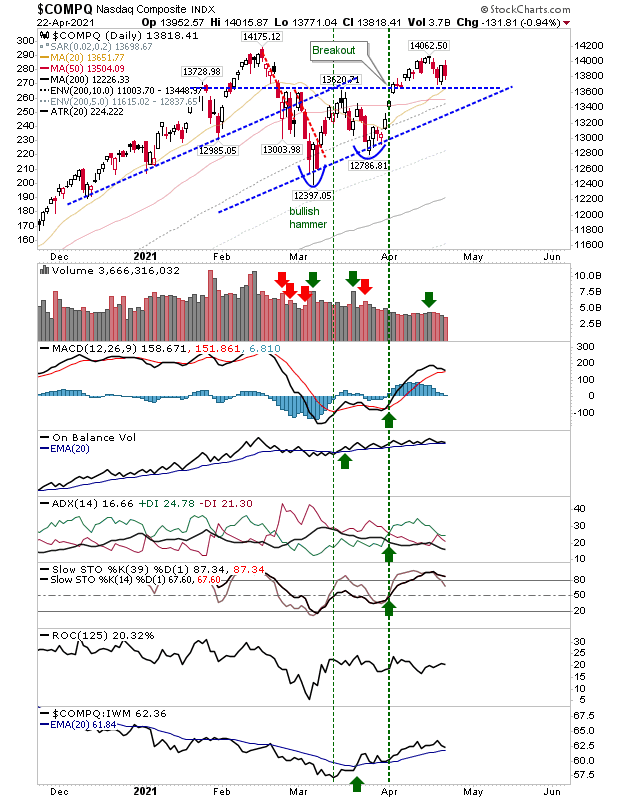

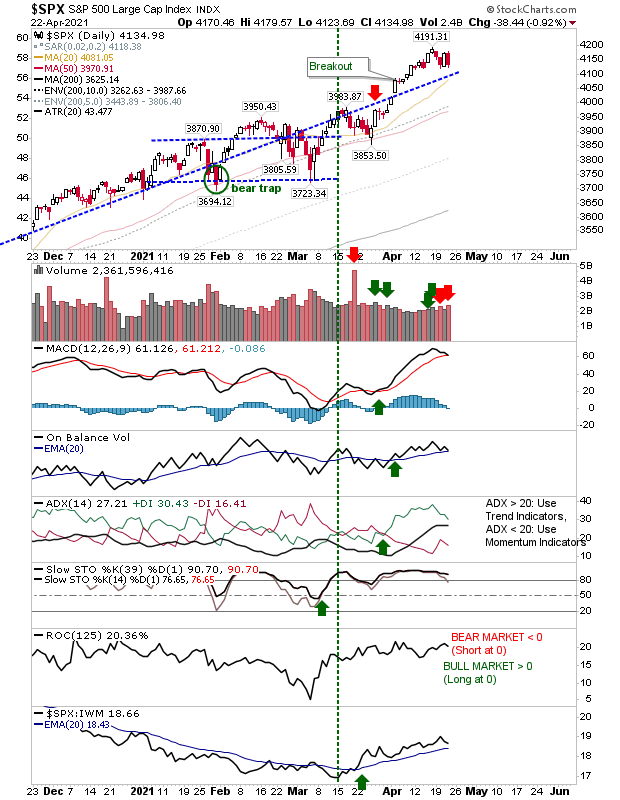

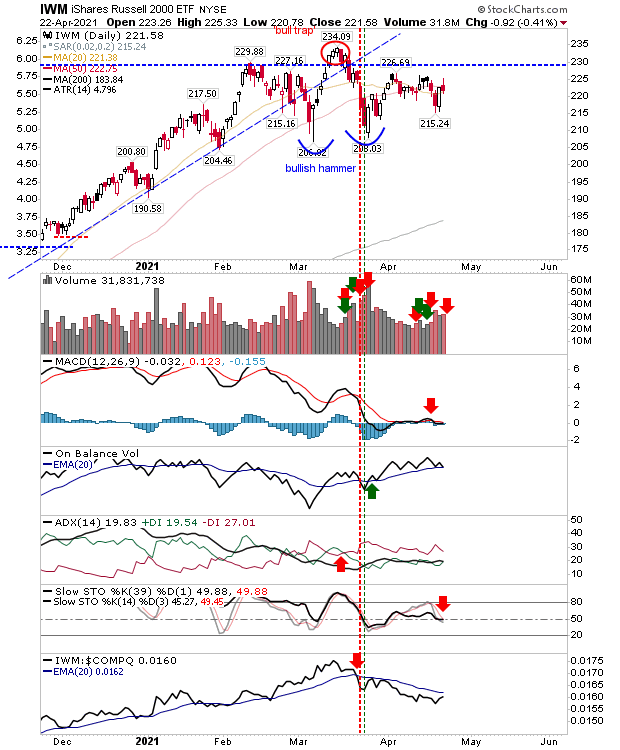

Since the last update there has been a bit of back-and-forth for the indices. The NASDAQ had bounced off breakout support yesterday before it quickly gave up those gains. It was a similar story for the S&P, although this index trades well above its key moving averages. The Russell 2000 experienced the lightest loss, although its struggling to clear its handle.

The upcoming test of the 20-day MA for the S&P comes on the back of good technical strength. Selling over the last few days registered as bearish distribution, but as yet, not enough to trigger a 'sell' trigger in On-Balance-Volume.

If the Russell 2000 is to lead out it needs to build on yesterday's gain and not suffer too many days like today. Small Cap leadership is vital to the sustainability of any rally, and we are not there yet.

Indices are effectively consolidating gains after a sequence of consecutive up days. As long as things stay sideways (before resuming the rally), then current action is not a concern. However, all it will take is a big red downward candlestick to spoil the party.