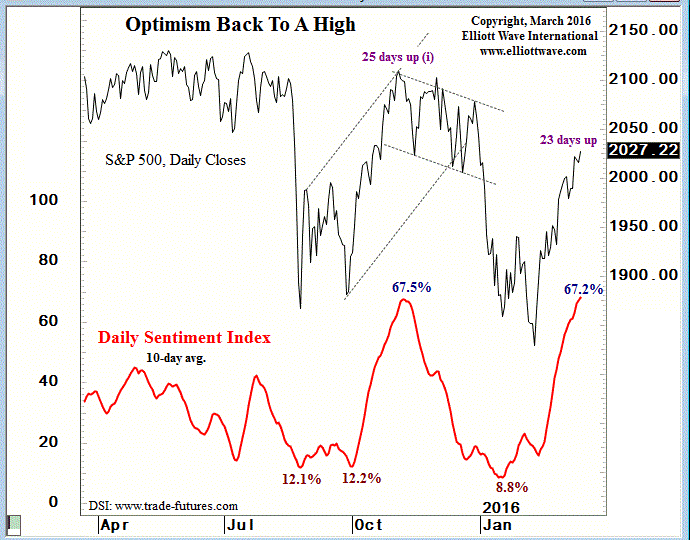

This evening, I got my latest Short-Term Update from Elliott Wave International, and this graph jumped out at me:

We seem to be back in “real soon now” mode (e.g. “this insane countertrend rally will stop and we will get sinking prices again…………..real soon now.”) That’s all well and good, but it just doesn’t seem to be happening. Of course, after the Fed did their announcement, there were a couple of times when it looked like the jig was up, but, nope – – the market ultimately pushed higher.

The worst bit of news for the bears was that the Dow Jones Composite violated its intermediate-term trendline. The strength of the Utilities had something to do with this, but I’m not going to try to spin this; it’s not good.

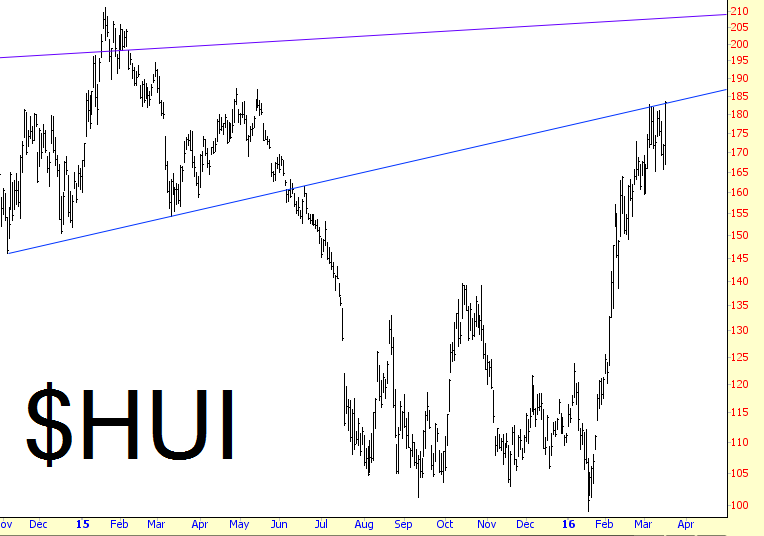

I was enthused to see precious metals (and miners) continue to be strong, and as big a fan as I am of them, I think the trendline shown below suggests caution (unless we rip right through it, in which case we’re truly dealing with a new era here).

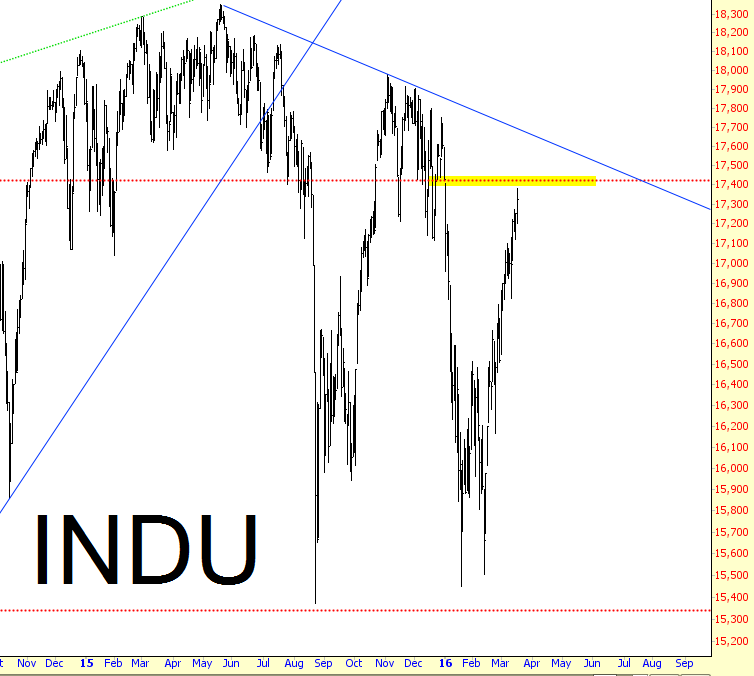

All is not lost, however, because there are many gaps neatly in place. The most typical gap is between December 31, 2015 and January 5, 2016, and it is tantalizingly close to being close in many indexes, such as the Dow 30:

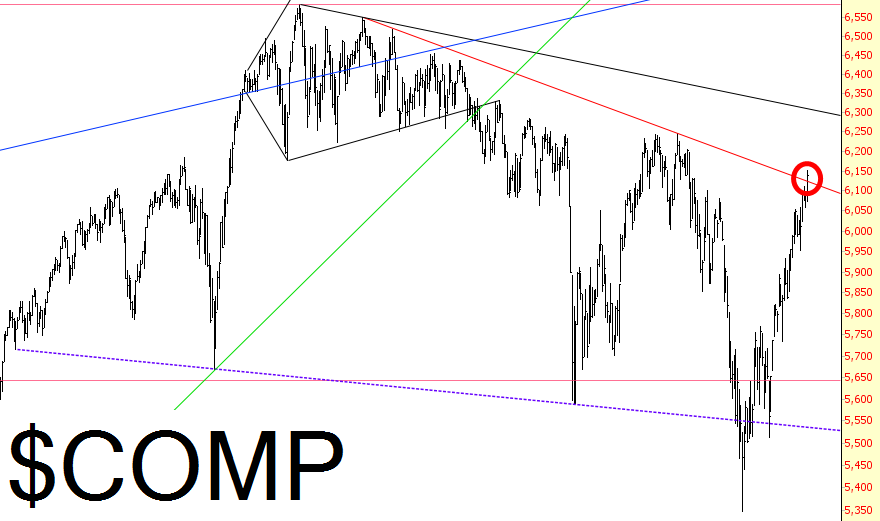

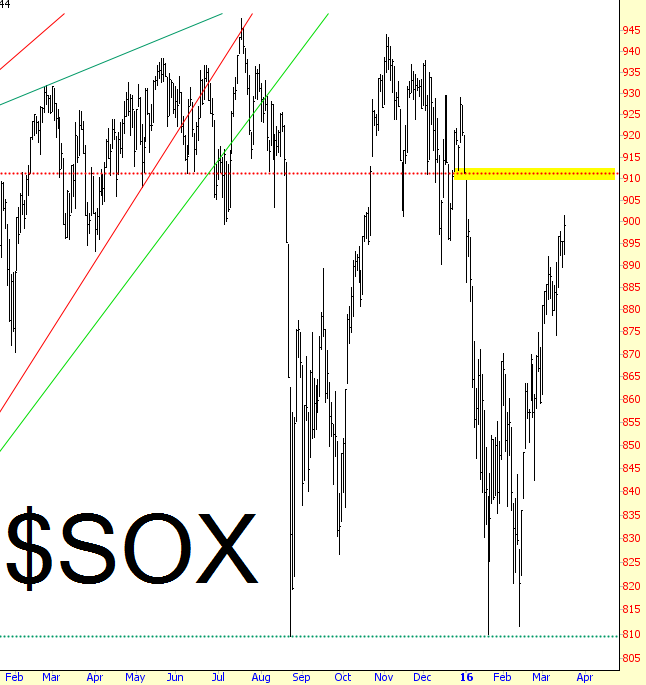

And the semiconductor index:

And the S&P 500:

In addition, the Dow Transports (which one would think would be under pressure from rapidly-soaring fuel costs) is just underneath its enormous topping pattern.

As one last slim hope to offer, I’ll say this: the last “big” Fed announcement (in which you get the press conference) was back in mid-December, and the market was very enthused back then, too (and that enthusiasm spilled over into the next day). It took the market about a week more to figure things out, then………the thrill was gone.