The image above (or worse) comes to mind when you put together the words Germany and March. But not all marches in German should evoke such images. The march higher in the German stock market has been a much more pleasant picture. All eyes have focused on the US stock market since the Presidential election in November. And who can blame them. The stock market is up over 10% since then and continues to roar.

But the US is not the only place to make money in stocks. We have been long in Japan and China for sometime and reaping the benefits. And from the beginning of December European markets have perked up. The leader of the European market is the German DAX, and it is about to set a monthly all-time high close. What is next for Germany?

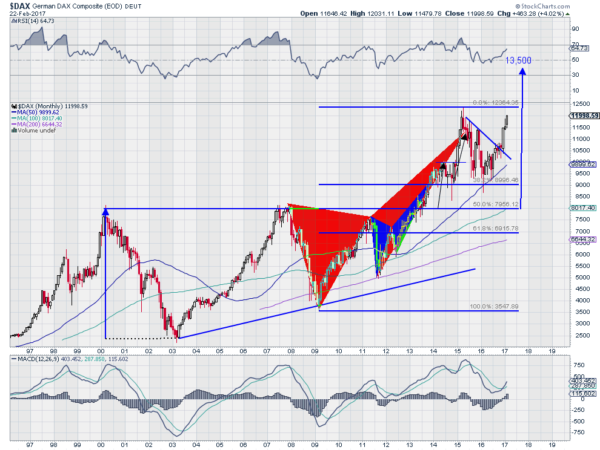

The chart above shows the monthly price action for the DAX over the last 20 years. There is a bearish deep crab harmonic pattern noted by the two triangles that had taken hold and placed some concern through 2015. That met its potential reversal zone and did reverse, retracing 38.2% of the pattern. That reset has allowed longer patterns to take control back as the DAX rises. There was a break out of an ascending triangle in 2013 that gave a target to 13500. With a close over 12000 this month it seems the DAX is well on its way to that target.

Momentum supports continued price action to the upside. The RSI is in the bullish zone and rising but a long way from being overbought. The MACD at the bottom has just crossed up, a bullish signal, and is positive. And all of the SMA’s are rising. This is a strong chart, like the S&P 500, for those looking for exposure outside of the US.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.