Friday June 10: Five things that the markets are talking about

Risk assets are again seeing a global sell-off in the last trading day of the week.

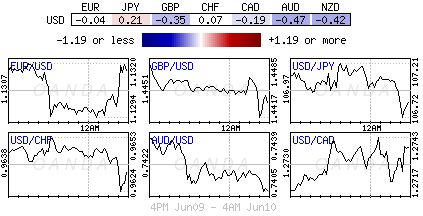

On Monday, markets honed in on the dollar, pricing out some of its rich interest rate differential premium after a weak nonfarm payroll (NFP) print the previous Friday. The “lower for longer” attitude also gave some stock indices a lift to multi-month highs.

However, that feel good factor was always going to be difficult to last with some of the upcoming seismic events slated for the remainder of this month – the U.K referendum on European Union membership (June 23) and the Fed, BoJ and BoE meetings.

1. Bond yields continue to hit fresh record lows.

European and Japanese bonds are rallying hard with the global selloff. The yield on the 10-year German bund has touched an all-time low of +0.025% this morning as the ECB kicked off the purchases of corporate bonds as a part of its ongoing QE program. Dealers now believe it’s only a matter of time before German 10s trade below zero into negative territory.

The yield on the 10-year gilt has also hit an all-time low of +1.222%. Japan’s 10-year and 20-year JGB yields are now trading deeper into negative territory. Japan’s 10-year JGB yield is at record low of -0.145%.

With domestic yields so low, investors continue to scour the globe for returns. It’s this foreign demand that has U.S Treasuries better bid further out the curve.

The U.S 10-year yield has dropped from +1.80% ahead of last week’s dire May payrolls report to +1.665% this morning, its lowest level since February. With the lower 10-year, the 2s/10-yr UST spread has fallen below +90 bps.

2. Global Bourses See Red

Recent optimism that a combination of loose monetary policy and moderate global growth would bolster risk assets appears to be peaking.

In Europe, financial stocks are moving lower with Treasury spreads and are weighing heavily across most European indices ahead of the U.S open.

With WTI trading below the $50 a barrel handle once again, is adding to the losses seen in the commodity and mining stocks in the FTSE 100.

Indices: Stoxx50 -1.4% at 2,948, FTSE -1.2% at 6,155, DAX -1.7% at 9,922, CAC 40 -1.1% at 4,355, IBEX 35 -1.5% at 8,640, FTSE MIB -1.4% at 17,507, SMI -1.0% at 7,996, S&P 500 Futures -0.5%]

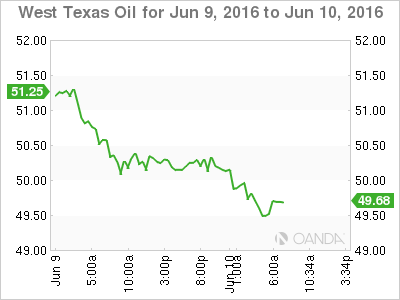

3. Oil Prices Slip

U. S. oil futures prices have dipped below $50 a barrel this morning, dragged down by an appreciating U.S. dollar and negative sentiment across financial markets.

Are the ‘bears’ in control? Oil prices have doubled since its decade-low print on February 12, supported mostly by a number of supply outages around the world and not OPEC. These disruptions seem to be supporting the theory that the global oversupply of crude would shrink faster than expected.

This morning’s drop is being attributed to the poor sentiment on financial markets and profit taking ahead of key events next week (FOMC meet) rather than to the fundamental situation in oil supply. Currently, the disruptions in Nigeria and Canada have taken around -3m barrels off the oversupplied market in recent weeks.

Brent crude has fallen -1.3% to $51.28 a barrel, while WTI is down -1.4% at $49.83 a barrel.

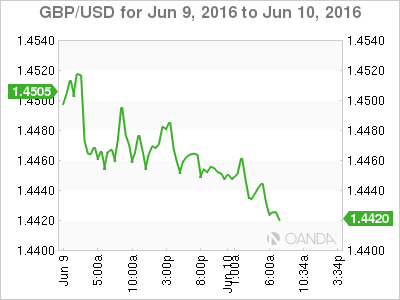

4. Brexit Jitters Boost GBP Implied Volatility

GBP outright is again under pressure ahead of the open stateside (down -0.3% at £1.4424). Last weekend, a plethora of Brexit polls greatly influenced Sterling’s move on the Asian open and this weekend should be no different. Both profit taking and position squaring continues to dominate ahead of these weekend opinion polls releases.

The cost of buying options protection against falls in sterling in the event of a Brexit vote is getting ever more expensive as the U.K.’s June 23 referendum date approaches.

Implied volatility for one-month options on the pound vs. the dollar has rallied to +23.5%, the highest in seven years, and more than double the level at the end of April.

5. Loonie Waits For Employment

The loonie bulls have had a good run of it of late, supported mostly the price of oil.

The CAD (C$1.2740) is little changed ahead of the open despite the retreat in crude oil prices over the past 24-hours. Investors prefer to take a look at Canada’s employment details before deciding what’s next up for this commodity sensitive currency.

Canada’s employment data will be released at 8:30 am EDT this morning. The economy is expected to add +3,000 new jobs and keep the unemployment rate at +7.1%. No matter the print, investors should be expecting both profit taking and position squaring to dominate price moves ahead of the weekend.