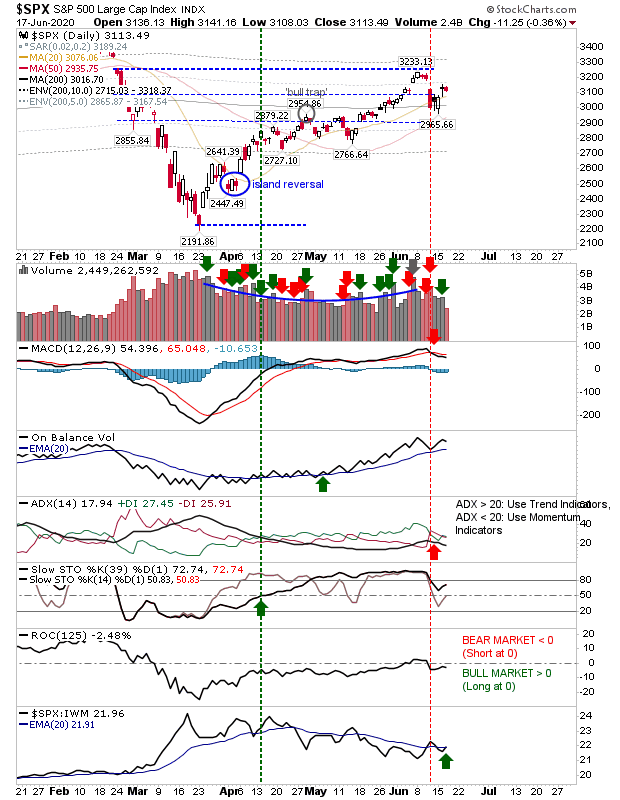

The S&P experienced a narrow loss yesterday, as it traded inside Tuesday's doji, which was within last Thursday's gap down. The MACD is still on a 'sell' trigger but it returned to a relative advantage against the Russell 2000, which would suggest money flowing back to defensive issues—although trading volume was light.

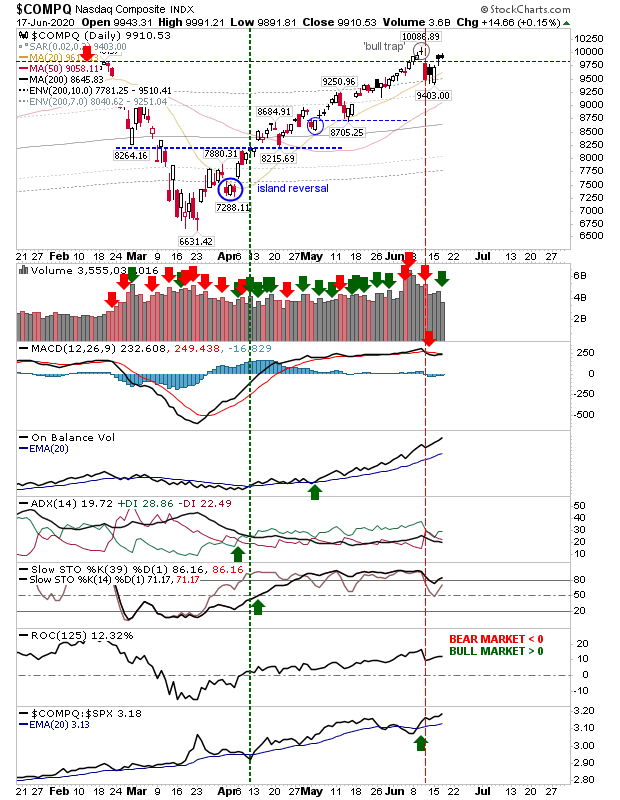

The NASDAQ is also in Thursday's gap as it looks to challenge the 'bull trap'. Like the S&P, it has a MACD trigger 'sell' to work with it. Yesterday's buying came on lighter volume.

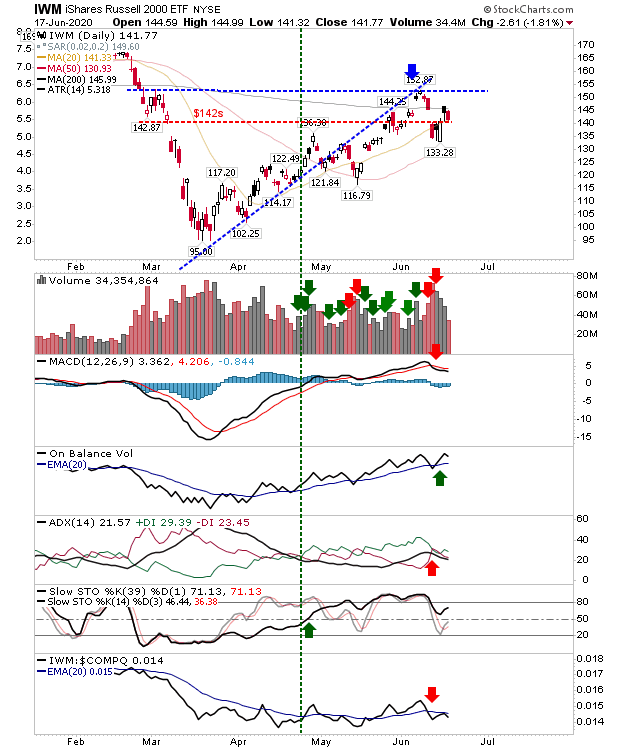

The Russell 2000 (via iShares Russell 2000 ETF (NYSE:IWM)) experienced larger selling, confirming yesterday's bearish black candlestick. Of the indices, the MACD, ADX and relative performance are all on 'sell' trigger. Will profit taking continue?

Wednesday's action gave larger credence that recent action is controlled selling in line with trader profit taking. The question now is whether the buyers coming in here are value buyers or weak-hand traders. The latter group will cause an acceleration in the decline, but we are not there yet.