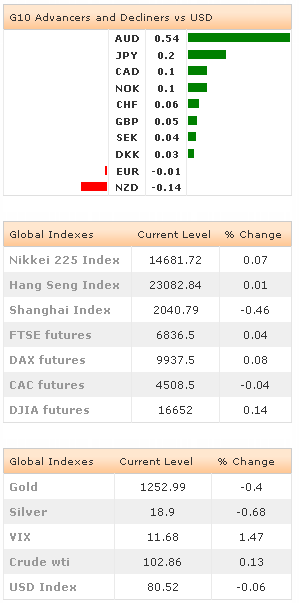

FX was subdued in the Asia session with price action contained in Gold and Silver. Regional equity indices were little changed as news flow grinded to a halt. The Nikkei rose to 0.07%, the Shanghai Composite fell -0.28% while the Hang Seng was flat. After a sharp fall in US hours, treasury yields were unchanged with the 10 years holding at 2.43%. European peripheral bonds rose after a weak German employment and Money supply data supported expectations for ECB easing. AUD/USD rose to 0.9302 from 0.9220 in response to stronger than expected CAPEX survey results for 2014/2015. AUD/NZD continues to improve breaking above key resistance at 1.0890. USDJPY dipped marginally to 10166 despite reports that retail sales plunged. Sell pressure on EUR/USD eased slightly as the pair based around the 1.3600 handle. EM FX was mixed, as USD/INR is down somewhat, trading at 58.88. Heading into Europe Gold and silver became very active. Gold fell sharply to $1252 while silver collapsed to $18.858.

Overnight Data

Out of Japan, BoJ board member Sayuri Shirai stated that proactive monetary stimulus will be enforced as the banks central 2% target remains fluid. Japan’s retail sales collapsed -13.7% m/m in April, the quickest pace in 14 years. Large retailers' sales dropped -6.8% in April after solid rise of 16.1% the previous month. From Australia, private capital expenditure fell 4.2% weaker than consensus at 1.5%. Yet , total capex survey results for 2014/2015 was better than expected at A$137bn, much better than expectations around A$128bn. In addition, the composition of the data suggests a healthy shift from mining to other industries.

US GDP in focus

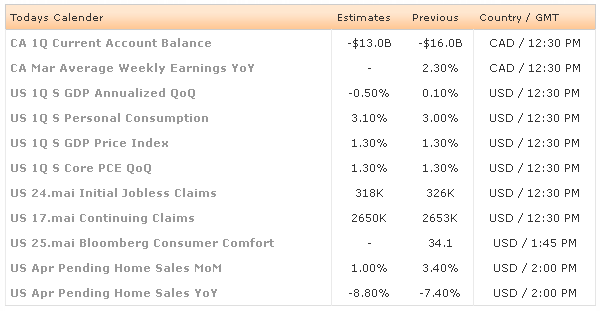

For today, traders will be focused on US Q1 GDP expected at -0.5% from 0.1% prior result. The winter weather clearly has had a stronger adverse effect than previously thought. However, the Fed has made it very clear they see the weak trend in Q1 growth as a one off and should be overlooked. Hence there will be no adjustment to forward expectations and no implication on policy. In the European session, Spanish GDP is expected to be confirmed at 0.4% q/q in Q1.

Currency Tech

EUR/USD

R 2: 1.3624

R 1: 1.3610

CURRENT: 1.3591

S 1: 1.3584

S 2: 1.3564

GBP/USD

R 2: 1.6746

R 1: 1.6730

CURRENT: 1.6704

S 1: 1.6704

S 2: 1.6683

USD/JPY

R 2: 102.15

R 1: 101.95

CURRENT: 101.56

S 1: 101.46

S 2: 101.00

USD/CHF

R 2: 0.9004

R 1: 0.8990

CURRENT: 0.8981

S 1: 0.8967

S 2: 0.8952