Market Brief

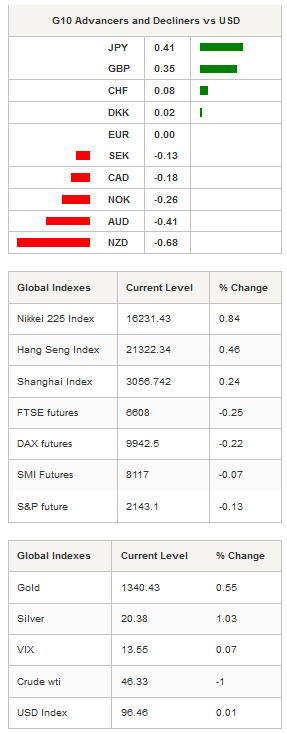

US equity indices printed at a new all-time high yesterday as investors cast aside their concerns about slowing global growth and Brexit spillovers. In Wall Street yesterday, the Dow Jones Industrial Average broke its previous record from May 19 2015 and hit 18,259.12 points. The S&P 500 set, for the second day in a row, a new all-time high at 2,155.40.

In the bond market, US treasury yields eased slightly during the Asian session, taking a breather after rallying for five straight days. Monetary sensitive 2-year yields eased to 0.6752% from 0.69%; 10-year yields fell to 1.4875% after testing 1.5288%. The rally in bond yields should last as investors continue to show a taste for riskier assets in this improving risk environment.

In the FX market, the pound sterling continues to rally as Theresa May takes over the reins as Prime Minister. The fact that she has made it clear that she won’t rush to push the Brexit button has helped clouds to dissipate in the short-term and allowed the pound to rally for a fourth day in row, up to $1.33, while it was still trading at around $1.29 last Friday.

However, the pound’s upside potential may be limited as the BoE is expected to cut its benchmark interest rate on Thursday. GBP/USD traded range bounded in Tokyo between 1.3225 and 1.3338 as it tumbled on the 1.3350 resistance area (previous highs from early July).

In Japan, the yen stabilised after rallying roughly 4% over the last three days. We expect the Japanese yen to resume its freefall as traders keep buying back their short positions and investors adjust their positioning ahead of the BoJ meeting at the end of July. USD/JPY edged down 0.50% to 104.42 after hitting 104.99 in Wall Street.

Commodity currencies took a hit with NZD, AUD, NOK and CAD falling sharply on Wednesday as crude oil prices edged lower and traders locked in their recent profits. NZD/USD fell roughly 1% from Wall Street’s high, down to 0.7250, while the Australian dollar slid 0.90%.

Both currencies failed to break their respective key resistance levels to the upside as crude oil prices stabilised. USD/CAD rose slightly to 1.3070, while USD/NOK was up 0.40%.

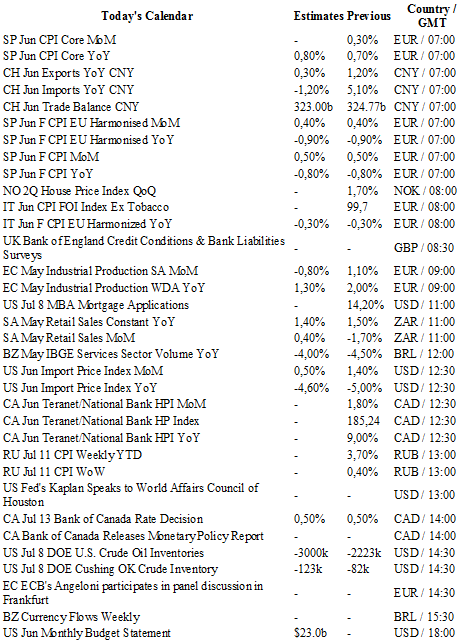

Today traders will be watching CPI from Spain, Italy and Russia; industrial production from the Eurozone; MBA mortgage application, monthly budget statement, Beige Book and crude oil inventories from the US; retail sales from South Africa; interest rate decision from Canada.

Currency Tech

EUR/USD

R 2: 1.1428

R 1: 1.1186

CURRENT: 1.1053

S 1: 1.0913

S 2: 1.0822

GBP/USD

R 2: 1.3981

R 1: 1.3534

CURRENT: 1.3269

S 1: 1.2798

S 2: 1.1880

USD/JPY

R 2: 107.90

R 1: 106.84

CURRENT: 104.38

S 1: 99.02

S 2: 96.57

USD/CHF

R 2: 1.0328

R 1: 0.9956

CURRENT: 0.9885

S 1: 0.9522

S 2: 0.9444