The DAX index is showing little movement in the Tuesday session. In North American trade, DAX is trading at 12,68.50, up 0.10% on the day. On the release front, Germany’s trade surplus improved to EUR 21.2 billion, above the estimate of EUR 20.8 billion.

German indicators started off the week on a sour note, as Industrial Production recorded a sharp decline of 1.1%. However, there was better news on Tuesday, as the trade surplus rose to EUR 21.2 billion, its highest level in 2017. Last week’s indicators were solid and continue to point to an expanding German economy. Retail Sales jumped 1.1%, its second-highest gain in 2017. Factory Orders gained 1.0%, while unemployment claims dropped 9 thousand – the employment indicator has declined every month in 2017, except one. Although manufacturing and services PMIs dipped in July, both are well over the 50-level, indicative of expansion. Are the strong German numbers too much of a good thing? Some analysts think so, and are cautioning that the German economy is in danger of overheating. Still, there’s no arguing that the eurozone economy has received a boost from the robust German economy. Eurozone GDP gained 0.6% in the second quarter, up from 0.5% in the previous quarter. As well, Eurozone Retail Sales gained 0.5%, marking a 4-month high.

The euro has recorded impressive gains over the past few months, jumping 10.7% since April 1. Last week, the euro briefly pushed across the 1.19 line, its highest level since January 2015. Although the US economy is in better shape than the eurozone, investors have snapped up the continental currency, as expectations remain high that the ECB is not far away from starting to wind down its ultra-easy monetary policy. The cautious ECB has not provided any dates for a change in policy, but in June, ECB President Mario Draghi spoke about a “strengthening and broadening recovery” in the eurozone, and this sent the euro soaring. Clearly, any hints from the ECB about tightening policy could send the euro higher.

In sharp contrast to the euro, the dollar has taken a beating, as Donald Trump’s antics and inability to pass healthcare legislation has increased political risk in the US. As well, the Federal Reserve’s monetary policy remains unclear. Earlier this year the Fed strongly hinted that it planned to raise rates three times in 2017, but has only pressed the rate trigger twice. In June, Fed Chair Janet Yellen shrugged off low inflation, saying that it was due to “transient” factors, leaving the impression that the Fed still planned one final hike. However, inflation has not improved and the Fed has changed its tune. Last week, St. Louis Federal Reserve President James Bullard said he opposed further Fed hikes, warning that another hike would actually delay inflation from hitting the Fed’s target of 2%. The markets have become more skeptical about a rate hike in December, as the odds have fallen to 33%, compared to 43% a week ago.

Economic Calendar

Tuesday (August 8)

- 2:00 German Trade Balance. Estimate 20.8B. Actual 21.2B

*All release times are EDT

*Key events are in bold

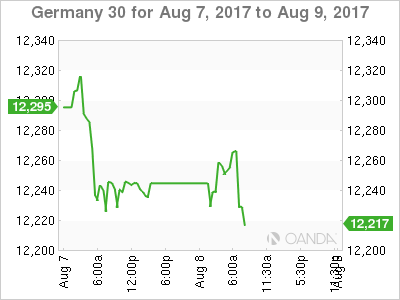

DAX, Tuesday, August 8 at 6:45 EDT

Open: 12,238.00 High: 12,231.50 Low: 12,272.00 Close: 12,268.50