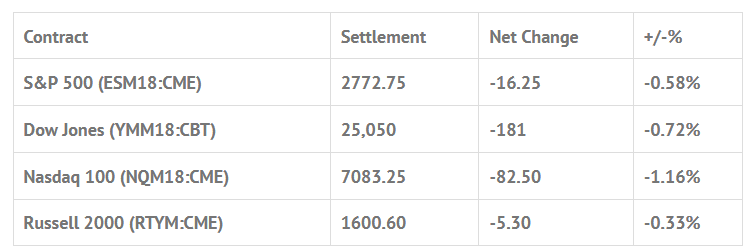

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 7 out of 11 markets closed higher: Shanghai Comp +0.34%, Hang Seng +0.01%, Nikkei +0.12%

- In Europe 10 out of 12 markets are trading higher: CAC +0.37%, DAX +0.35%, FTSE +0.12%

- Fair Value: S&P +4.43, NASDAQ +26.13, Dow +22.21

- Total Volume: 766k ESH and 1.9mil ESM; 2.5k SPH, and 3.0k SPM traded in the pit

Today’s Economic Calendar:

The Weekly Bill Settlement, Jobless Claims 8:30 AM ET, Philadelphia Fed Business Outlook Survey 8:30 AM ET, Empire State Mfg Survey 8:30 AM ET, Import and Export Prices 8:30 AM ET, Bloomberg Consumer Comfort Index 9:45 AM ET, Housing Market Index 10:00 AM ET, EIA Natural Gas Report 10:30 AM ET, Treasury International Capital 4:00 PM ET, and Fed Balance Sheet and Money Supply 4:30 PM ET.

S&P 500 Futures: #ES 2748 #VIX 17.59

After a weak close on Tuesday, the S&P 500 futures (ESM18:CME) rallied up 2783.50 on Globex Wednesday morning, and opened at the 2780.00 level on the 8:30 CT bell. The first move was a drop down to 2771.50, followed by a rally back above the vwap to 2778.50, and then a selloff down to a new low at 2766.25. The ES then went on to make a series of higher highs up to 2773.50 before going into a free fall down to 2761.75, 3 ticks below Monday’s low, and then eventually all the way down to 2752.00.

Once things began to settle down, the futures rallied up to 2759.25, sold off down to 2750.25, rallied up to 2761.75, and then double bottomed at the 2750.25 low. After that, the ES shot up to 2767.25, up 17 handles from the low, and then sold off down to a new low 2748.50 at 1:45 CT. At 1:53 total volume was only 1.19 million. The rest of the day was a series of lower highs.

The MiM opened up showing small to sell, and ended up at $101 million to buy. On the 3:00 cash close the ES traded 2754.75, and went on to settle at 2754.00 on the 3:15 futures close, down -14.25 handles, or -0.51% on the day.

In the end, Tuesday’s weak price action followed through during Wednesday’s trade. As I have said, this is a game of too long / too short. Soon the crowd will be too short, and the ES will start to go up again.

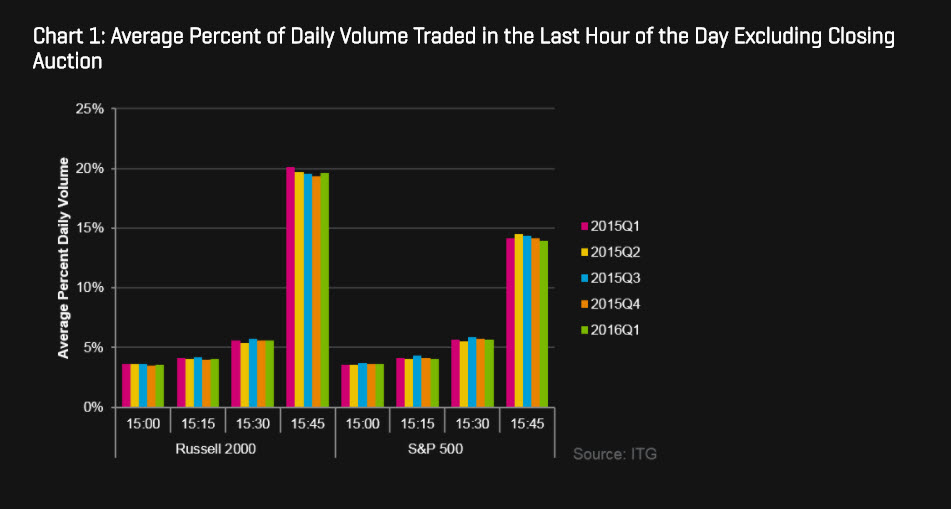

Why The MiM Is So Important?

According to Credit Suisse (SIX:CSGN), last year, 26% of all trading activity on the NYSE’s flagship exchange took place in the last trade of the day, up from 17% in 2012, exchange data shows. Last year, trades at the close accounted for more than 8% of trading volume in S&P 500 stocks, nearly four times what it was in 2004.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. Any decision to purchase or sell as a result of the opinions expressed in the forum will be the full responsibility of the person(s) authorizing such transaction(s). BE ADVISED TO ALWAYS USE PROTECTIVE STOP LOSSES AND ALLOW FOR SLIPPAGE TO MANAGE YOUR TRADE(S) AS AN INVESTOR COULD LOSE ALL OR MORE THAN THEIR INITIAL INVESTMENT. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.