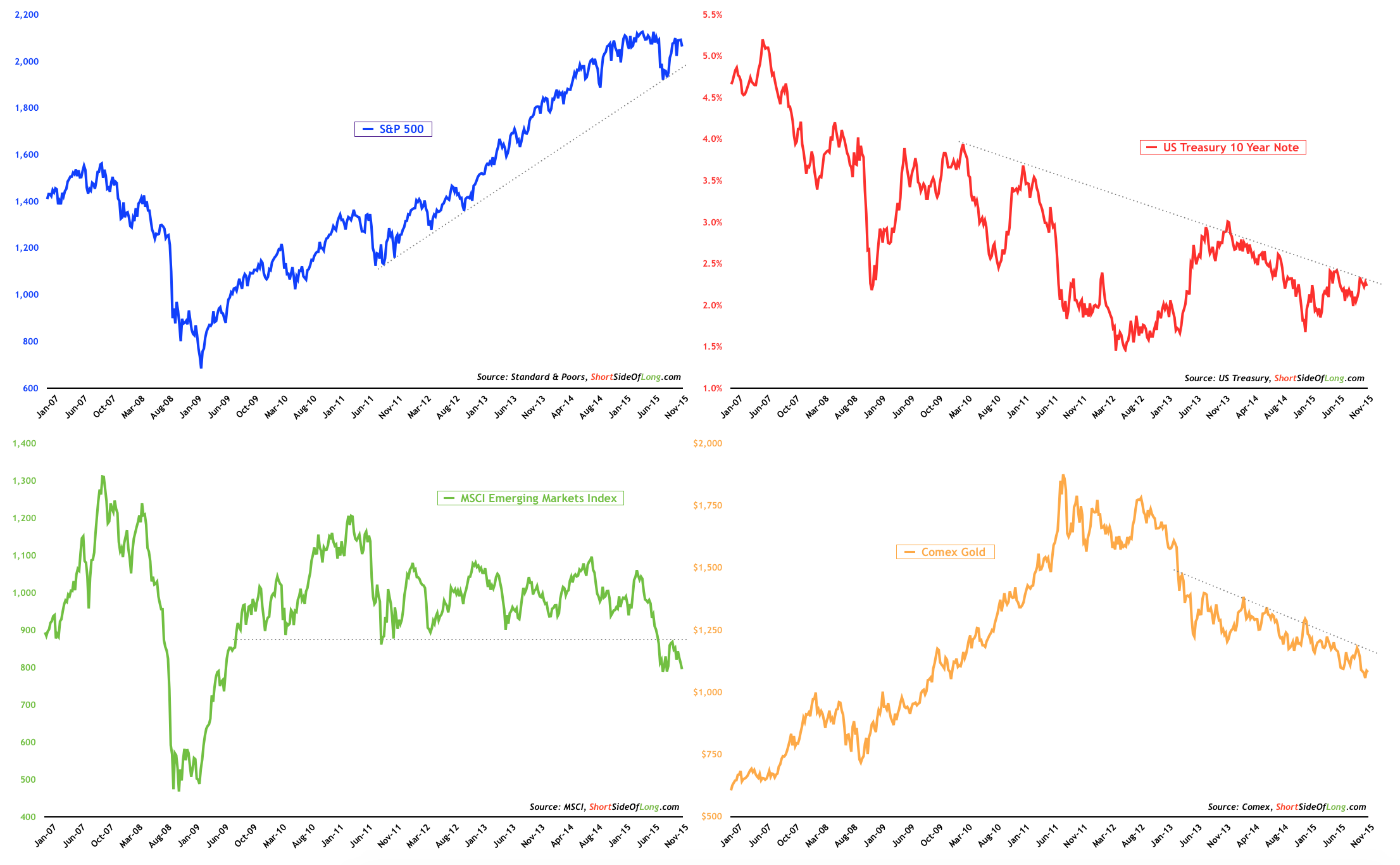

Apart from US stock market, other assets continue to underperform

Source: Short Side of Long

It hasn’t been a good year for most investors, that's for sure. US Treasury bonds (represented by 10-Year in chart, above) have been struggling since the beginning of the year, Emerging Market equities have suffered in 2015 and Gold is on track for yet another annual decline. Technically speaking, the S&P 500 remains in a primary uptrend, but has yet to make a higher high. MSCI Emerging Markets is in a primary downtrend, since at least the 2011 peak.

Furthermore, EM stocks are down considerably since their 2007 all time high. Finally, after peaking in August of 2011, Gold has declined over 45% in recent years and continues its technical pattern of lower lows and lower highs. Not much is working right now.

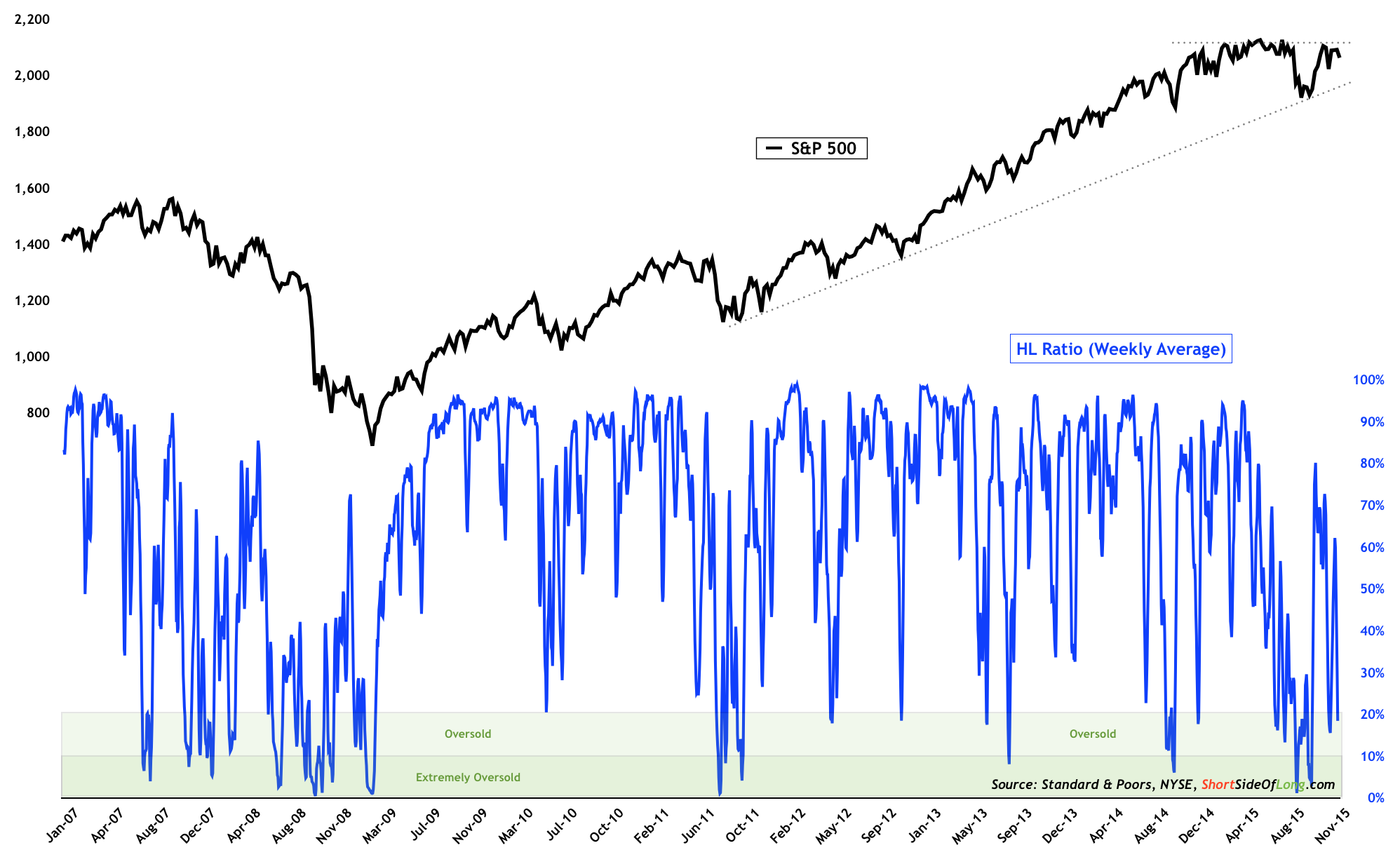

Market breadth has been very weak over the last few trading sessions

Source: Short Side of Long

While the US stock market index looks good on the surface, trading only a few percentage points from its all time record high level, breadth remains very weak. In the last post we noted that the percentage of NYSE 52 week new lows was dominating recent breadth numbers. Over the last few days, we have seen two consecutive days on the NY stock exchange where the number of 52 week new lows was relatively high, with 336 new lows on Monday and 365 new lows Tuesday.

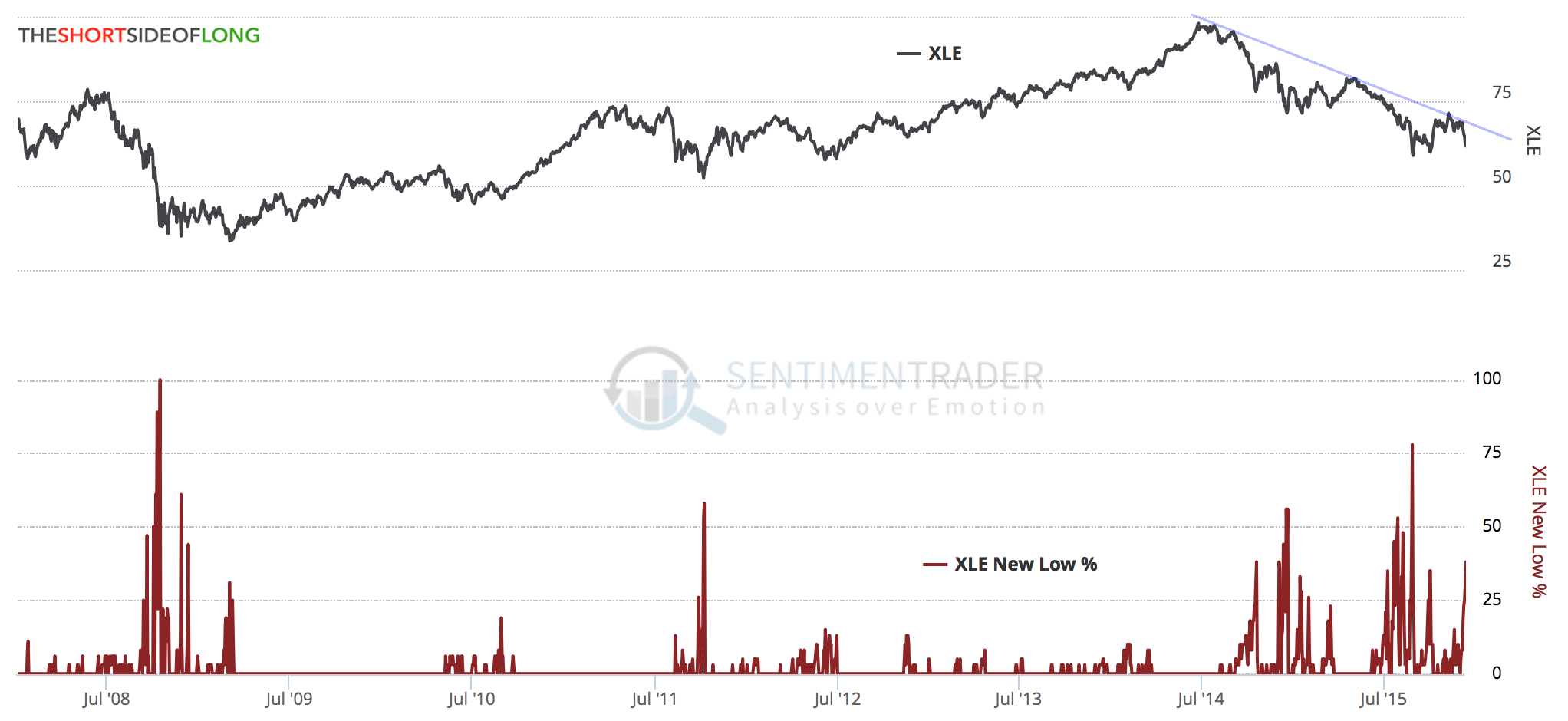

One of the major reasons for the poor breadth is the continual weakness in commodity producers, in particular the energy sector (Energy Select Sector SPDR (N:XLE)). Tuesday's sharp sell-off pushed 38% of the sector towards 52 week new lows. Sharp spikes in breadth, such as the one we saw Tuesday, tend to mark oversold levels. As I write this, oil and gas stocks are bouncing…

Energy is under pressure again, with 38% of the index making new lows

Source: SentimenTrader (edited by Short Side of Long)