Market Brief

The pound sterling fell the most against the US dollar as Brexit discussions took the front stage over the weekend. Boris Johnson, Mayor of London, took the opposite line to that of David Cameron in supporting the UK leaving Europe.

GBP/USD dropped almost 1% to 1.4250 in early Asian session before continuing to slide further as European traders returned to their desks. Over the last few weeks, the highly sensitive Brexit story and the prospect of low interest rates have weighed on the pound.

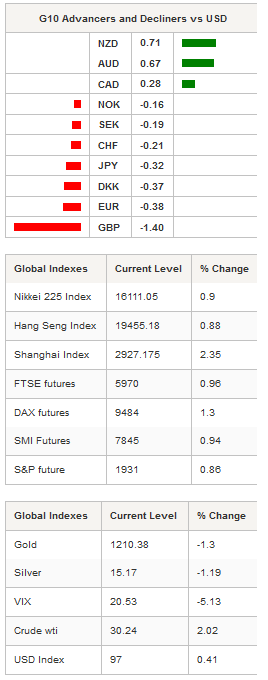

A recovery in crude oil prices helped commodity currencies to extend gains. Among the G10 currencies, the New Zealand dollar gained the most against the greenback, rising 0.40% to 0.6660, as the global risk sentiment keeps improving.

In the medium-term, NZD/USD is trading sideways within the 0.6550-0.6750 range; however the pair is currently testing the key 0.6650-0.6670 resistance area, which corresponds to the point of convergence of a few indicators (50dma, 200dma and the upper bound of the multiyear declining channel). A break of this area to the upside would send a strong bullish signal. The next resistance can be found at 0.69 (psychological level and high from October 15th).

In the equity market, Asian regional markets started the week on a firmer footing as mainland Chinese equities were buoyed by commodity gains and the announcement that Liu Shiyu has taken over as Chairman of China Securities Regulatory Commission. Iron ore for delivery at the port of Qingdao rose 16% over the month of February and almost 3% since last Thursday, reaching $48 a metric ton on Monday.

The Shanghai Composite settled up 2.35%, while the tech-heavy Shenzhen Composite rose 2.04%. In Hong Kong, the Hang Seng jumped 0.88%, in Singapore the STI edged up 0.15%, and in Australia the ASX scored 0.98%. In Europe, equity futures were blinking green across the screen with futures on the footsie up 0.96%. In Germany futures were up 1.30%, while in Switzerland SMI futures were up 0.94%.

Safe haven assets lost ground on Monday amid improving risk sentiment. Gold fell 1.30% and silver dropped 1.19%. The Swiss franc and the Japanese yen extended losses against the greenback, down 0.20% and 0.30% respectively, as investors favored riskier assets. The recovery in US treasury yields should continue to support dollar bulls.

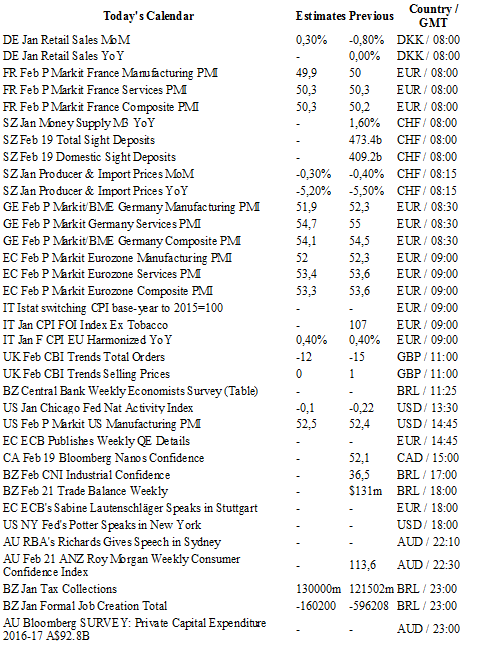

Today traders will be watching retail sales from Germany; market PMI from Germany, France, the euro zone and the US; money supply, domestic sight deposits and producer and import price index from Switzerland.

Currency Tech

EUR/USD

R 2: 1.1376

R 1: 1.1261

CURRENT: 1.1085

S 1: 1.1067

S 2: 1.0711

GBP/USD

R 2: 1.4591

R 1: 1.4409

CURRENT: 1.4190

S 1: 1.4150

S 2: 1.4081

USD/JPY

R 2: 117.53

R 1: 114.91

CURRENT: 112.90

S 1: 110.99

S 2: 105.23

USD/CHF

R 2: 1.0257

R 1: 0.9985

CURRENT: 0.9925

S 1: 0.9847

S 2: 0.9660