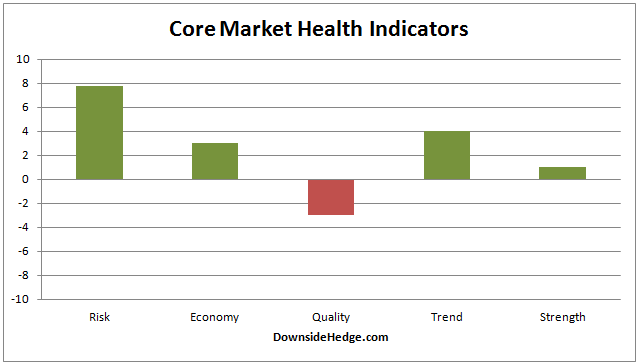

Over the past week the majority of my core market health indicators improved. Most notably is the market strength category. It has finally pushed above zero, resulting in a change to the core portfolios. The new allocations are as follows.

Long / cash portfolio: 80% long and 20% cash

Long / short portfolio: 90% long high beta stocks and 10% short

Volatility hedged portfolio: 100% long (since 7/1/2016)

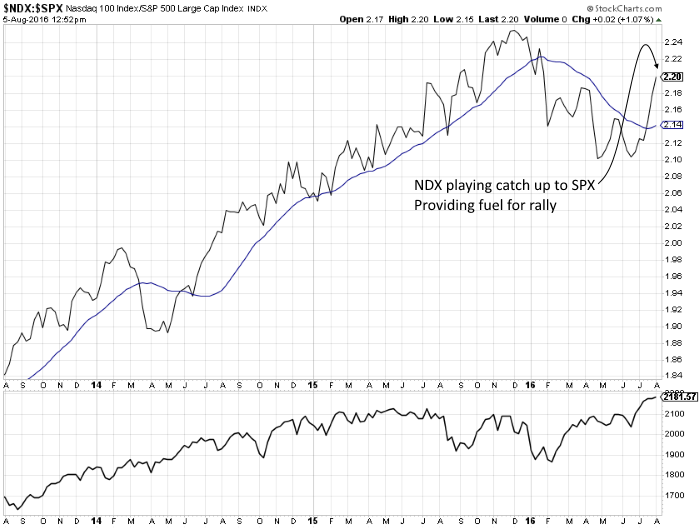

In early July, I highlighted some problems with leadership in the market. Most of those problems have been resolved. As you know, I’ve been watching the ratio between the Nasdaq 100 (NDX) and the S&P 500 (SPX). It made a good break higher two weeks ago and is currently fueling the rally as NDX plays catch up to SPX.

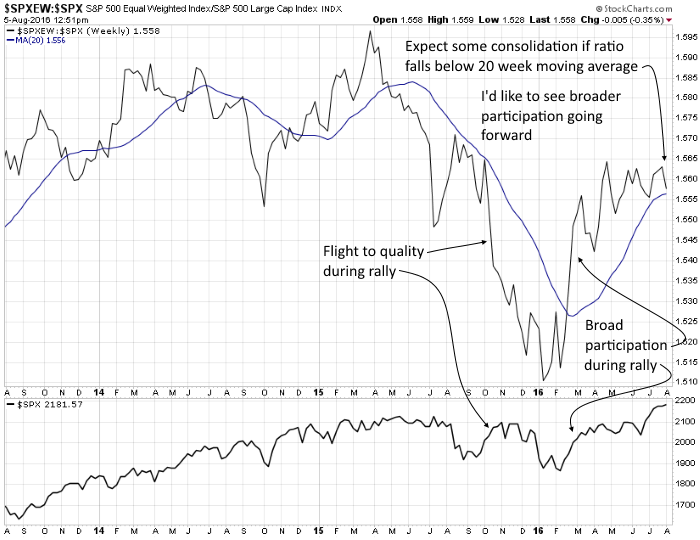

One thing that hasn’t fully resolved itself is the ratio between the S&P 500 Equal Weight Index (SPXEW1) and SPX. The current rally has this ratio moving sideways, which shows lackluster participation from the “smaller” big cap stocks in SPX. If the ratio moves below its 20 week moving average, expect some consolidation. If it can move higher it will signal a healthy rally.